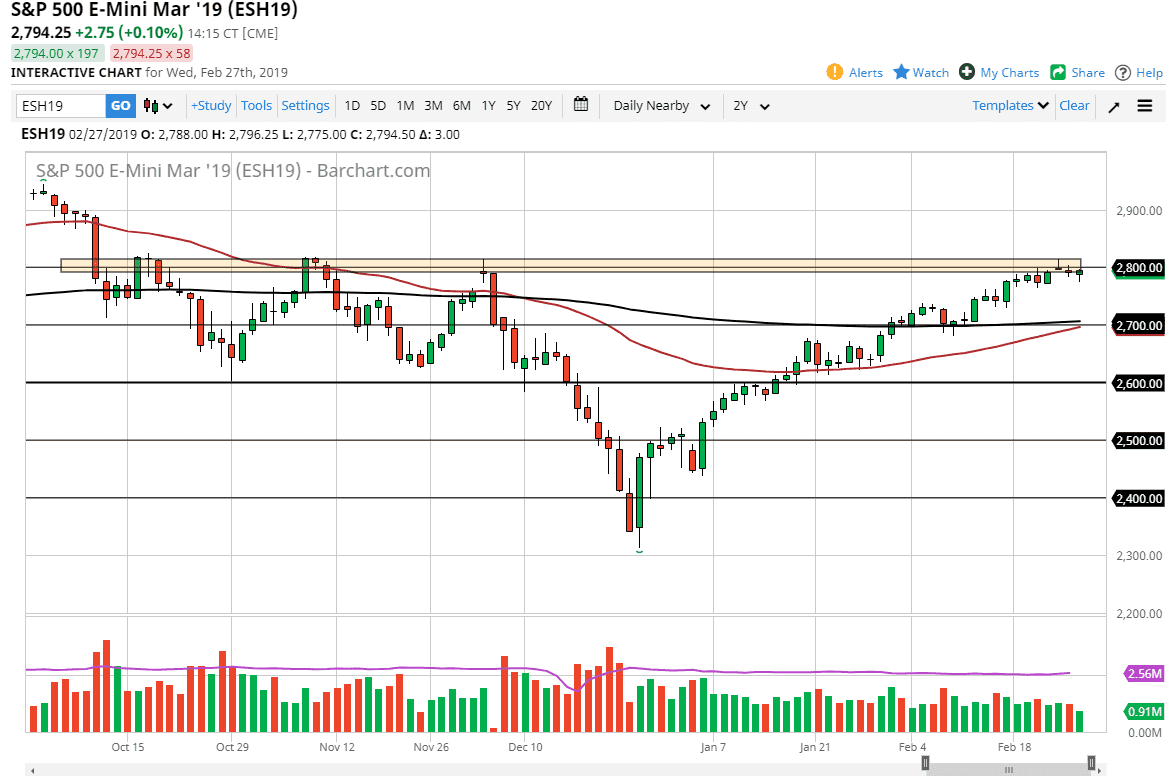

S&P 500

The S&P 500 continues to struggle with the 2800 level, as we continue to see a lot of selling pressure in that area. Even with Jerome Powell speaking during the session and sounding a bit more dovish, the S&P 500 civilly cannot seem to be able to break out of this area. By the end of the day, we did form a slightly bullish candle, but nothing that is overly impressive. It looks as if the market continues to tread water and that it needs desperately find some type of directionality going forward. At this point, it looks as if we are still in and uptrend but the sellers are starting to press the issue. Because of this, I would be on the sidelines until we get an impulsive candle in one direction or the other. Trading at this point is simply back and forth gambling.

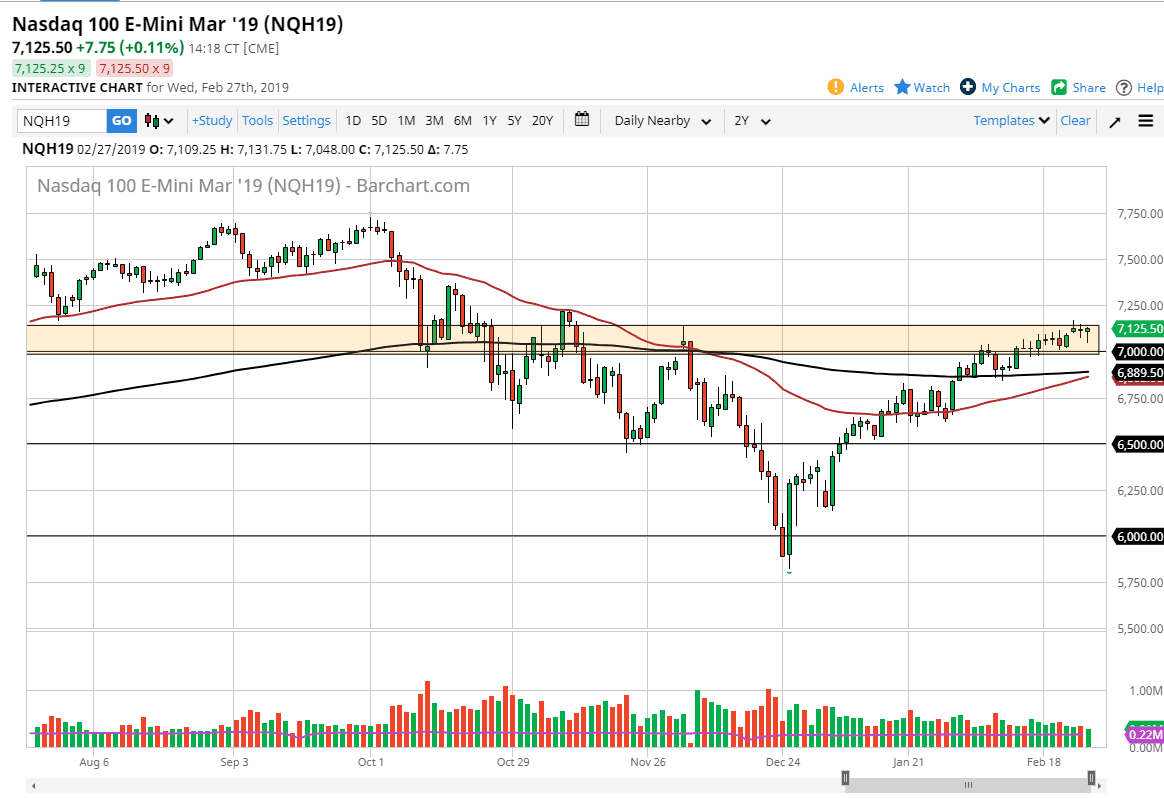

NASDAQ 100

The NASDAQ 100 fell during most of the day but turned around of form a hammer. This is a bullish sign and suggest that we are ready to continue going higher. However, I see a lot of resistance above that extends to the 7250 level, meaning that even if we do go higher, it’s going to take a significant amount of momentum. At this point, if we turn around and break down below the 7000 handle that would be very negative and could send this market much lower. Buying the dips continues to work in the short term, but if we break down below that level then we have to question a lot of things going forward and wait to see whether or not the buyers come back near the 200 day EMA.