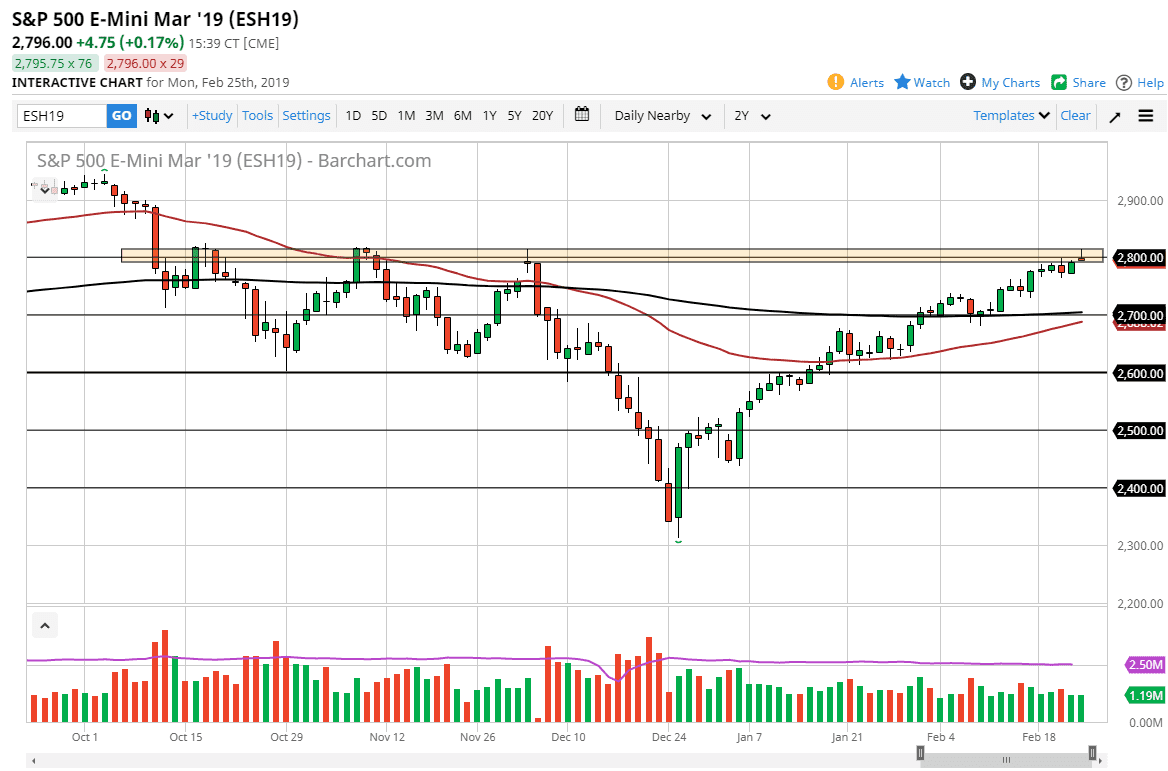

S&P 500

The fact that Donald Trump tweeted he was pushing back tariffs against the Chinese, which of course had a “risk on” feel to it, the market reached towards the top of this range, but then turned around of form a shooting star. That’s an exhaustive candle, and therefore I think the 2800 level is probably going to cause a significant amount of bearish pressure at this point, and overall the market attitude is one that is a bit overextended, so I would not be surprised at all to see this market pulling back a bit from here. If we break down below the bottom of the range for the trading session on Monday, it’s very likely that we will go looking towards 2775, possibly the 2750 handle. At this point, it’s only going to take some negative news to send this much lower. Otherwise, if we break above the top of the shooting star, then the market will free itself to go to the 2900 level.

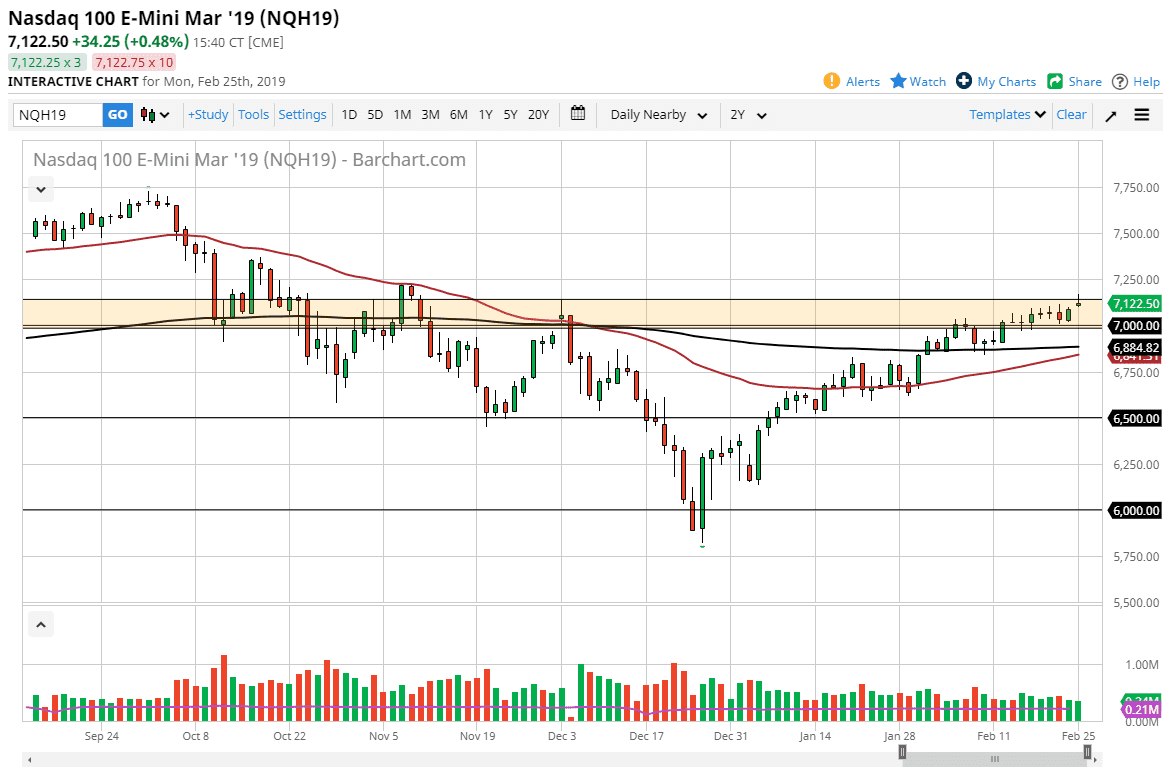

NASDAQ 100

The NASDAQ 100 gapped higher to kick off the week as well but found enough resistance near the 7200 level to turn around and form a shooting star. The shooting star is a very negative sign, and therefore I think we could pull back from here and go looking towards lower levels. The 7000 level is a major support level, and at this point it’s likely that the market continues to struggle. The 200 day is underneath there, and I think that we may have to pull back to test it as we had gotten a bit ahead of ourselves. Ultimately, if we break above the top of the shooting star, the market could then go much higher above.