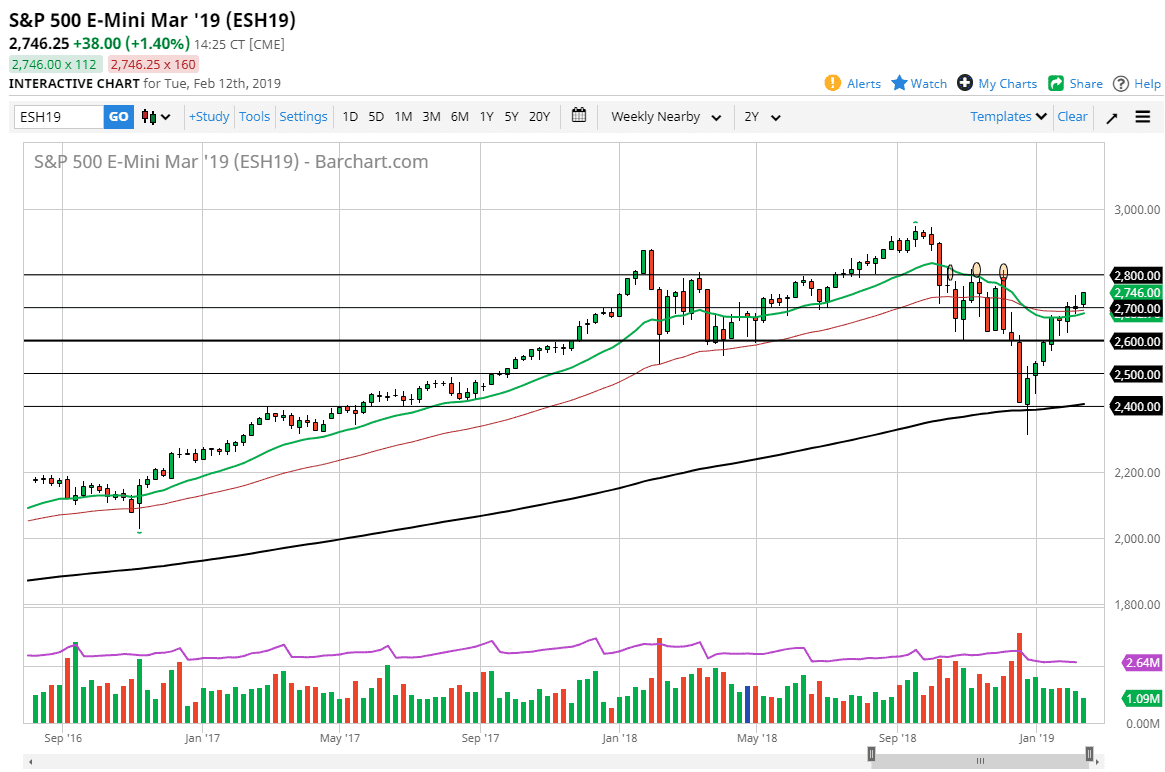

S&P 500

The S&P 500 initially dipped slightly during the trading session on Tuesday but found plenty of support at the 2700 level. Because of this, the market rallied rather significantly, and perhaps even more importantly, have broken above the top of the shooting star from the previous session, which of course is a very bullish turn of events. I think at this point it’s likely that the market will go looking towards the 2800 level based upon the potential government shutdown being possibly averted, and then of course signs of the US/China situation looking a little bit better after comments by Donald Trump. At this point though, I think the 2800 level is going to be very difficult to get above so I think that the upside is probably somewhat limited to that level unless of course we get some type of deal.

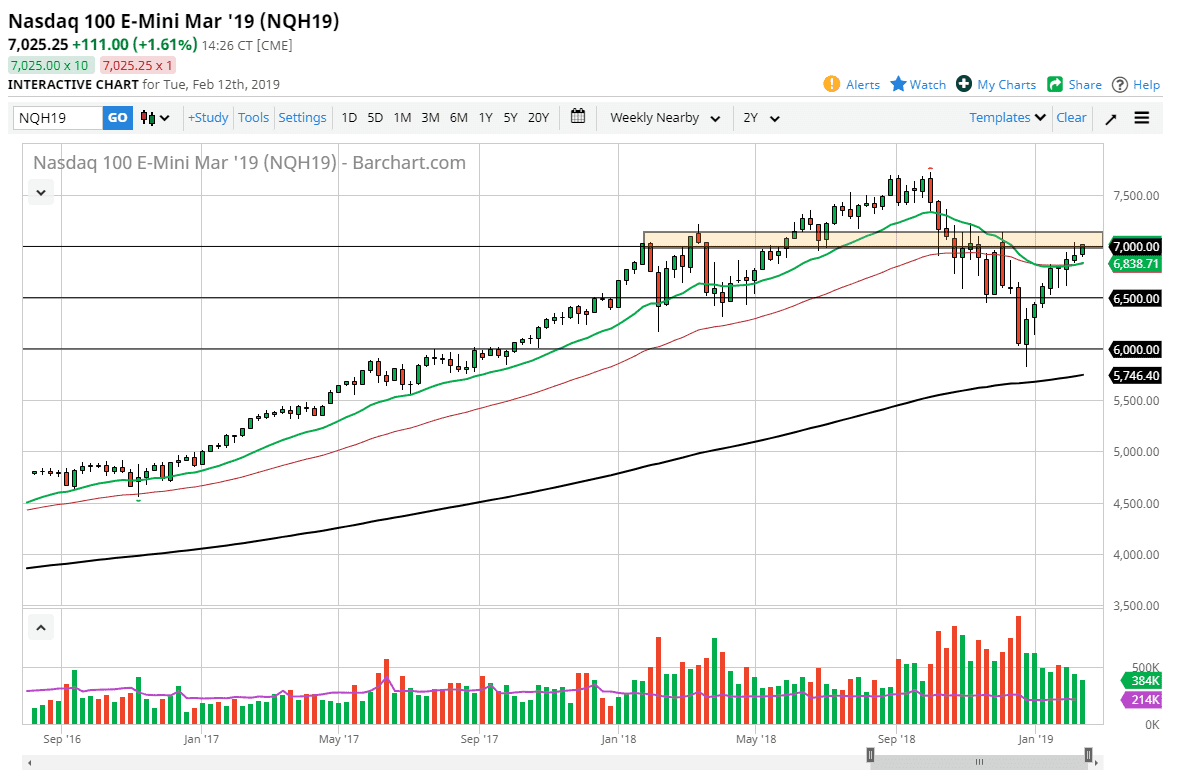

NASDAQ 100

The NASDAQ 100 also had a bullish day but did not break above the resistance from the previous session. Beyond that, we have a huge resistance barrier that is just above the 7000 handle, so I think we still have some work to do here. I would not be surprised at all to see this market lead to the S&P 500 lower if it falls, but if we do break above the 7200 level, then I think the market goes higher. Expect a lot of volatility but it’s obvious to me that we have a major barrier to overcome. I believe that you should be very cautious about putting too much money into this market, but it certainly looks as if the buyers are trying to flex their muscles. Out of the two markets, I believe that the S&P 500 has an easier route higher.