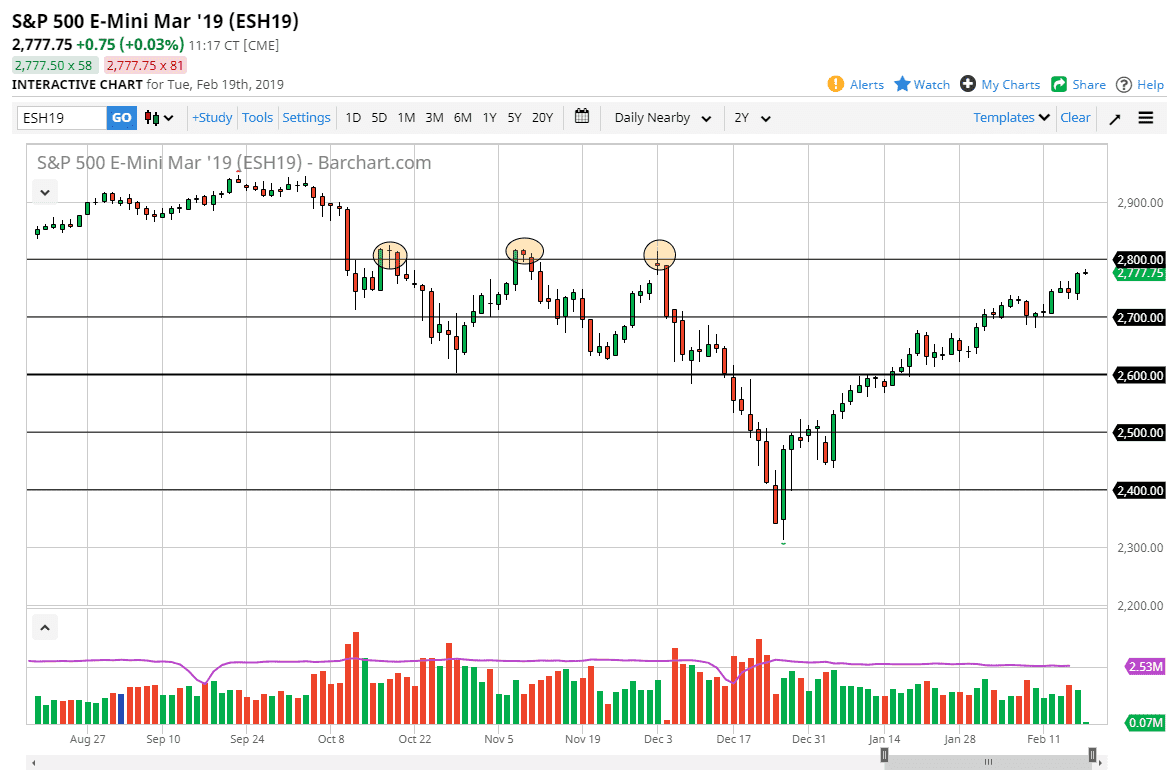

S&P 500

The S&P 500 futures market only had shortened electronic trading during the day, as the underlying index was closed due to the Presidents’ Day holiday. That being said, we could still glean some information at the recent price action, slamming into what should be a significant resistance barrier. The 2800 level above should be massive resistance, and I think that at this point we are probably going to see a bit of a pullback. However, what you should be paying attention to as the market rallies is whether or not we can close above that area on a daily candle stick. I suspect that the Tuesday candle stick will be crucial, as we could end up forming a selling signal just as easily as a breakout. You should be very cautious about putting money into this market, as I think we are reaching a major inflection point and it’s probably best to let the market show you where it is going to go and simply following it.

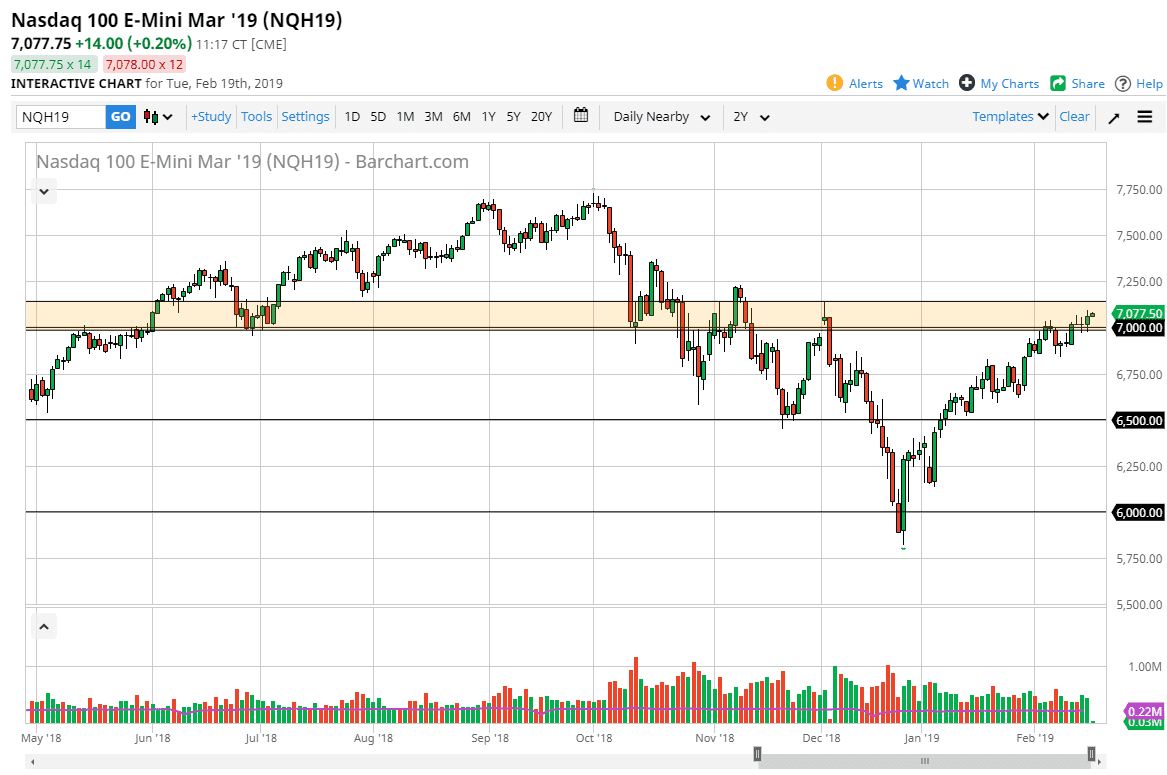

NASDAQ 100

The NASDAQ 100 has rallied a bit during the electronic futures session on Monday, but the underlying index of course wasn’t open as Presidents’ Day also affected this market. I think at this point, we are in a major inflection point here as well, and we should be very cautious about putting money to work. There will be a reckoning rather soon, so what we need to see is some type of exhaustive candle, or an impulsive one to put money to work. You are best served to sit on the sidelines right now, and let the market decide what it wants to do before risking your trading capital. There is no need to be a hero here, because the next move should be rather big, but we don’t know what direction yet.