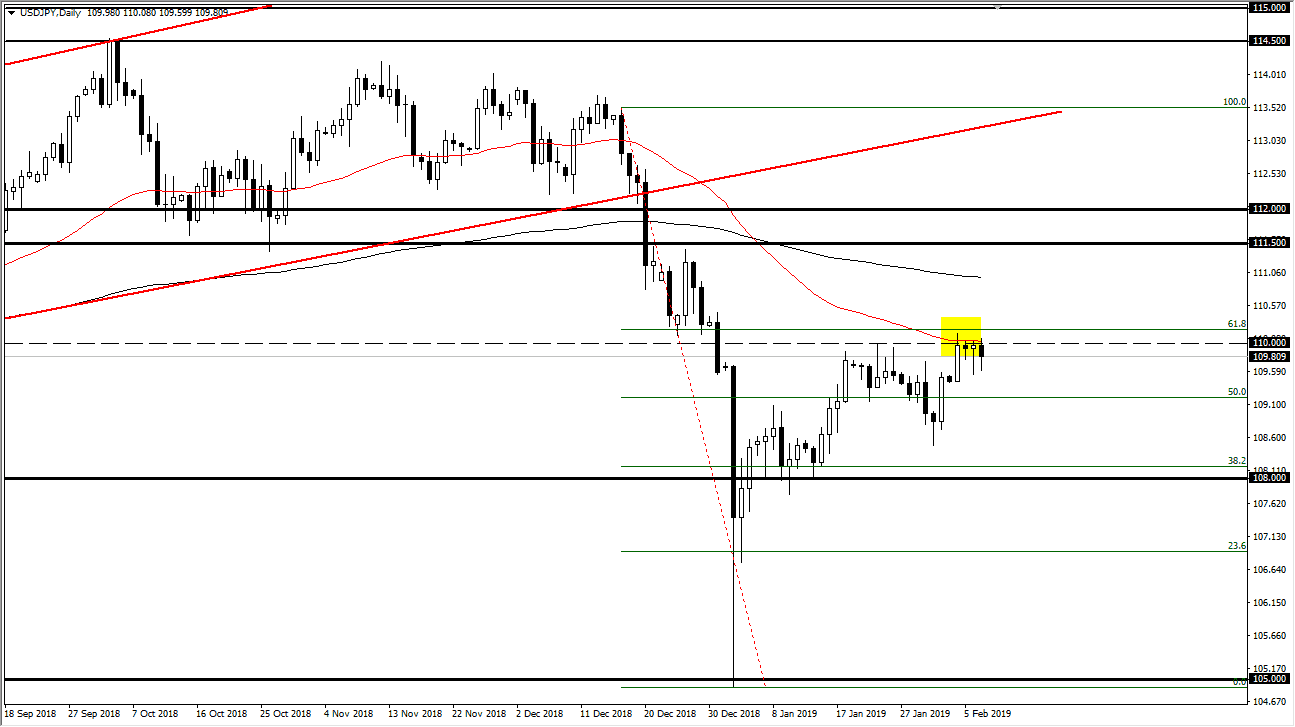

USD/JPY

The US dollar fell against the Japanese yen initially during the trading session on Thursday but found enough support at the ¥109.50 level to turn things back around and form a bit of a hammer like candle. This shows there is a significant amount of resiliency in this market, as we have pressed against the 50 day EMA. That’s an area that of course would cause a lot of resistance not only based upon that moving average, but the fact that it is the ¥110 level, and then the 61.8% Fibonacci retracement level. Because of this, I think there is a significant amount of resistance above, so it is going to be difficult to break out to the upside. Overall, this is a market that seems to be making a lot of decisions right now, and you may wish to wait for an impulsive candle stick in one direction or another to place a trade.

AUD/USD

The Australian dollar fell a bit during the trading session on Thursday, breaking below the 0.71 handle. We have turned around to show signs of support, as the market has been relatively quiet for the session. This is a sign that perhaps the market is trying to find buyers in this region, and I think that what we are probably about to see is a bounce. However, it’s very likely that it’s going to be difficult to grind higher, and the significant word here is going to be grind. With that in mind, I like the idea of buying the Australian dollar, but I also recognize that you’re going to have to be very patient. I believe the 0.70 level continues to be major support underneath that can be seen on the monthly charts.