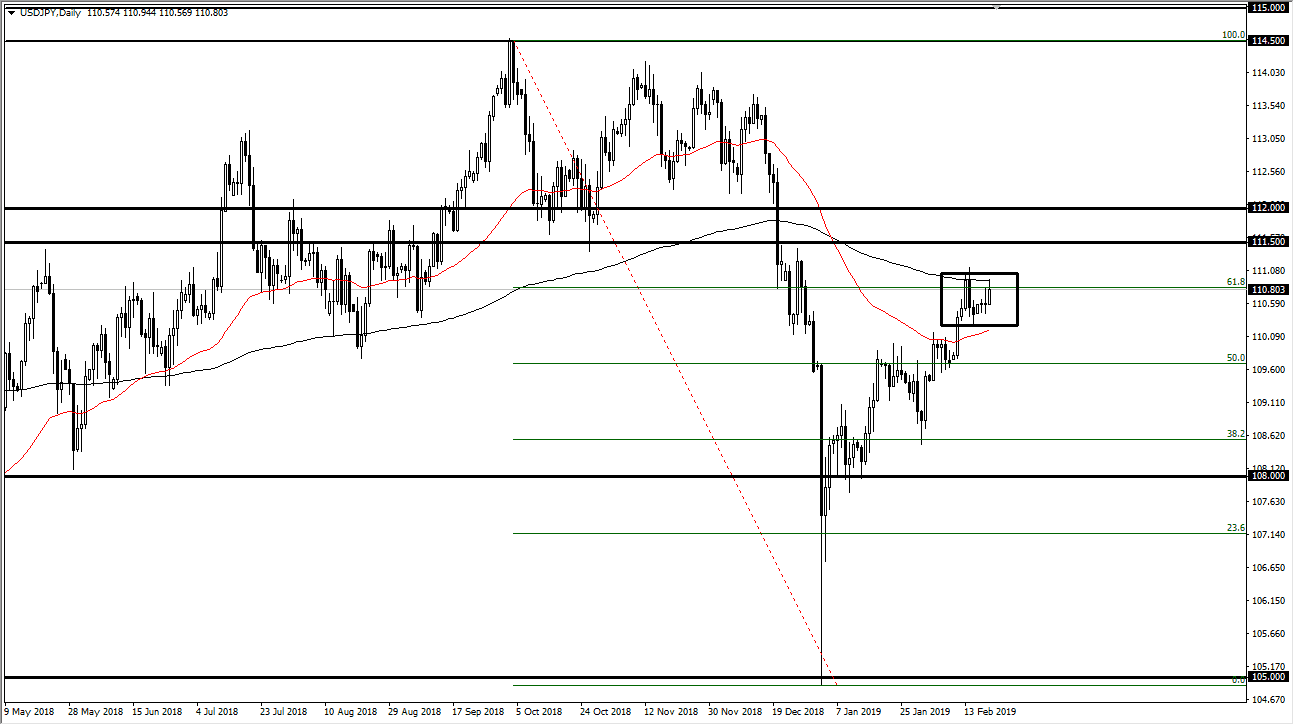

USD/JPY

The US dollar rallied a bit against the Japanese yen, but it seems as if we are still struggling at the 200 day EMA, and of course the 61.8% Fibonacci retracement level. The ¥111 level is significant resistance in and of itself, and as you can see to the left there is a cluster of trading in the middle of December. With that cluster being there, I think there is a lot of order flow, and at this point I think it makes sense that we will eventually roll over a bit and start going down to the ¥109 level given enough time. At this point, I find it very difficult to buy this market as there’s so much in the way of noise overhead. I anticipate that this will be an area that causes a lot of trouble, but I believe that if we can break down below the bottom of the hammer from last week, that could be the signal for sellers to jump in.

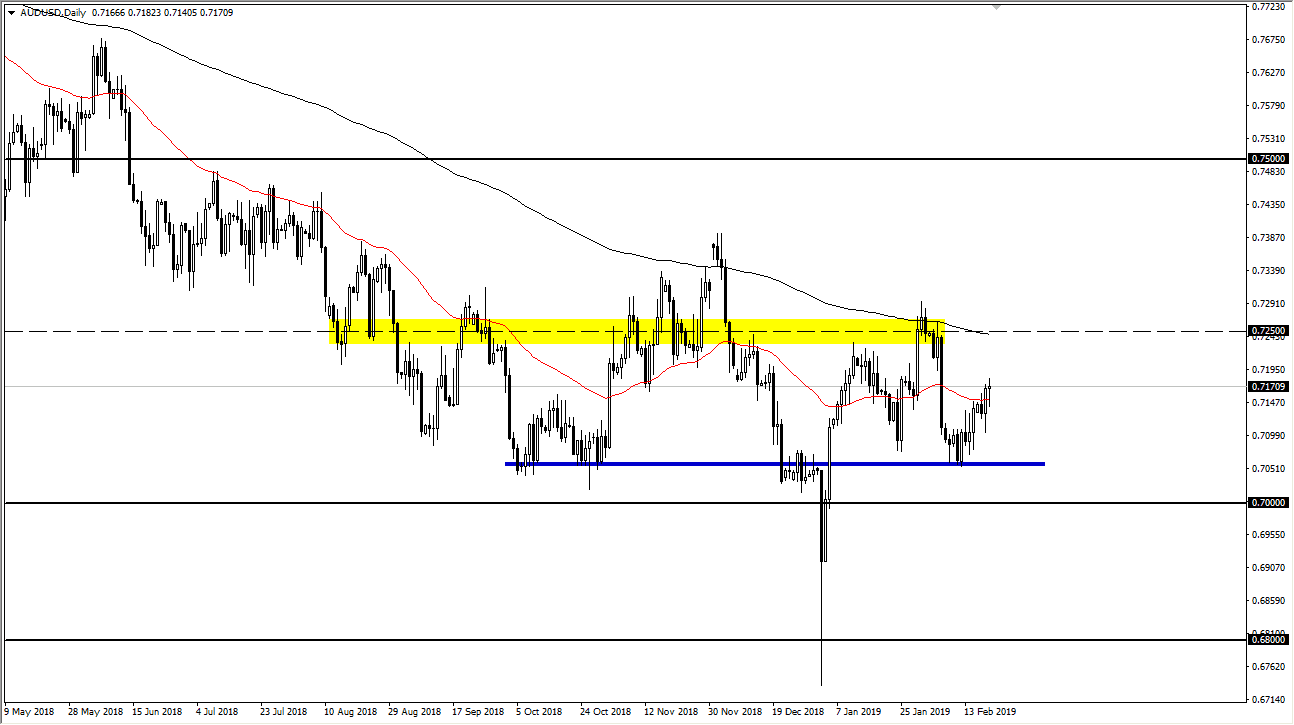

AUD/USD

The Australian dollar has initially fallen during trading on Wednesday but has turned around of form a slightly bullish looking candle as it looks like we will probably continue to grind towards the 200 day EMA above, with a target at roughly 0.7250. With that being the case, I do like buying here still but I also recognize that the noise in the market will continue to be rather difficult to deal with. The 0.70 level underneath is the beginning of massive support, extending down to the 0.68 level. Overall, I think it’s only a matter before we go higher, and if we can clear the 0.7250 low, then I think we could go to the 0.75 handle longer term. If we get good news out of the US/China trade relations, that could send this market into overdrive.