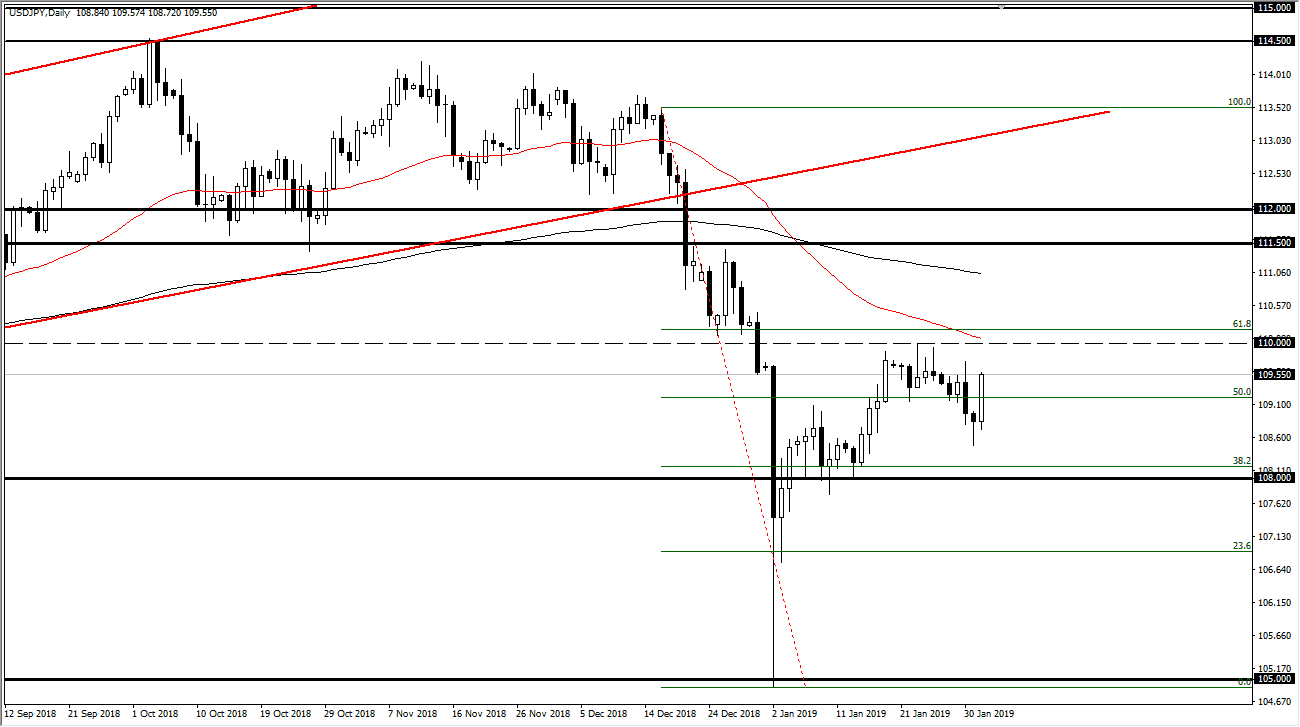

USD/JPY

The US dollar initially dipped a bit during the trading session on Friday, but after the jobs number rocketed higher to break above the ¥109 level handling and approach the ¥109.50 level. While this is a very bullish sign, the reality is that there is a ton of resistance just above. I would not be surprised at all to see the ¥110 level reject price yet again, and then the market would roll over. I certainly think at this point we are likely to see a big fight there as not only do we have the ¥110 level, but we also have the 50 day EMA and the 61.8% Fibonacci retracement level. With that in mind I am looking to fade rallies that show signs of exhaustion closer to the ¥110 region. I believe that the ¥108 level is massive as far as support is concerned.

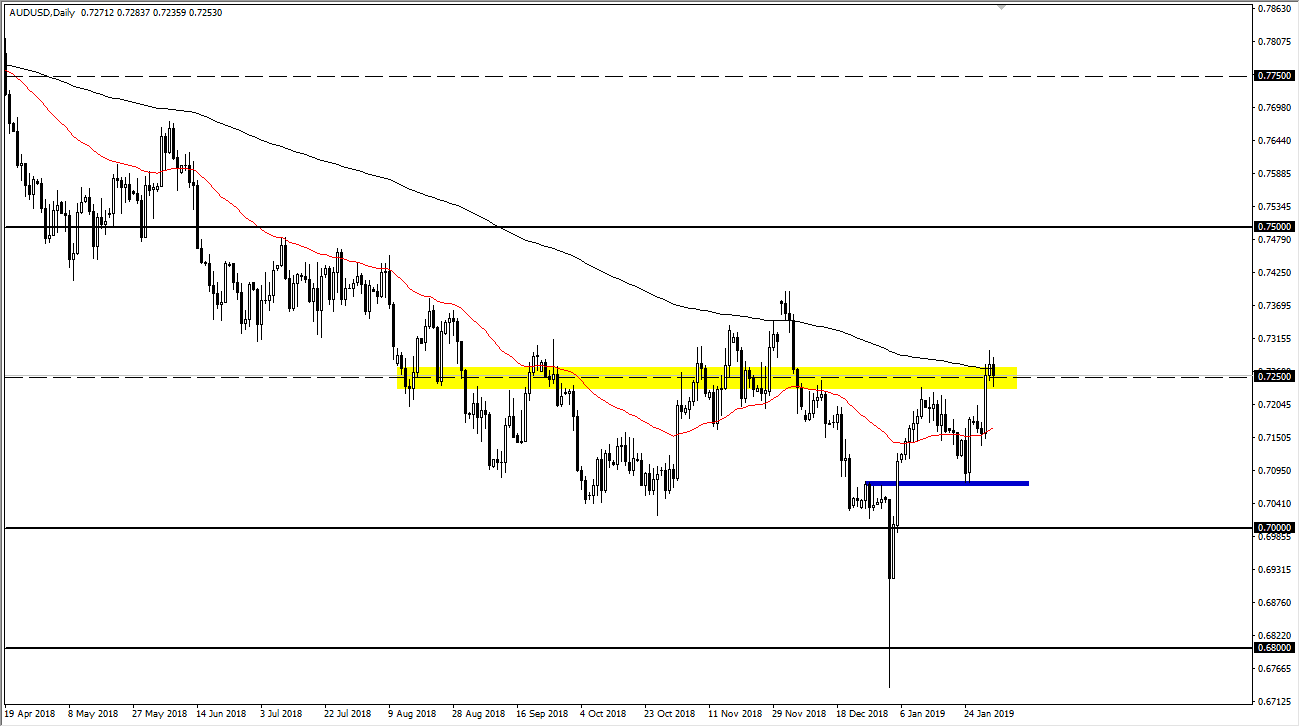

AUD/USD

The Australian dollar has fallen a bit during the Friday session, as we continue to hover around the 200 day EMA. I would fully anticipate that we could get a little bit of a pullback from here, but I also recognize that there should be a lot of support underneath. I believe that the 0.70 level underneath is massive in its importance when it comes to support longer term, that extends down to the 0.68 handle. With that in mind, I would not be surprised at all to see a bit of a pullback after we have had such bullish pressure, and of course we have a lot of conflicting signals coming from the US/China trade situation. Longer-term though, I do believe the buyers are trying to find a bit of a base in this area and a trend change is always a messy affair.