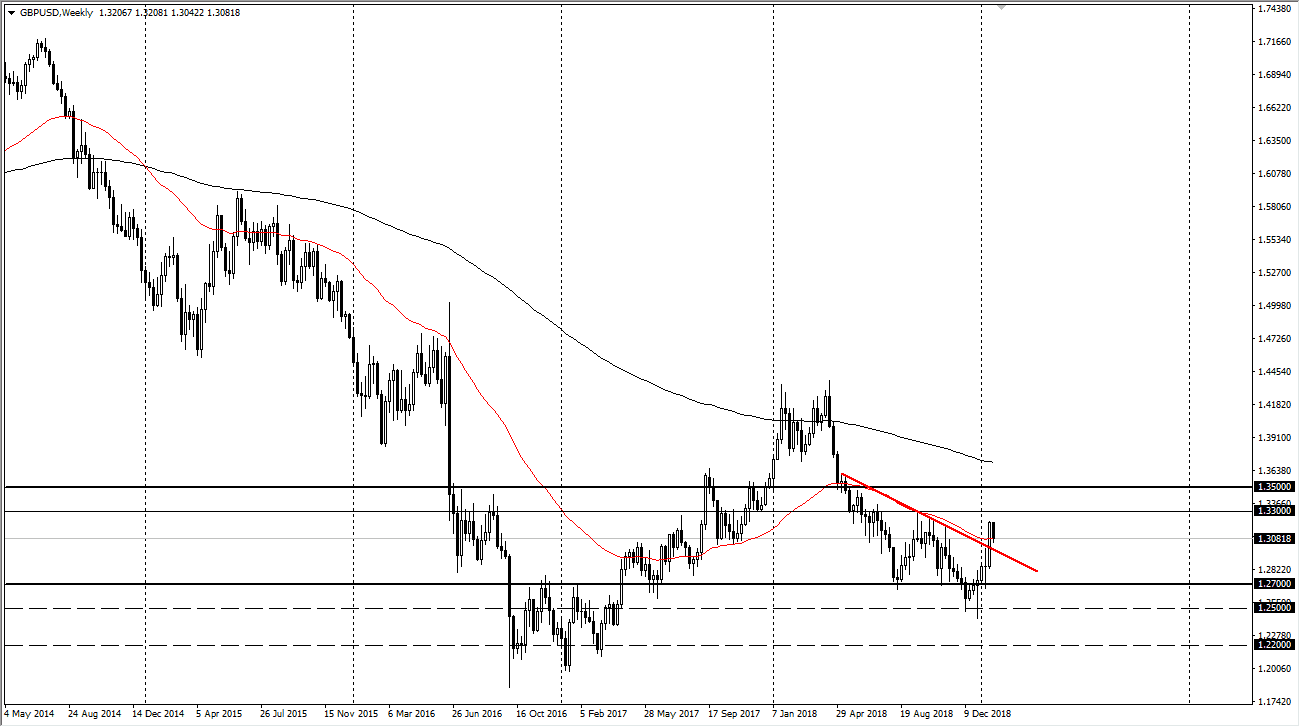

GBP/USD

The British pound pulled back during most of the week, but on Friday ended up forming a hammer right at the 200 day EMA. We also are sitting just above the 1.30 handle and the previous downtrend line that had just gotten smashed. By pulling back the way we have, we should be finding buyers in this area to continue to push the pair higher. Beyond that, if we get any sense of a Brexit deal or moving towards the delay, that should continue to push the British pound towards the 1.33 level, possibly even the 1.35 level over the next couple of weeks.

