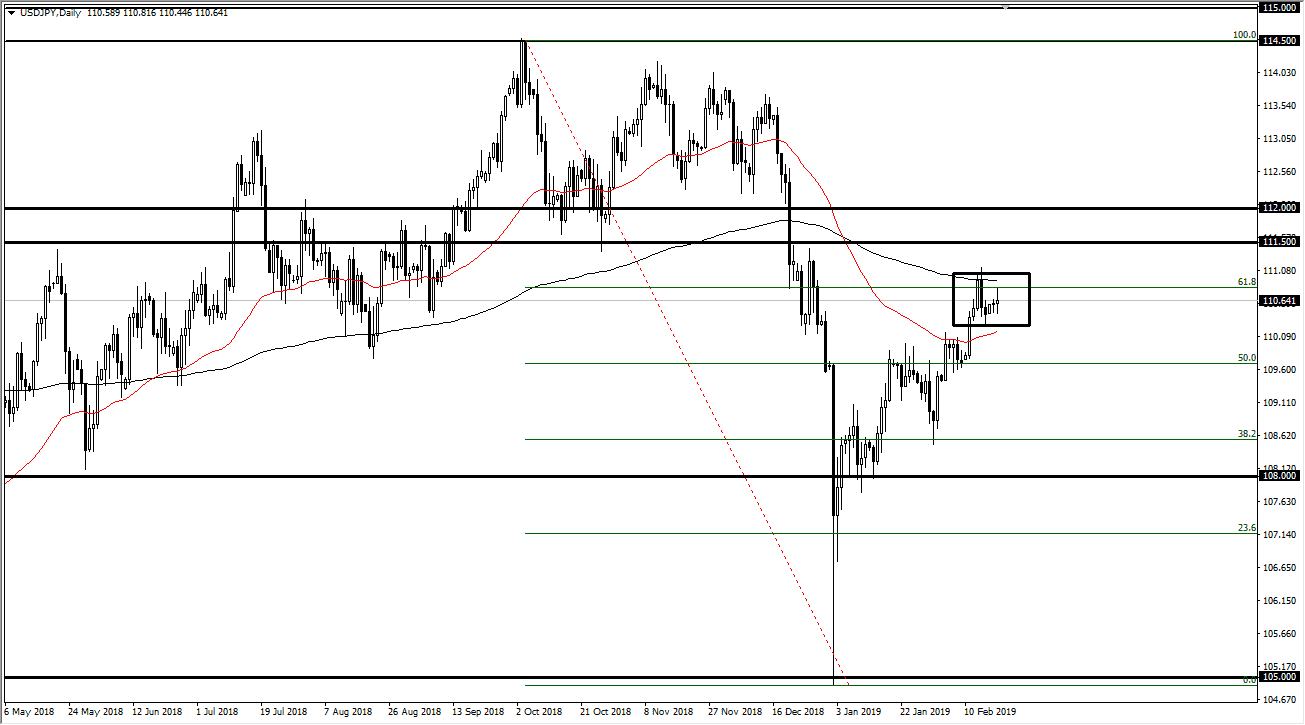

USD/JPY

The US dollar has been a bit volatile against the Japanese yen during the trading session on Tuesday, reaching towards the 61.8% Fibonacci retracement level before finding sellers again. There is the 200 day EMA just above, and that of course causes a bit of resistance on longer-term charts. The 50 day EMA underneath of course is support, so we continue to go back and forth between these two moving averages. If you look to the left, there is a cluster in this area that has been important previously, so it makes sense that we could struggle a little bit in this area regardless. If we break down below the ¥110 level, then I think that the market probably continues to go lower, perhaps reaching down to the ¥109 level, maybe even the ¥108 level. If we do rally, there’s a lot of pressure above as the US dollar has been falling anyway, and of course we have structural and exponential moving average resistance.

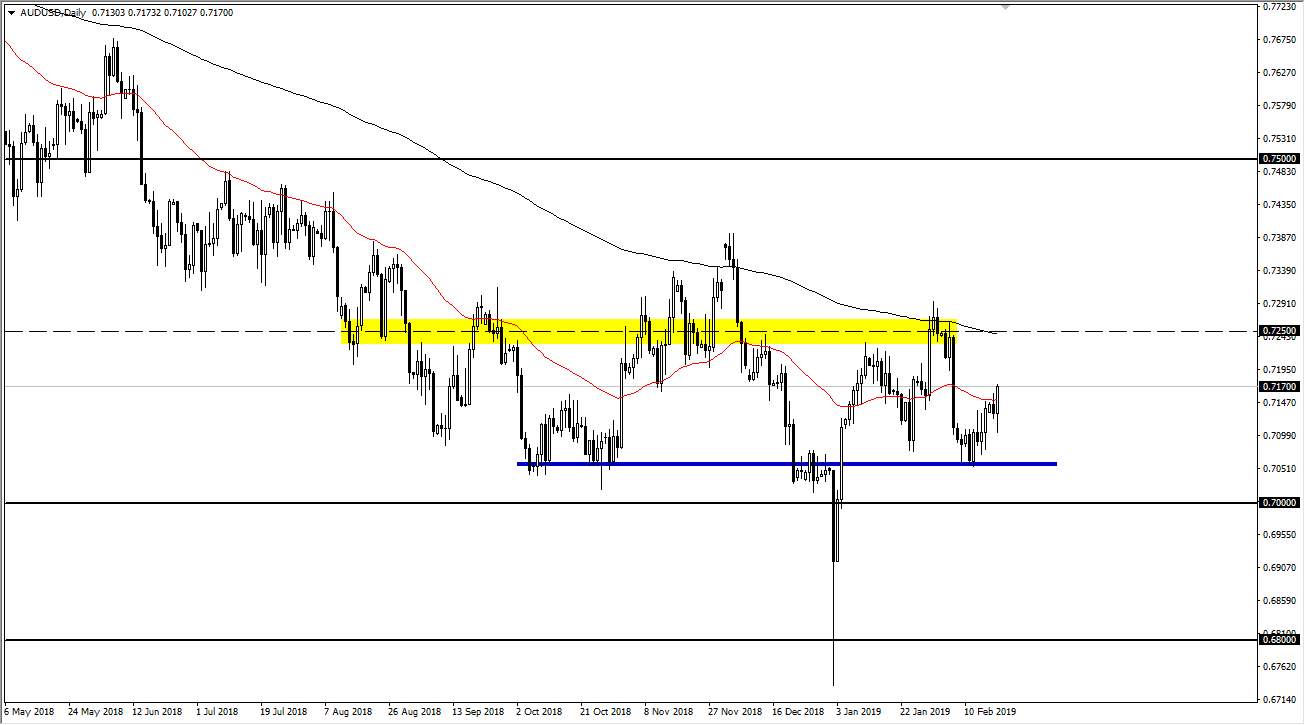

AUD/USD

The Australian dollar pulled back a little bit during the trading session on Tuesday but found buyers underneath near the 0.71 handle to turn around and show signs of life. This is a market that has essentially bottomed from what I see, and I think that we will continue to see the Australian dollar grind higher. This is especially true considering that the US/China trade relations are being discussed this week, so we get any good news whatsoever, that probably since the Aussie much higher. On the other side of the equation, the 0.70 level is massive support on the longer-term charts, just as the 0.7050 level has been. I see support near the 0.70 level on the monthly charts, which very typically doesn’t give way. I’m a buyer but I recognize that the 200 day EMA near the 0.7250 level will be resistive.