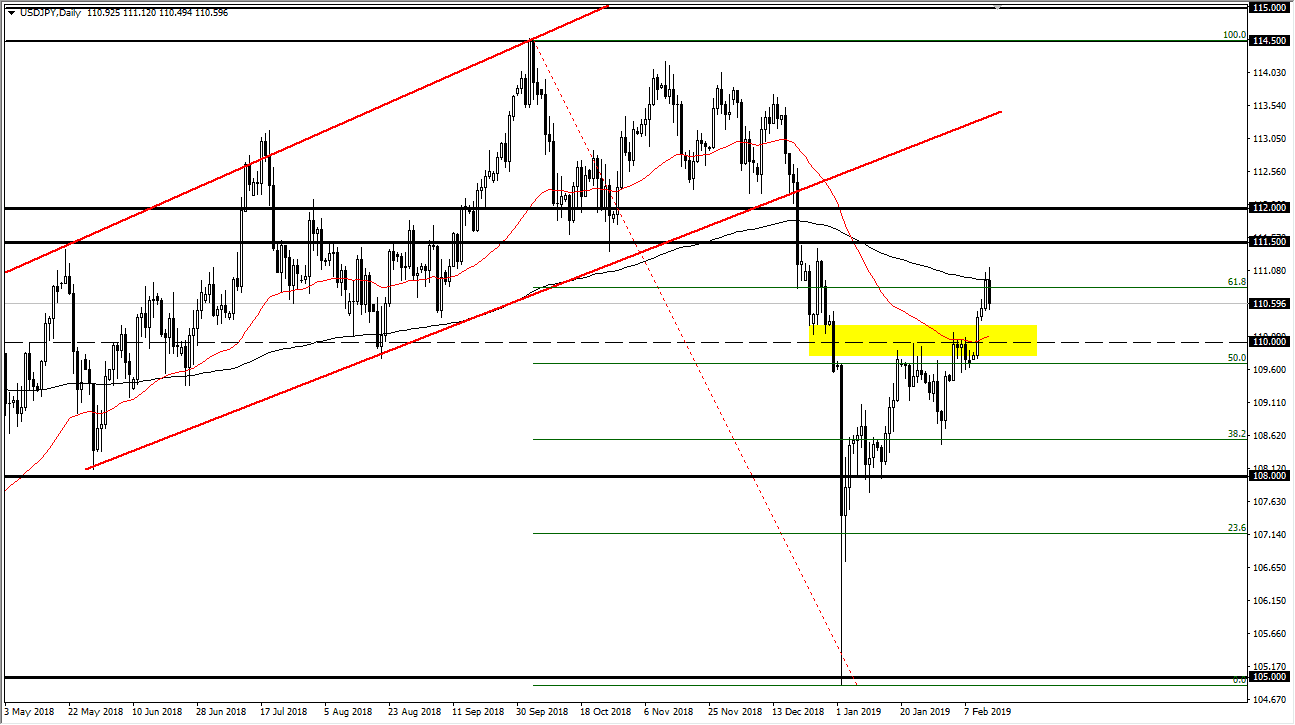

USD/JPY

The US dollar initially tried to rally during the trading session on Thursday but gave back quite a bit of the gains as we got very poor economic numbers out of America. Beyond that, the 200 day EMA of course would attract a lot of attention. Ultimately, I think that gives an excuse for traders to get involved and start shorting again. After all, not only do we have the 200 day EMA, but we also have the 61.8% Fibonacci retracement level and a cluster to the left which was a significant area of selling previously. In fact, it’s the area we broke down from when the yen flash crash happened. On this chart, I think the next target to the downside would probably be ¥110. If we do rally from here, I think the ¥111.50 will be very difficult to break above.

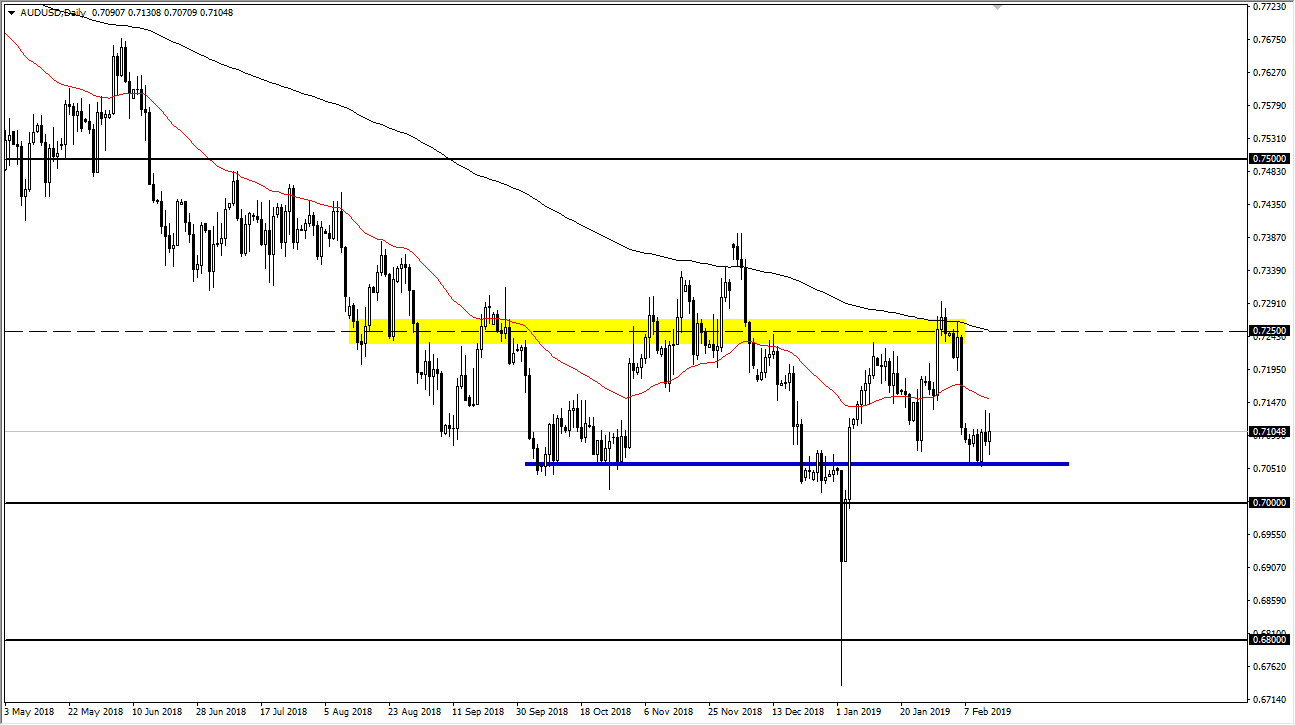

AUD/USD

The Australian dollar was all over the place during the trading session on Thursday, as we continue to build a bit of a base to try to break out to the upside. I think that at this point the 0.70 level looks very likely to offer significant support, so therefore I believe that we are trying to build up reason or momentum to go higher. At this point, I think that the Australian dollar is eventually going to break out to the upside and that you should be using short-term pullbacks for buying opportunities.

When you look at the longer-term charts, the 0.70 level extends down to the 0.68 level as massive support on the monthly time chart. Ultimately, this is a market that is going to be very noisy, but I think we are trying to find a way to turn the entire trend around.