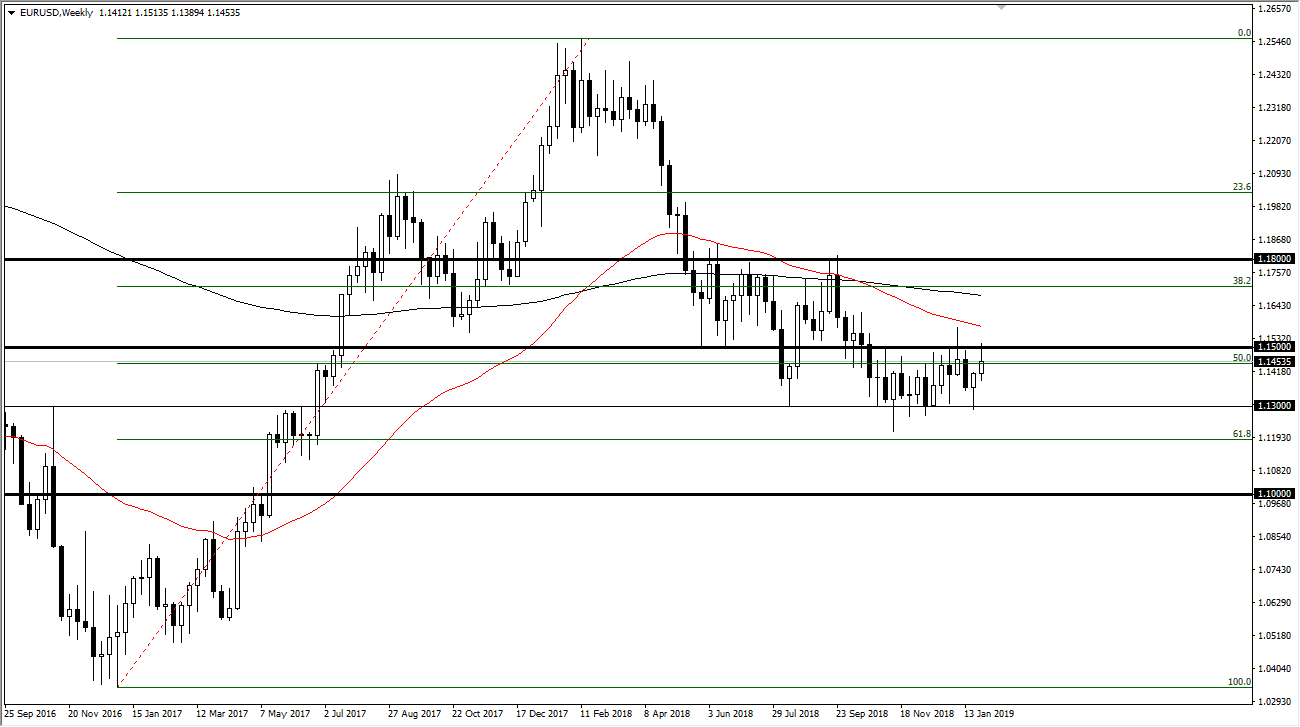

EUR/USD

If there’s ever a place where money went to die, it’s this pair. It’s extraordinarily choppy, but it is somewhat well defined in its range. The 1.15 level continues offer a lot of resistance above, but the 1.13 level below offers a significant amount of support. I think this choppiness continues to be a mainstay in this market, because quite frankly the Friday candlestick was so poor. How one hand, we have been extraordinarily soft Federal Reserve, on the other hand we have a European Union that is putting out very soft and sad economic figures. More noise and choppiness is to be expected.

