USD/MXN

The US dollar fell slightly against the Mexican peso to kick off the trading session on Monday, but keep in mind that it was Presidents’ Day in the United States, and by far the biggest producer of volume in this pair will be the United States during north American trading. In other words, there was very little to move the market during the day so it’s not a surprise that we ended up basically unchanged.

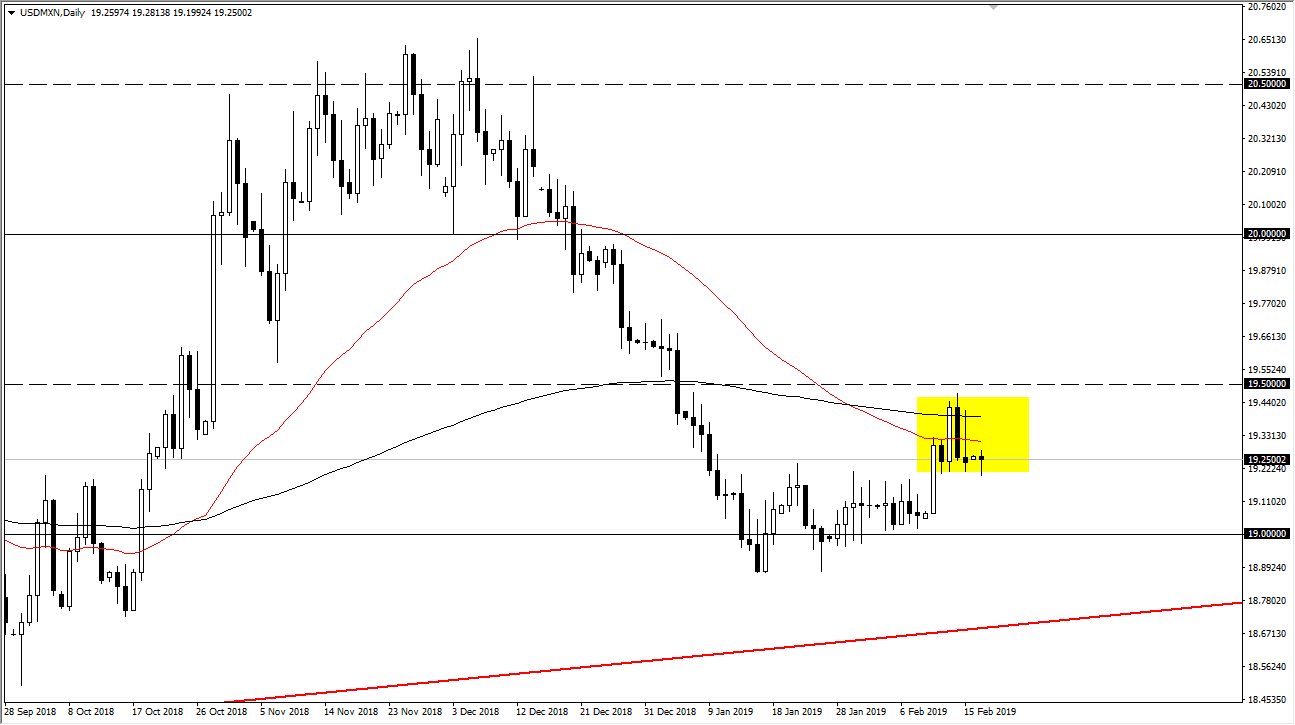

Looking at this chart, it seems as if the 19.25 level is starting to offer a bit of support, after the recent breakout. We had previously been in a symmetrical triangle, and by breaking out of it does suggest that we are going to try to grind our way back towards the highs at the 19.50 paces handle. Overall though, I do think that the market will remain a bit difficult as the US dollar is softening against many currencies around the world, but at the same time there are a lot of concerns about global growth, and that can work against the Mexican peso.

Looking at this chart, there is obviously a lot of support at the 19 pesos handle, and the uptrend line underneath should continue to support this market as well. I do believe that if we break above the ¥19.50 level, then the 20 pesos level would be targeted next. I think you can expect a lot of choppiness but we may be trying to continue the overall upward slant that we had seen for so long. Regardless, it’s going to be a very difficult market to hang onto, so keep your position size very small, and look for buying opportunities in the short term.