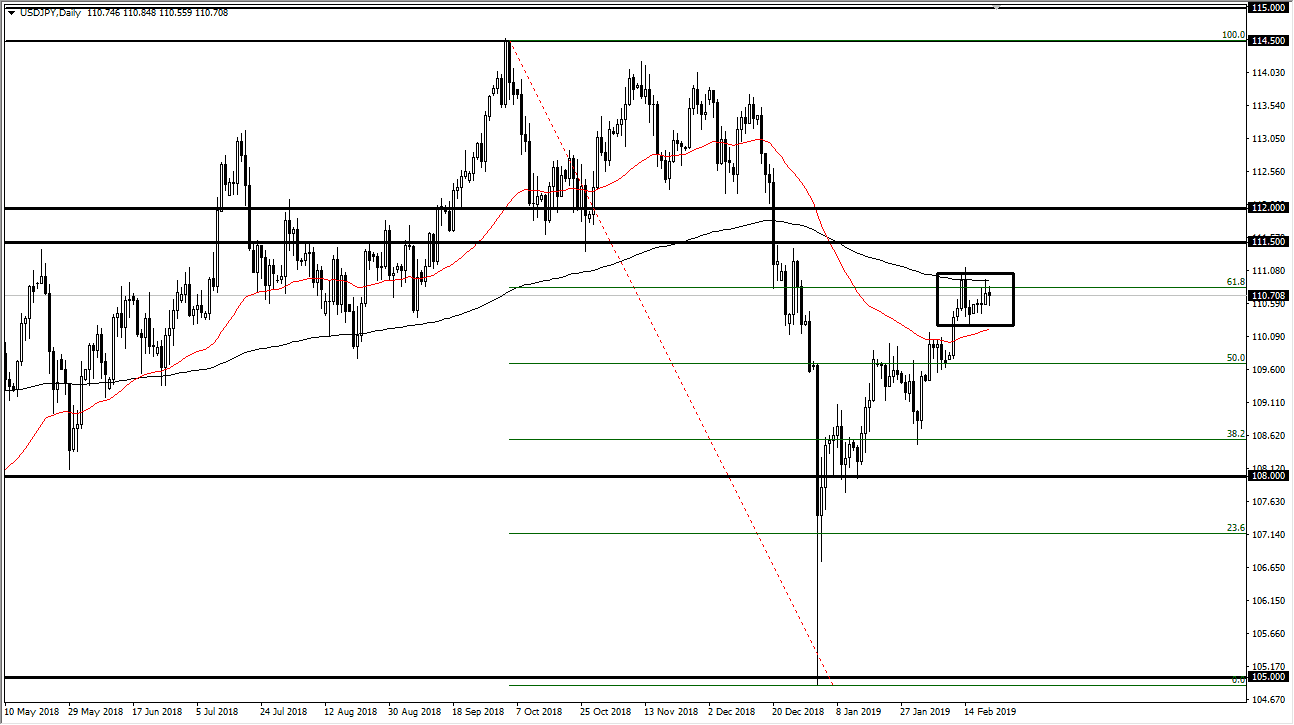

USD/JPY

The US dollar rallied a bit during the trading session after initially falling on Thursday, but overall we continue to meander in the same area that we have been in for some time. At this point, I think that the market is simply looking for some type of catalyst and that most likely of catalyst will be the US/China trade talks. With that in mind, it’s very difficult to imagine a scenario where this market moves without news coming from that, because there’s been nothing to get it interested in going in one direction or the other. However, looking at this market I think that the easiest path is probably lower, because we have a major cluster to the left, the 200 day EMA just above, and of course have seen a lot of technical destruction when it comes to the Japanese yen related pairs. However, the biggest thing would probably be the Federal Reserve on the sidelines and looking very soft overall. That probably will continue to weigh upon the greenback eventually. A move below the ¥110 level gives us the opportunity to start selling.

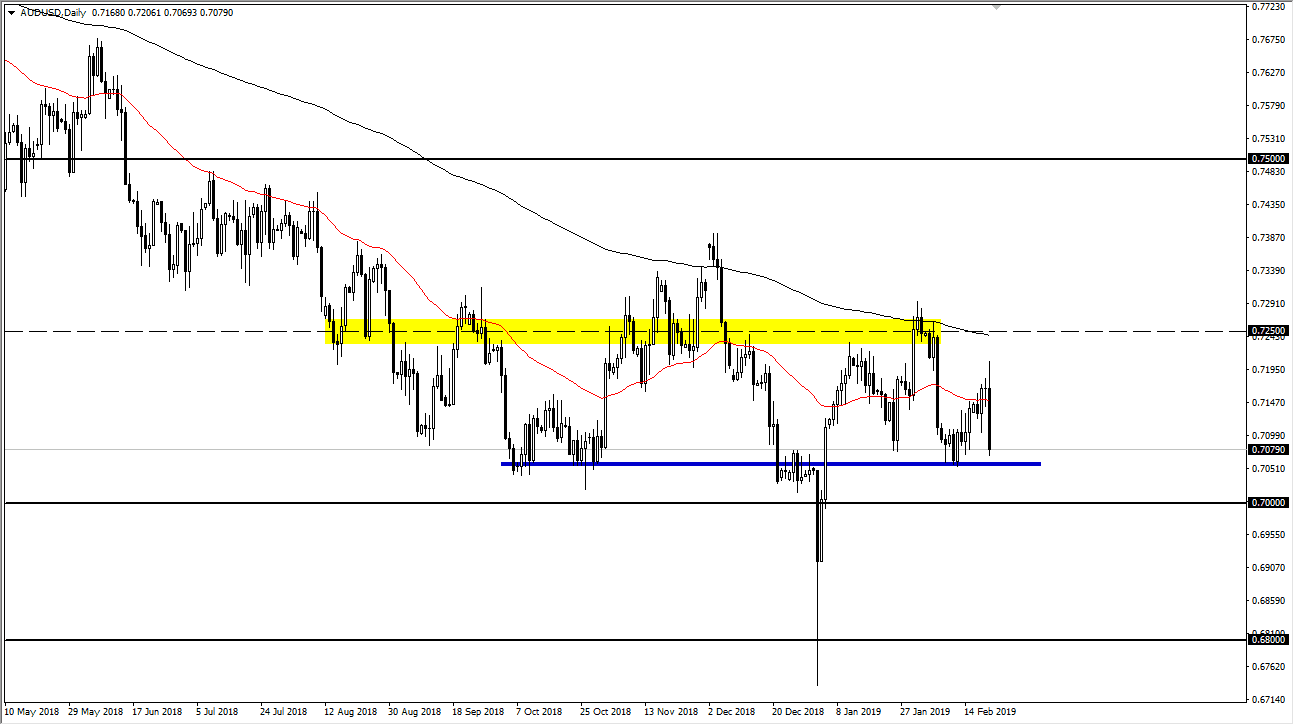

AUD/USD

The Australian dollar got hammered during the trading session on Thursday, but we are close to a significant support level, so I do think that it’s only a matter of time before the buyers come back. With that being the case, it’s very likely that will see a bounce as we have before from this area, but obviously we have a lot of work to do. It’s not necessarily a market that will scream to the upside, but we obviously have such massive support underneath at the market more than likely will respect the area. With that being the case, it’s very likely that the buyers will return.