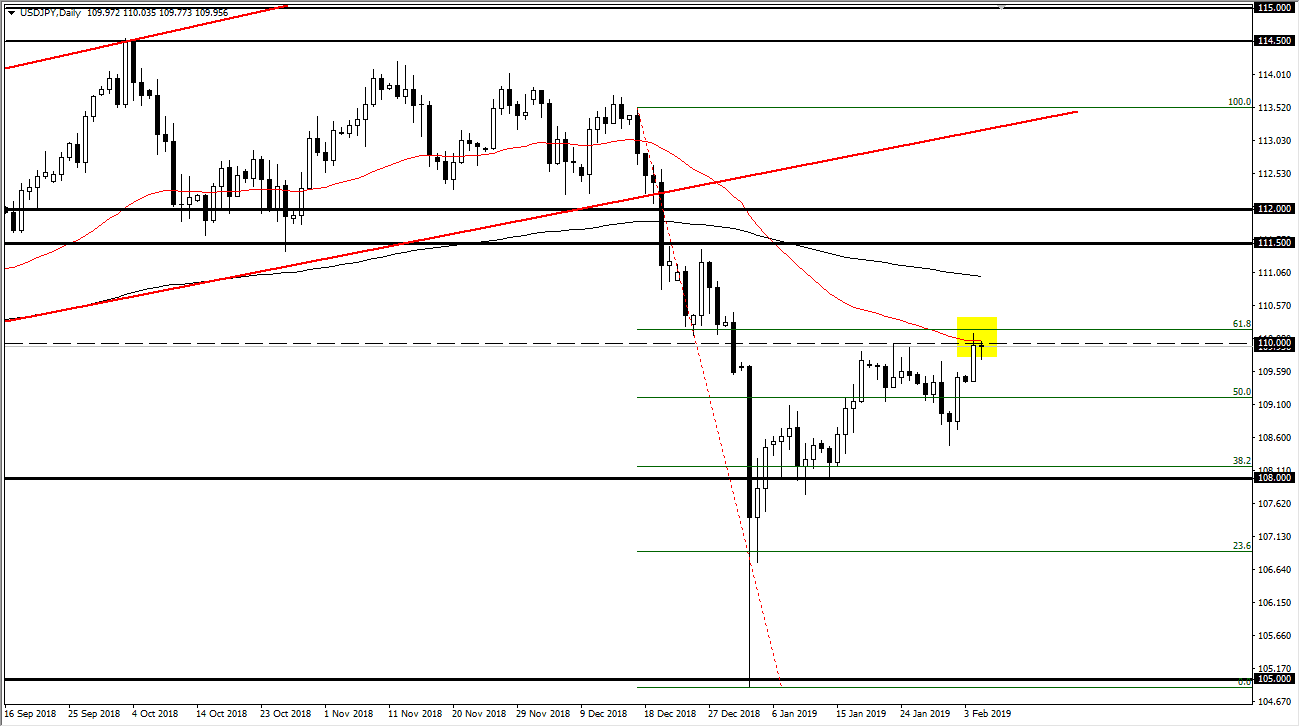

USD/JPY

The US dollar initially fell against the Japanese yen as the ¥110 level has offered significant resistance on Tuesday but gained later in the day. This could be more of a “risk on” move, but at this point we are struggling with significant resistance, as well as the 50 day EMA on the chart. The 61.8% Fibonacci retracement level of course is just above as well. I think at this point it’s very likely that the market remains very choppy, and I think there is a massive amount of resistance above that could cause some issues. That being said, the candlestick formation for the last couple of days does not make me want to short this market right away. If we can break down below the lows of Tuesday, then I would go ahead and start putting some money to work. As far as buying is concerned, I’m very hesitant to do so in this area.

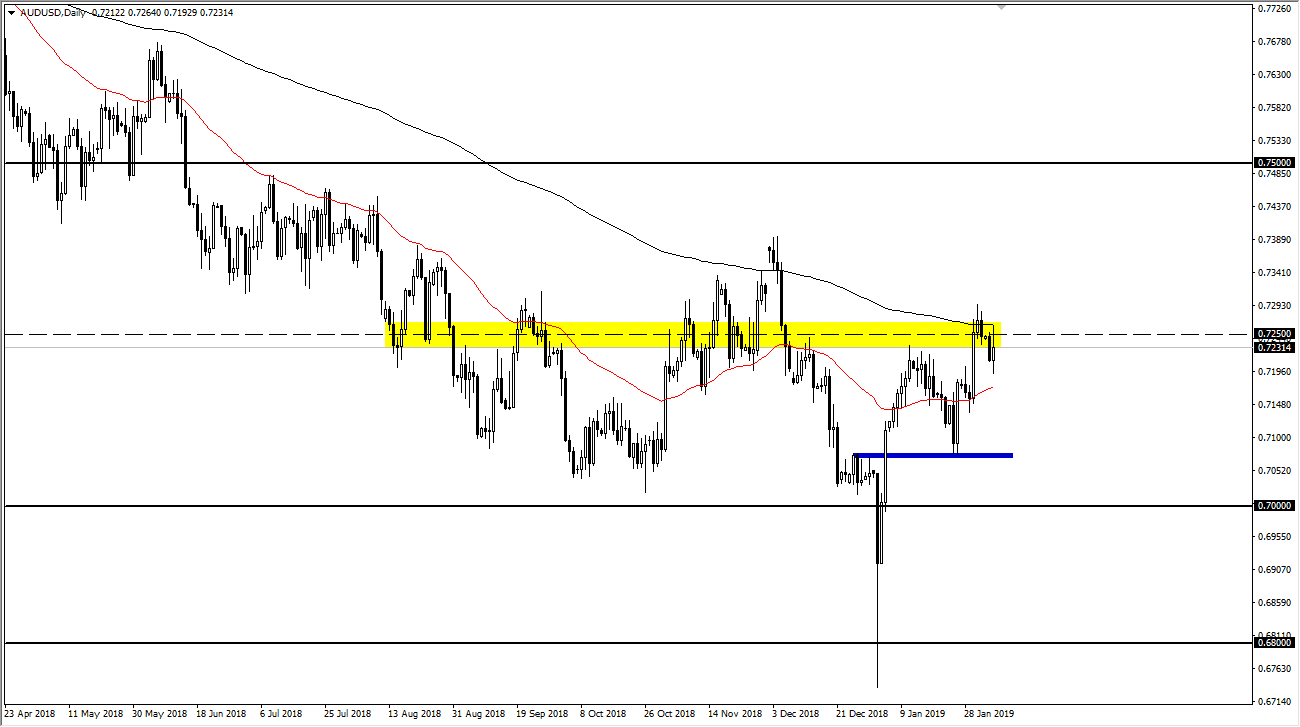

AUD/USD

The Australian dollar has gone back and forth significantly on Tuesday, reaching towards the 200 day EMA before falling again. The question here is whether or not it has to do with the US/China relations, or is it a bit of overall US dollar strength? I think that this pair does have plenty support underneath though, so if we do pull back it should end up being a nice buying opportunity. Ultimately, I like the idea of buying pullbacks as they come and show signs of support, and I believe that the 0.70 level underneath is the “floor” in the market that extends down to the 0.68 handle. Given enough time, I fully anticipate that we will see a recovery.