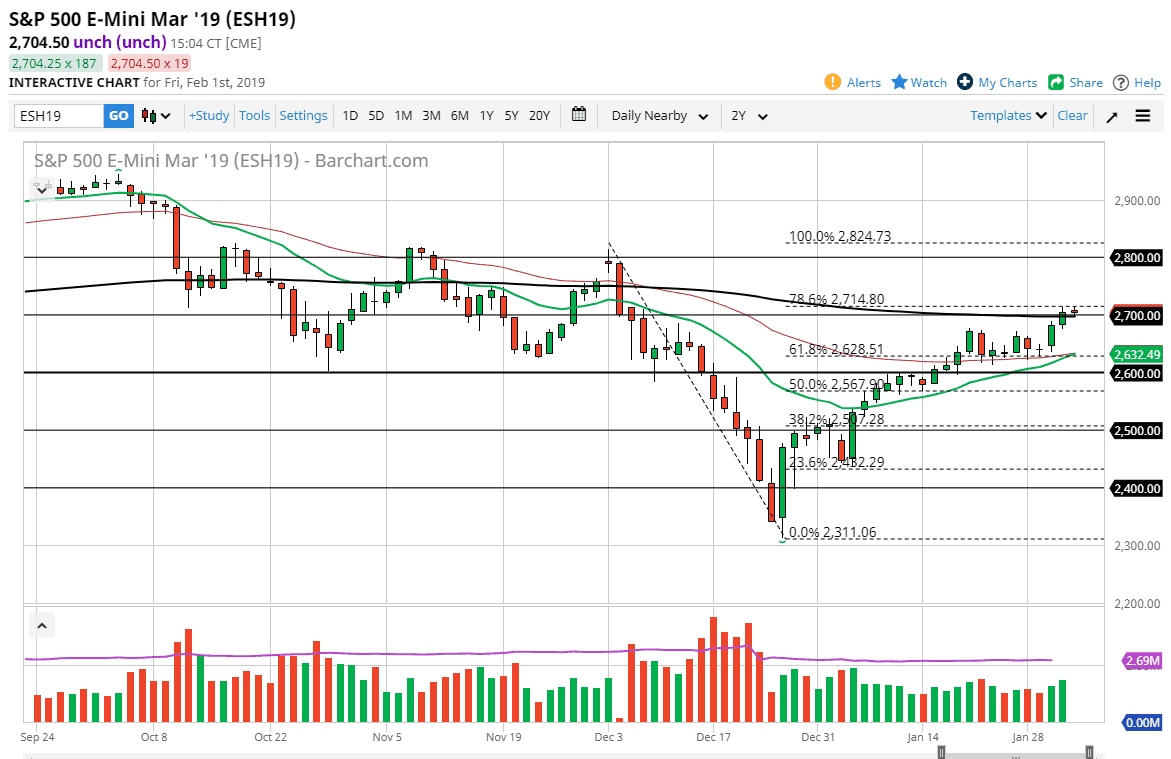

S&P 500

The S&P 500 went back and forth after the jobs number came out on Friday, as the United States added over 300,000 jobs for the month of January. That being the case, the market was very erratic but cautiously optimistic. At this point, the market initially tried to rally but then pulled back towards the 2700 level before we bounced again. This is a very choppy and difficult day to deal with, and quite frankly you probably could have lost a lot of money if you aren’t careful. We are at the 200 day EMA, but it is underneath and of course the Federal Reserve looks likely to be a bit on the W side going forward. I think at this point, if we can continue to go higher, then we can go to the 2800 level. If we pull back from here, I believe that the market will more than likely find plenty of support underneath.

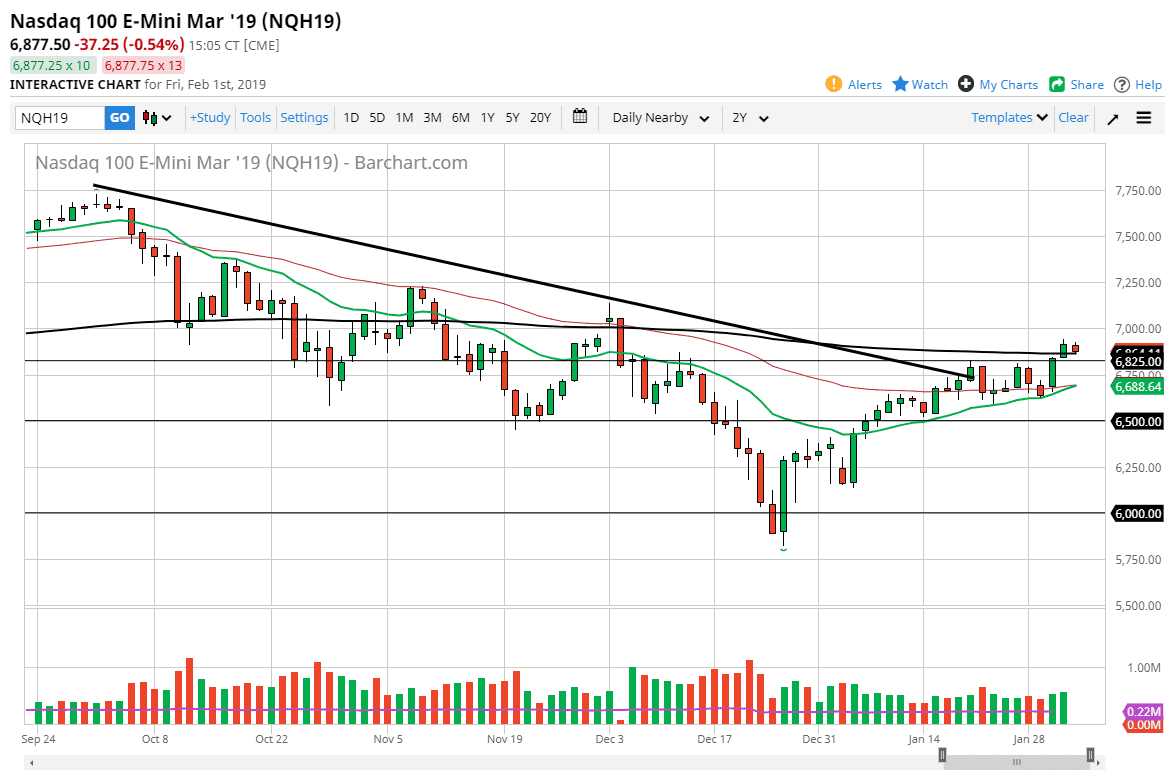

NASDAQ 100

The NASDAQ 100 had a flat-out negative day, pulling back to the 200 day EMA. We are sitting just above the 6825 level, an area that is previous resistance, so it should now be supportive. The bullish candle that broke above the 6825 level could be a major form of support as well. Beyond that, I think that we might be a little bit exhausted so keep an eye on the green 20 day EMA, which should have a certain amount of importance.

The alternate scenario of course is that we break above the highs from the Thursday session, which could send this market looking towards the 7000, but I do not think we are very likely to see that move without at least the market backing up a little bit to build up the necessary momentum. The 7000 level should offer plenty of resistance, so I think that breaking above there would be an extraordinarily bullish sign.