USD/MXN

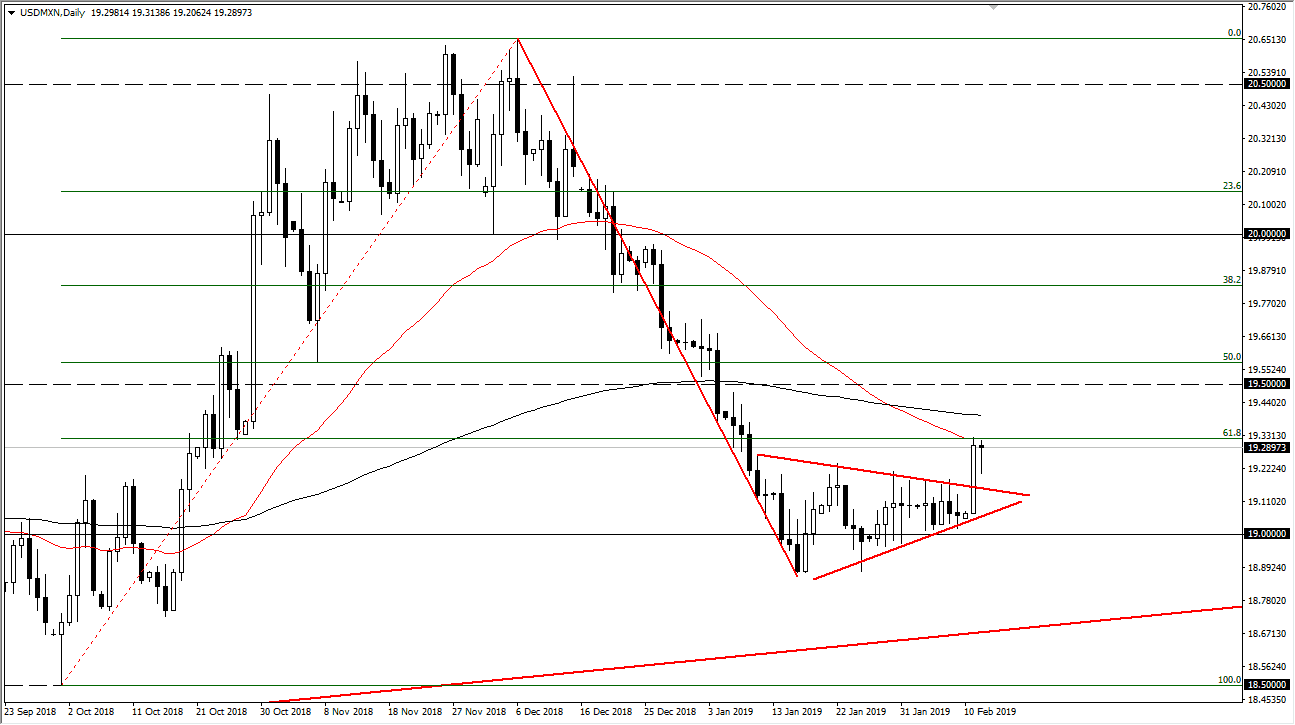

The US dollar pulled back initially during the trading session on Tuesday, repudiating a bit of the explosive move that we had seen during the Monday session. Remember, Monday we had broken out above the triangle that made up the bearish pennant, which shows signs of a complete turnaround. The US dollar fell initially during the trading session on Tuesday but then turned around to show signs of gains again. Looking at the massive bullish candle from the Monday session, it shows that the bearish flag has been busted, and it looks likely that we could continue to go a bit higher. At this point, the 50 day EMA is just above and it should cause a bit of interest, but the fact that we did of forming a hammer during the session on Tuesday it’s likely that we should continue to see buyers jumping into this market.

In fact, we pulled back during the session to test the previous downtrend line which has been part of the pennant itself. The fact that we have seen this reaction suggests that perhaps the US dollar will continue to find buyers. At this point, I think that the market will be rather choppy and noisy. The 200 day EMA is just above in black as well, so I think we are looking at a couple of tough days. If we can break above the 200 day EMA on a daily close though, then the market will more than likely continue to go higher towards the 20 pesos level. At this point, it’s unlikely that we will see sellers jump into this market in the short term as this explosive move and the fact that we have seen US dollar strength around the currency world suggests that the downtrend is now turning around.