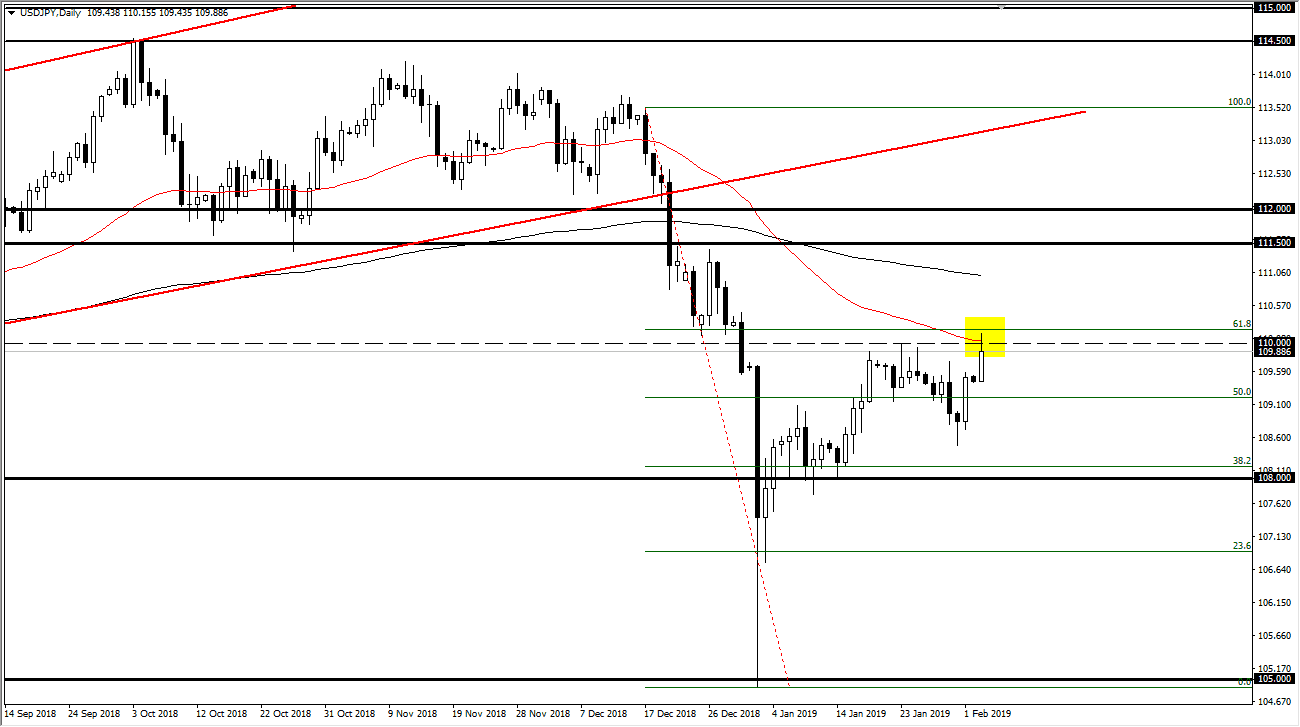

USD/JPY

The US dollar rallied significantly during the trading session on Monday but ran into quite a bit of resistance near the ¥110 level. The 61.8% Fibonacci retracement level has offered resistance as one would expect, and of course the 50 day EMA did as well. Because we have given back some of the gains for the session, I believe that the market is getting ready to roll over. Obviously, there is a lot of choppiness in this market, but with the Federal Reserve stepping away from a hawkish stance, it makes sense that the US dollar will continue to fall. Beyond that, people need to worry about what the Federal Reserve sees ahead, because if it is something to be concerned about, it makes sense that the Japanese yen will strengthen as it is one of the world’s most important safety currencies.

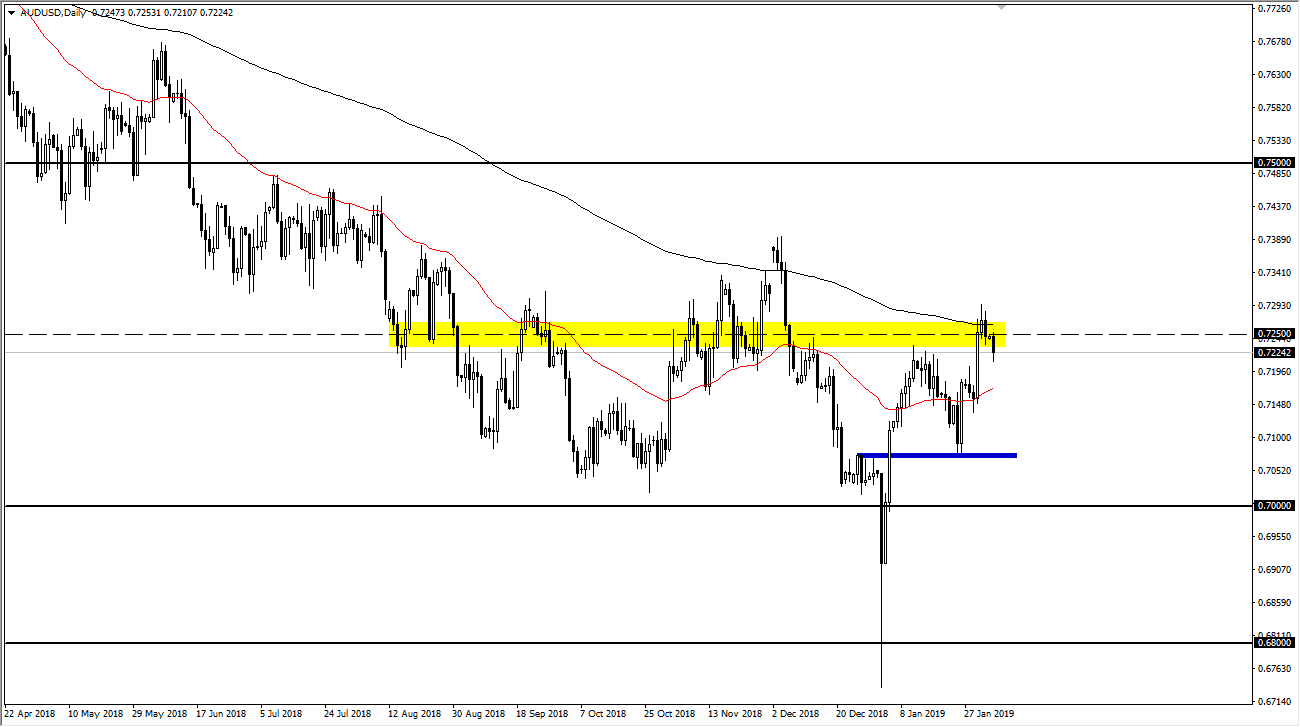

AUD/USD

The Australian dollar fell during the trading session on Monday, as we continue to see plenty of resistance of the 0.7250 level, which is an area that has been important more than once. Beyond that, we have the 200 day EMA just above there, which of course has a lot of importance placed upon it as well as the longer-term traders typically use it for a trend determining signal. The 50 day EMA is just below and turning up though, so I think that the Australian dollar is trying to rally a bit, but we obviously going to have a lot of choppiness ahead of us. This could be based on the Federal Reserve looking dovish, or perhaps we may get some type of momentum on the US/China trade relations. If we get good news out of there, that should send the Aussie dollar higher as well. Remember, the Aussie is a proxy for China.