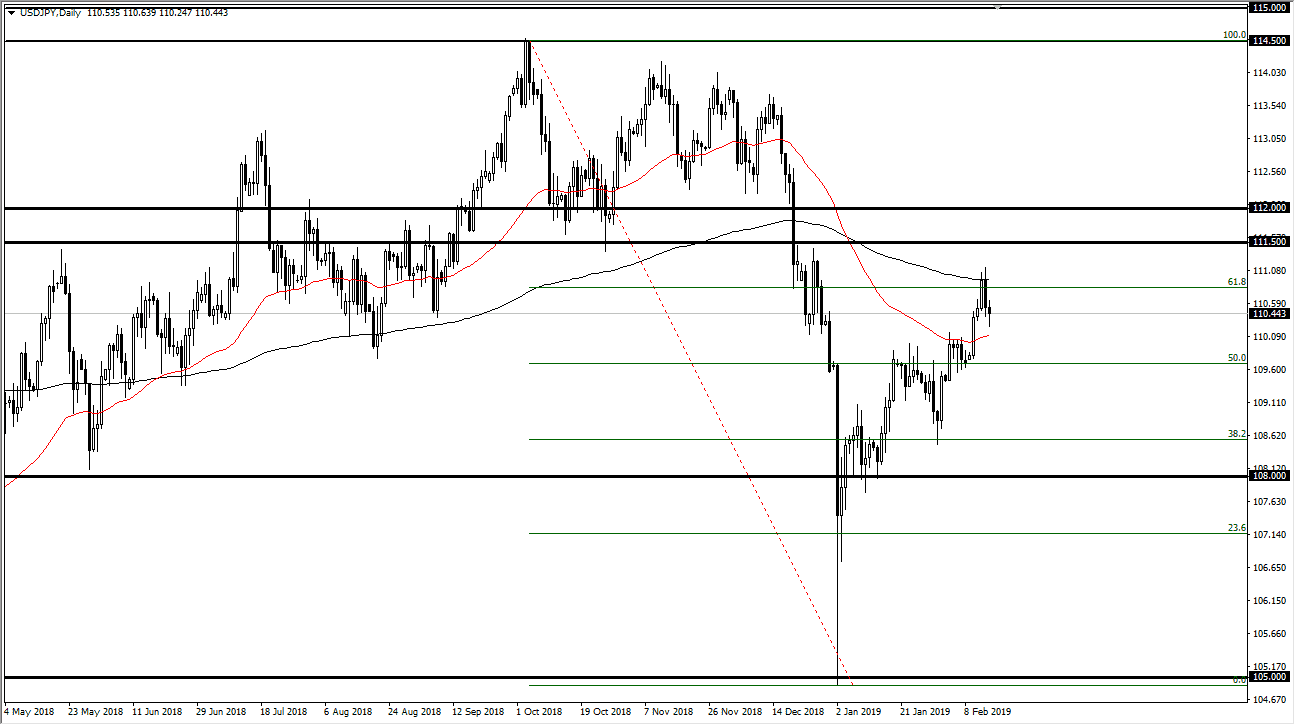

USD/JPY

The US dollar fell initially during the trading session on Friday but turned around of form a bit of a hammer. That’s a good sign, and it suggests that we are not quite done rallying. However, we are in the middle of a lot of noise as can be seen in the middle of December, and the fact that we are just below the 61.8% Fibonacci retracement level and the 200 day EMA. Because of this, expect a lot of noise but I believe that the market will make a bit of an attempt to rally from here. Willie go to a fresh, new highs? I don’t know, but I certainly recognize that we have gotten over bought so looking for signs of exhaustion might be a way to trade this market. I also notice a lot of support underneath at the ¥109 level, so we may be looking at a new choppy trading range forming.

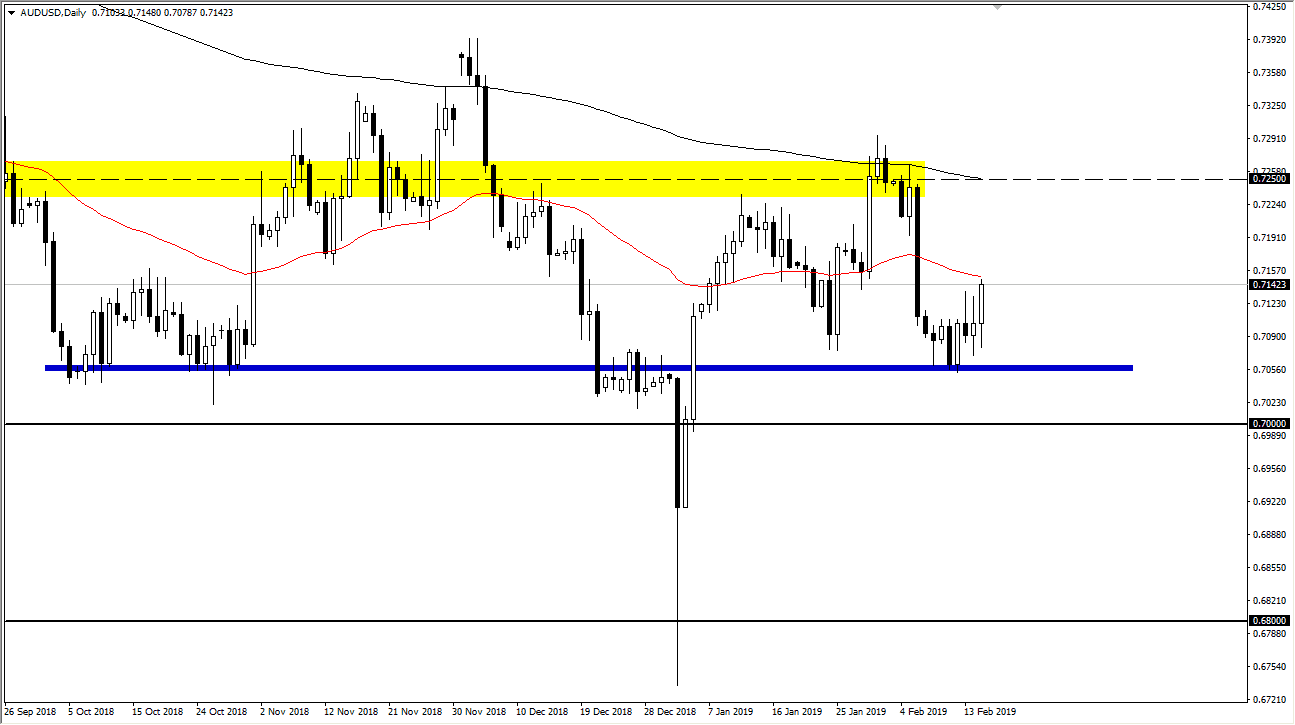

AUD/USD

The Australian dollar initially fell during the day as well but turned around to explode to the upside. The most important part of this chart is the fact that we have broken above the two long wicks from the previous sessions, showing that a certain amount of resistance has been broken. The biggest factor to this market stopping is the fact that it is Friday, and I do believe that eventually we will continue to reach towards the 0.7250 level yet again. That coincides with the 200 day EMA and of course an area that has shown a certain amount of resiliency on the sell side anyway. If we can break above that, the market can really start cooking to the upside. Just below us, there is a massive amount of support that I do not think it’s broken.