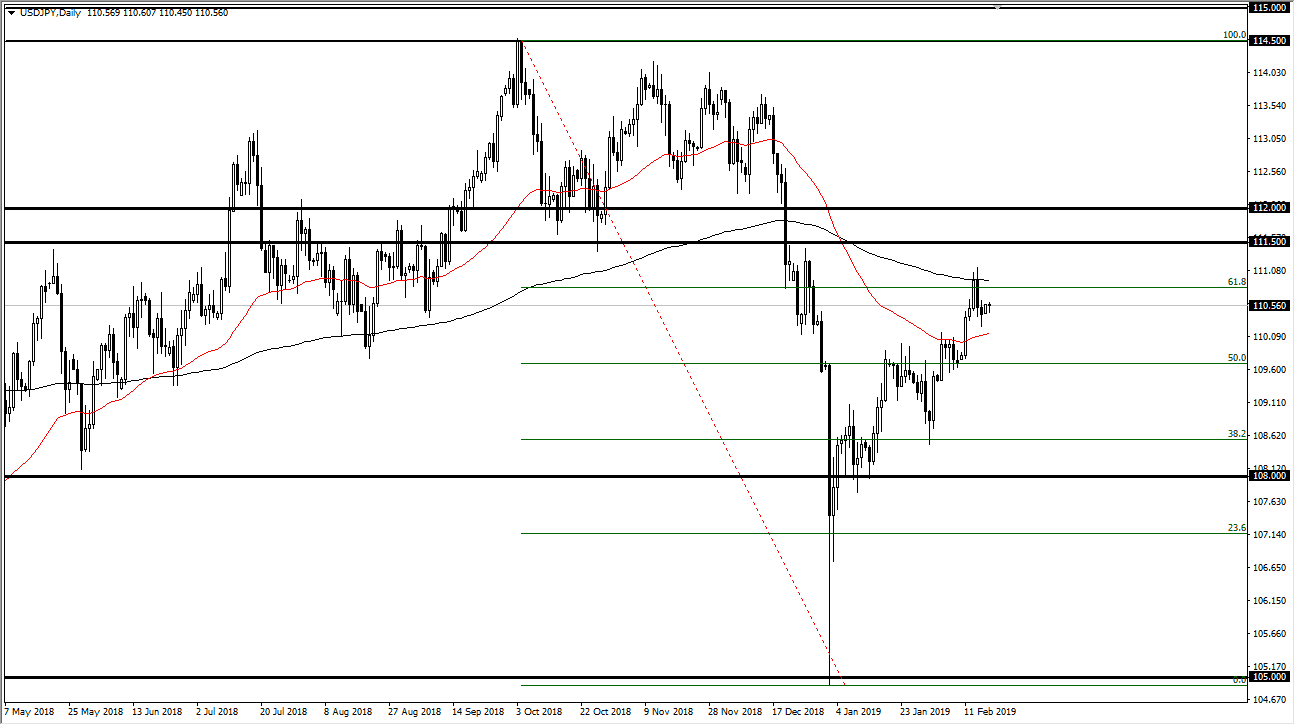

USD/JPY

The US dollar pulled back initially during the trading session on Monday to kick off the week but found strength again against the Japanese yen. It looks as if we are ready to consolidate further, with the 200 day EMA just above and hanging near the ¥111 level. That was a scene of selling pressure recently, and I think that it is only a matter of time before the sellers will return. Essentially I think that we are looking at consolidation just waiting to happen as we are at extremely high levels from the bounce and have seen the 61.8% Fibonacci retracement level offer resistance as well. Above this area, I think the ¥111.50 level would of course be resistance also. I anticipate short-term moves at best, as we continue to chop around and figure out where we are going as far as risk appetite is concerned.

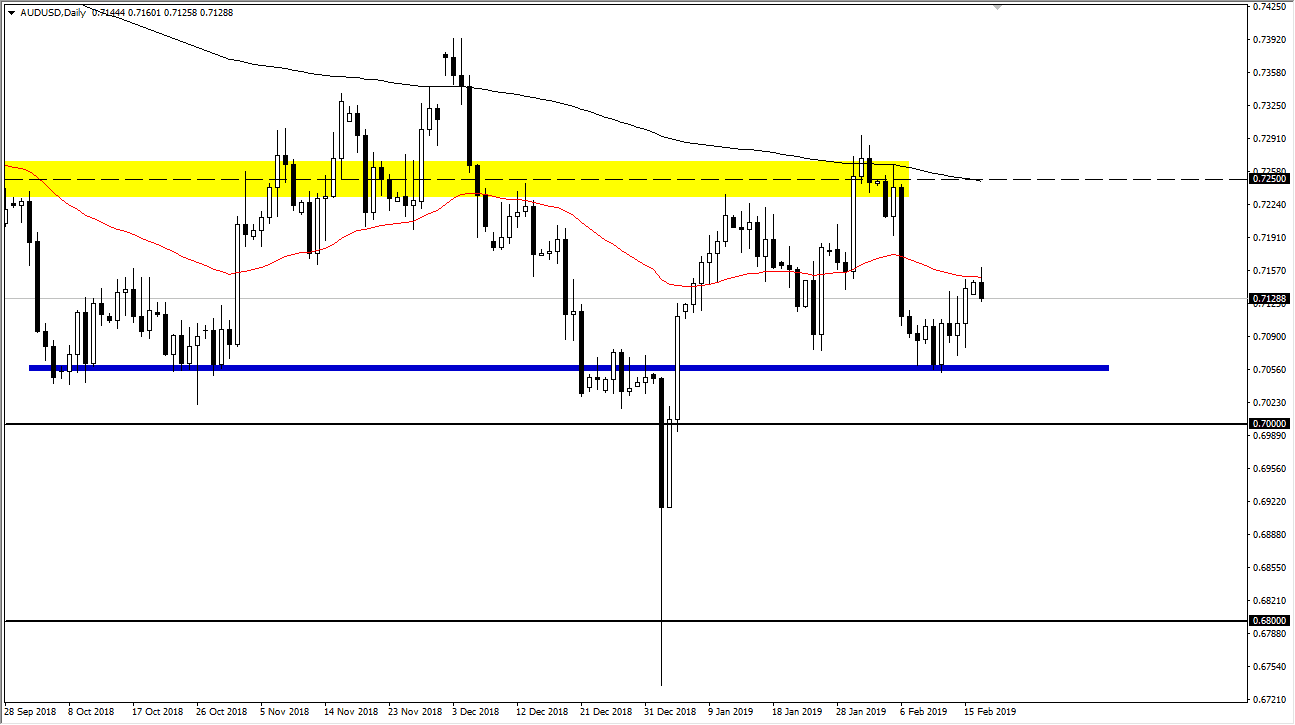

AUD/USD

The Australian dollar started out relatively strong during the trading session but pulled back to show signs of weakness again. However, I do think that there is a certain amount of buying pressure underneath so I’m looking for some type of short term supportive candle or a bounce or something that I can get involved with and start buying again. At that point, I think that the 0.7050 underneath offers a significant amount of support, extending down to the 0.70 level, and then eventually the 0.68 level after that. That is an area that has been a massive support level on the monthly chart, so therefore I think the buyers will continue to flock to this area. Beyond that, if we get any good news out of the US/China trade talks, the Australian dollar will rally significantly. I believe that the 0.7250 level is the target to the upside.