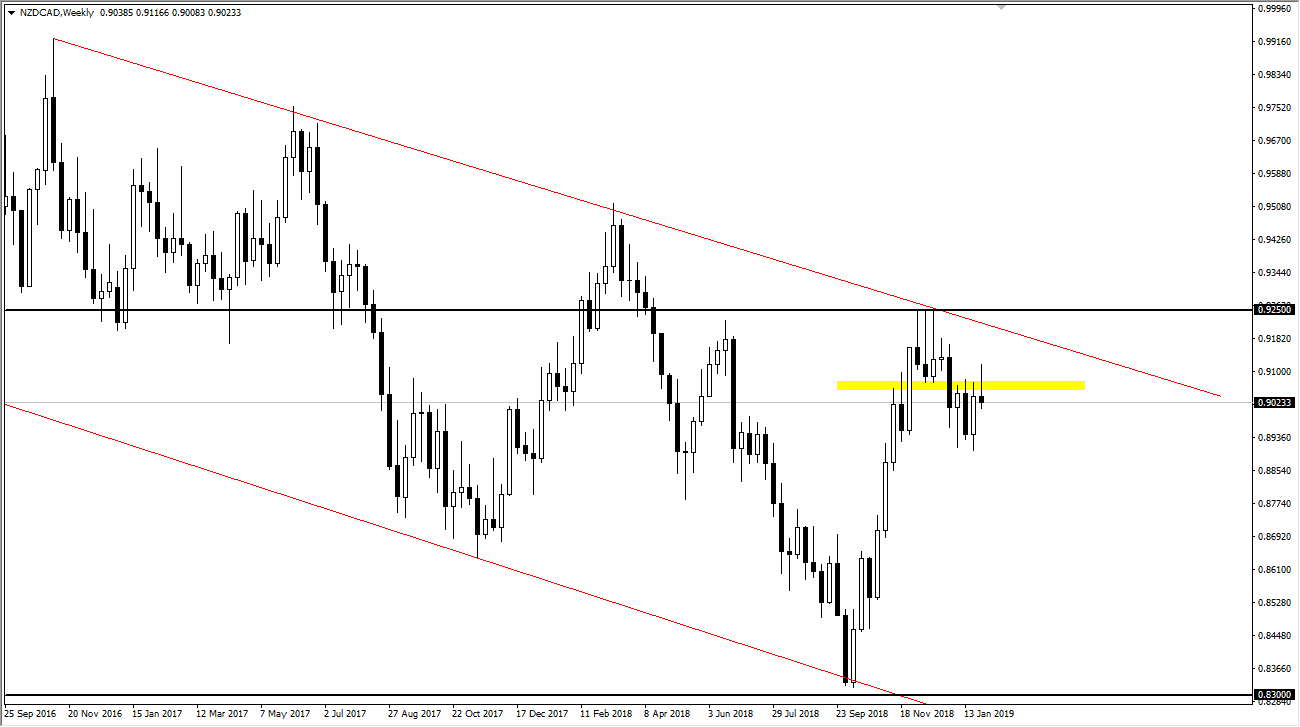

NZD/CAD

The New Zealand dollar initially tried to rally against the Canadian dollar but ran into quite a bit of resistance in the realm of 0.91 above. We turned around of form a shooting star, which sits just below several other shooting stars. I believe that this market is going to continue to be very noisy, but ultimately I think that we do continue to go lower due to the fact that oil is trying to break out, and of course we have to worry about Asia, which of course is bad for the Kiwi dollar. I suspect we will probably make a move towards 88.50 by the end of the week.

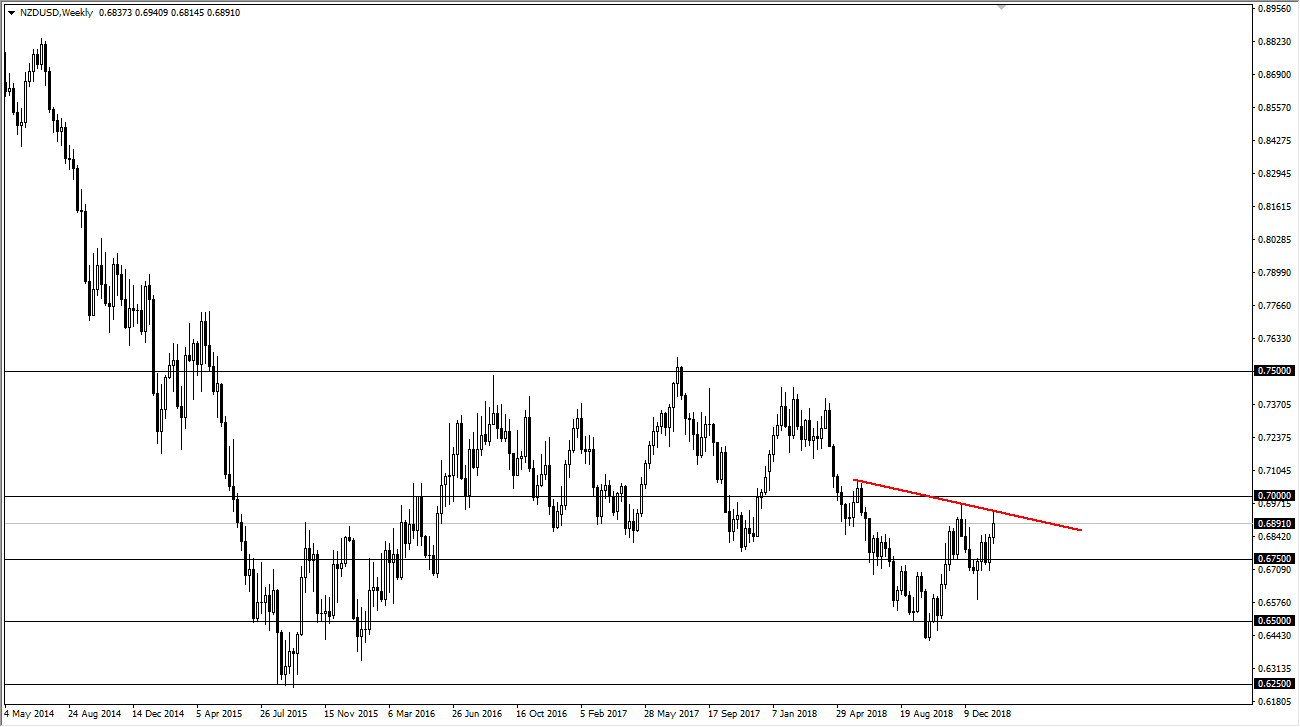

NZD/USD

The New Zealand dollar also tried to rally against the US dollar but has ran into a downtrend line and quite a bit of resistance at the 0.69 level. What I find interesting is that the Australian dollar also has quite a bit of negativity around it in this area, or at least it couldn’t break out during the day. That being the case, I think that we are more than likely going to continue to see struggles with Pacific currencies due to uncertainty in China.