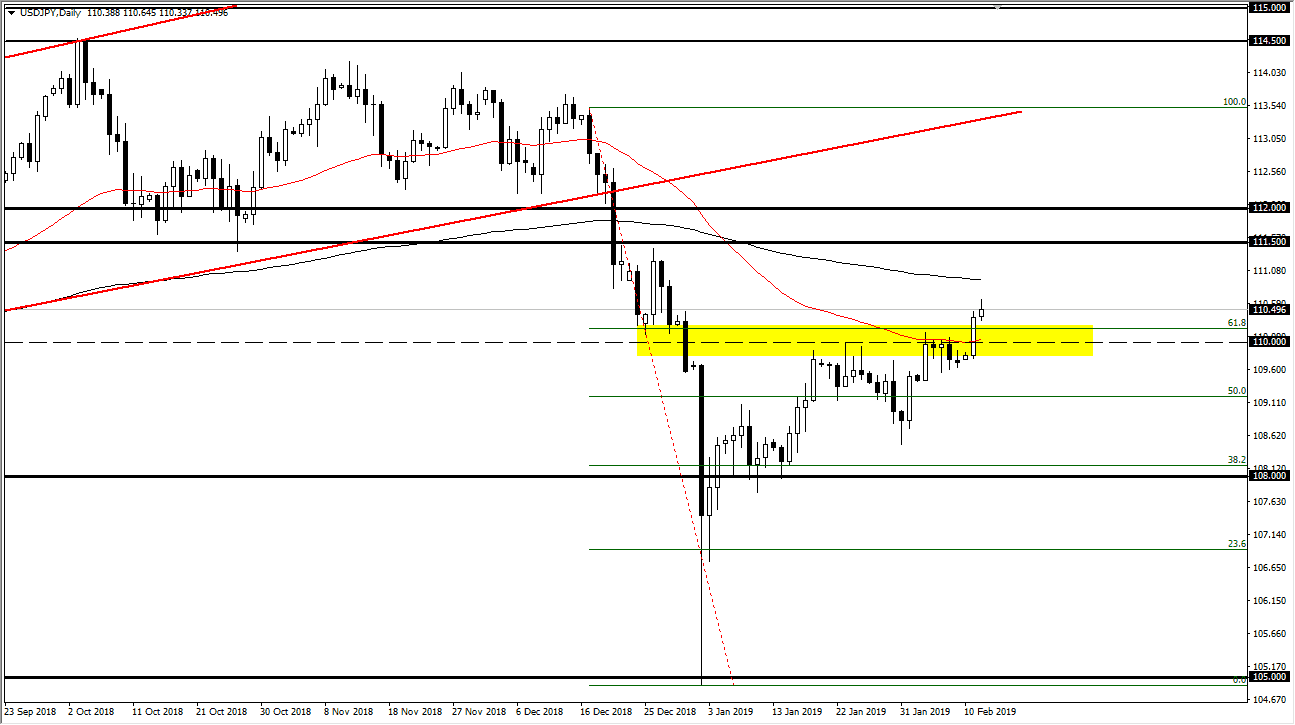

USD/JPY

The US dollar rallied against the Japanese yen again during the day on Tuesday, but did give back about half the gains, which of course isn’t necessarily the strongest of signals. At this point, I think it’s only a matter of time before we roll over, as we are approaching the 200 day EMA. However, we need to break back below the bottom of the daily candle to kick off a shooting star shorting opportunity, so until then I think you are probably best to sit on the sidelines. Yes, we have been bullish as of late but we are running out of momentum yet again. The 200 day EMA will certainly attract a lot of attention as well, so keep that in mind. I think that we are going to see this market roll over eventually, but in the meantime you are probably going to be best advised to stay away.

AUD/USD

The Australian dollar has rallied significantly during the day on Tuesday, using the 0.7050 level as massive support as we continue to grind in this general vicinity. I think that it is only a matter of time before we bounce from here, so short-term pullbacks should be thought of as potential buying opportunities. I think the AUD/USD pair is getting a bit of a boost from the possibility of a trade deal being worked out, as the tone has quieted a little bit going into this potentially important week. I think given enough time, we will get the reason to go long and the market will surge much higher. I believe that the 0.70 level is the beginning of a 200 pips range of massive support that can be easily traced on the monthly timeframe. With that in mind, I think pullbacks continue to be buying opportunities.