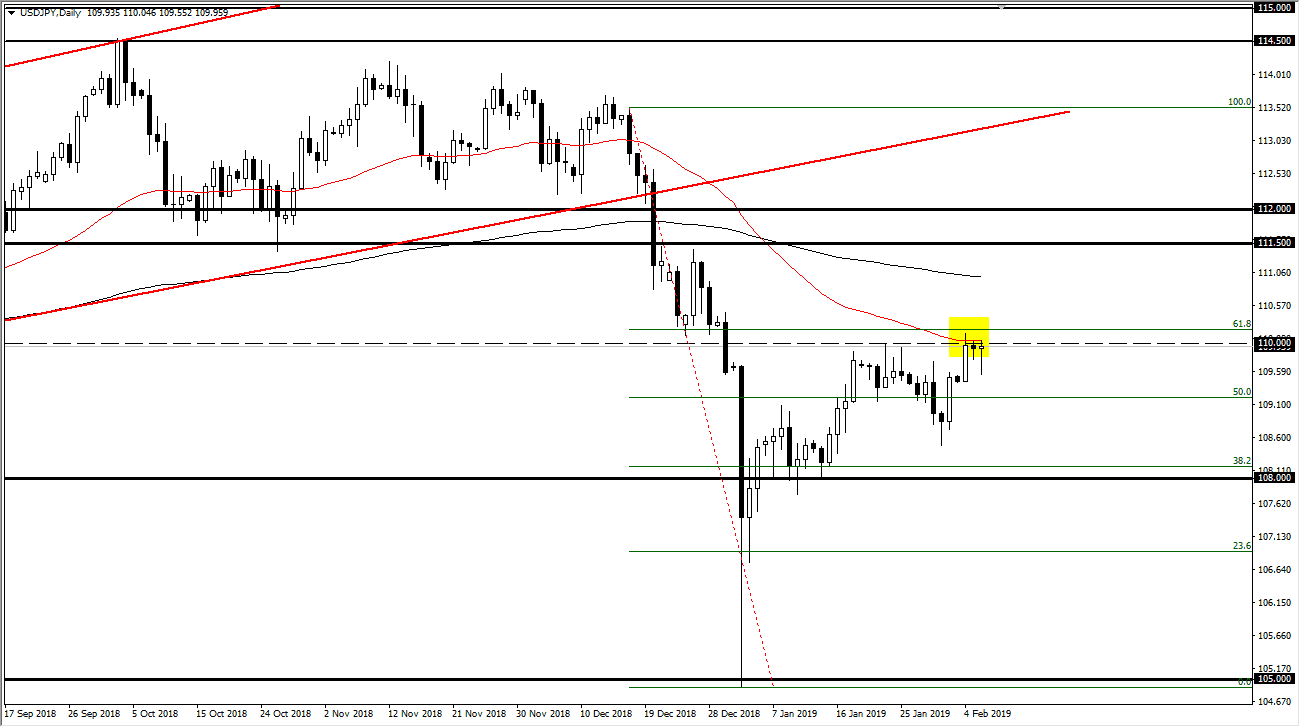

USD/JPY

The US dollar fell significantly against the Japanese yen initially during the day on Wednesday but found enough support near the ¥109.50 level to turn around of form a hammer. This of course is a bullish sign but we also have a 50 day EMA that’s flattening out just above it, and of course the ¥110 level. Overall, the 61.8% Fibonacci retracement level is one of the stronger ones that traders follow, and it just happens to be right above. Because of this, I think that we are going to see a lot of choppiness. I am a bit surprised that we recovered later in the day as the Federal Reserve looks to be rather soft. However, this pair can move counter to many of the other currency pairs at times as well, as it can be a measure of risk appetite. Nonetheless, I suspect you are probably better off leaving this one alone for a few days.

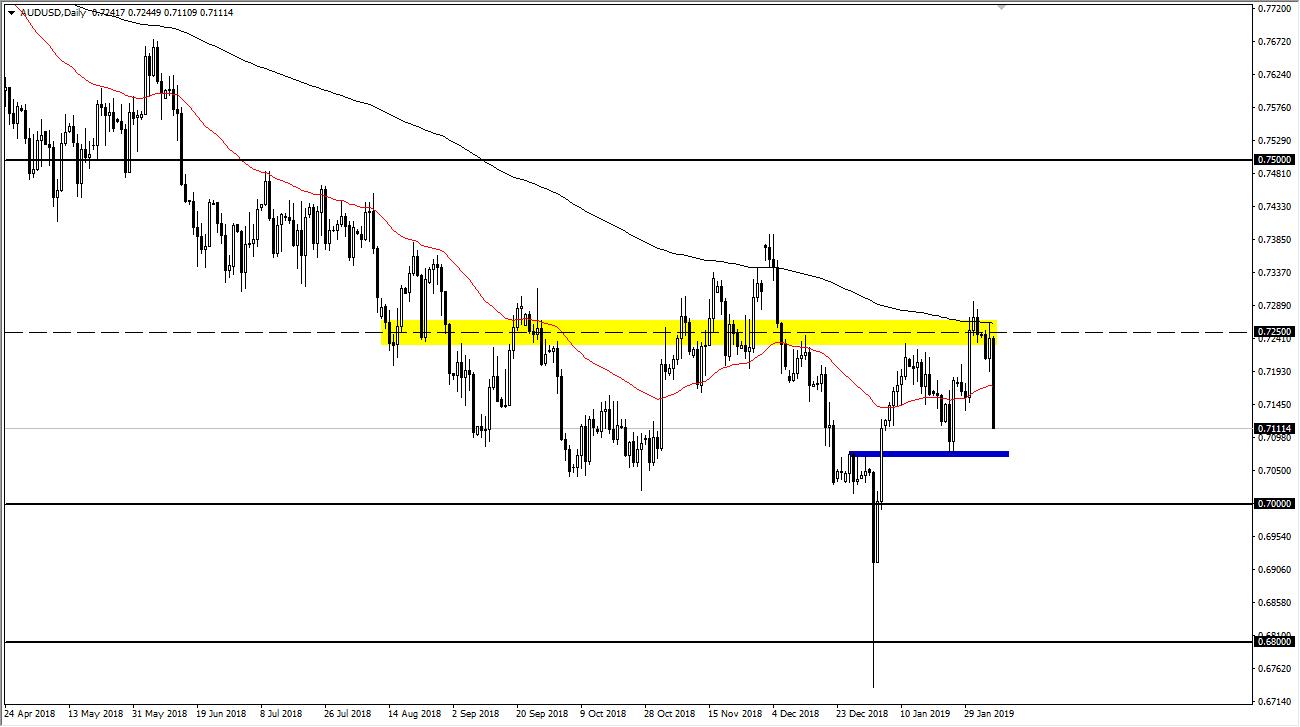

AUD/USD

The Australian dollar fell apart during the trading session on Wednesday, slicing through the 50 day EMA in reaching towards the 0.7100 level. However, I do think there is significant support underneath and the fact that we have fallen like this will probably be looked at as a potential buying opportunity, once stability comes back into play. I think the 0.70 level is still the beginning of massive support that extends down to the 0.68 handle, so I don’t have any interest in shorting this market in this region. I think that simply waiting for a supportive daily candle is the signed to start buying again. Don’t be wrong, I am not looking for a move higher from here to have legs, as the 200 day moving average is near the 0.7250 level. However, I think revisiting that area is very likely.