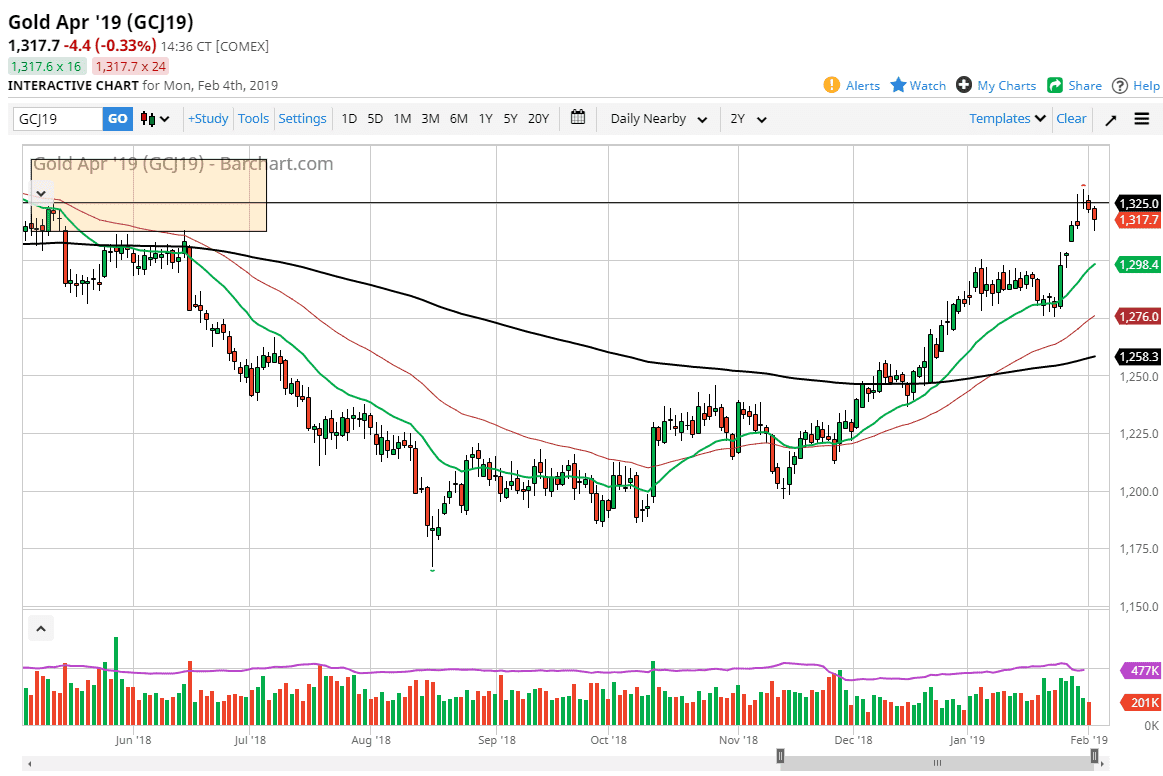

Gold markets pulled back to kick off the week on Monday, filling the gap from early Thursday morning, before bouncing yet again. This is a market that is very bullish overall, and we have gotten a bit ahead of ourselves. Because of this, it makes sense that we have seen a bit of a pullback but I think that the downside is somewhat limited. In fact, I believe that we should see a massive “floor” in the market at the $1300 level that extends down to the $1280 level. It seems very unlikely that we will be able to break through that, as the buyers have already shown their desire to get involved on the initial dip.

Looking at the chart, you can see that we are clearly in an uptrend and the 20 day EMA, the green one on the chart, has offered Knight support. That EMA is currently just below the $1300 level, and of course that large, round, psychologically significant figure will attract a lot of attention as well. The candle stick for the day on Monday is somewhat like a hammer, so it does show a certain amount of interest in the metal.

It’s very likely that we will continue to see an interest in gold, because the Federal Reserve has stepped away from its overly hawkish and automatic stance, which should drive down the value of the US dollar. It will all depend on the currency you match it up against, but gold is typically used as a proxy for the “anti-dollar” play. Gold in terms of Euros and many other currencies has been strong for some time, so now we are finally seeing the Gold markets catch up to the US dollar. Buying dips should continue to work.