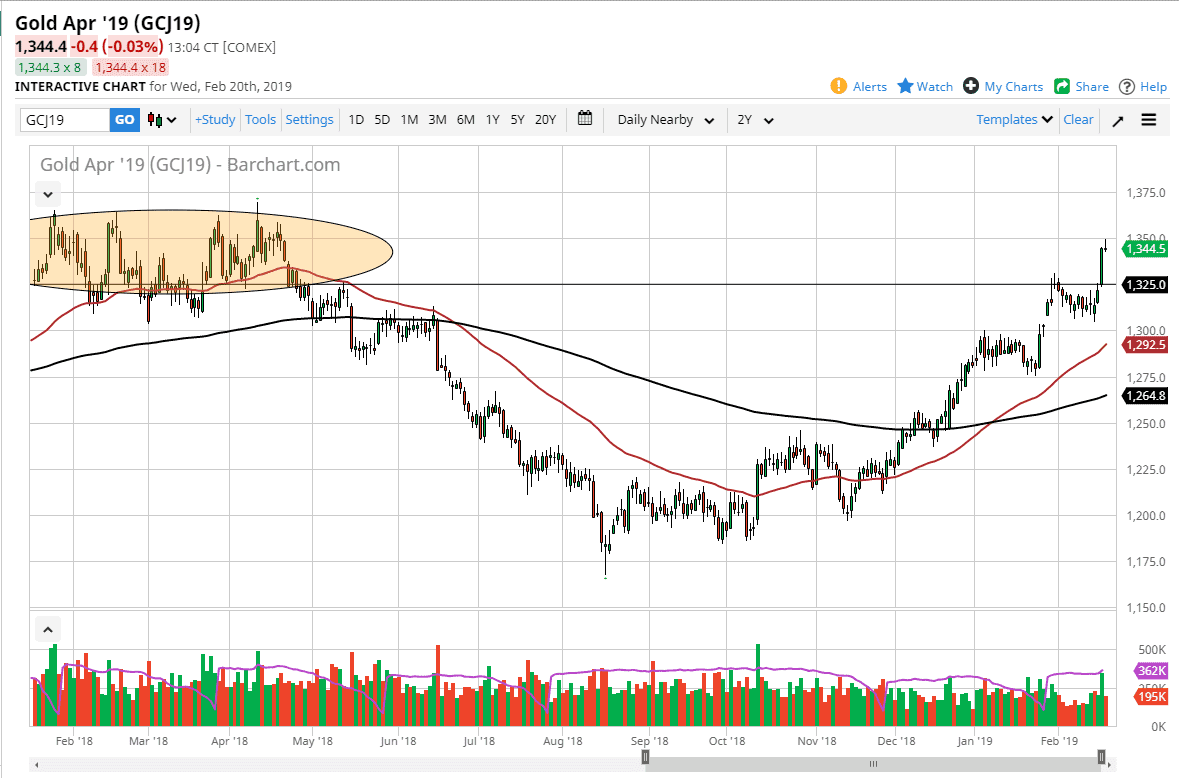

Gold markets initially rallied during the trading session on Wednesday but found a significant amount of resistance of the $1350 level. That’s an area that could be very difficult to overcome, and we got there too quickly to bust through.

Gold markets gained overall in hopes that the Federal Reserve was going to be extraordinarily loose in its monetary policy statement. However, it looks very likely that Gold will continue to go higher longer term, but we are a bit overextended. The $1325 level underneath should be supportive though, because it was previous resistance. I like buying the pullback as they occur, and ultimately looking for some type of supportive candle stick to take advantage of. Based upon the clustering just below the $1325 level, I believe there is plenty of order flow down there.

Looking at this chart, I believe that the $1300 level is also supportive, so quite frankly it’s only a matter of time before start going long again. The alternate scenario of course would be smashing through the top of the shooting star for the session on Wednesday, which of course would be extraordinarily bullish as well.

Although the statement out of the Federal Reserve wasn’t as dovish as people had hoped, the reality is that central banks around the world continue to be very loose. Beyond that, many of them are stocking up on gold so there is going to be a natural bid in this market regardless of the statement. I believe that $1400 will be targeted, and then possibly even higher than that given enough time. This isn’t necessarily going to be the easiest move in the world, but at this point I have no interest whatsoever in trying to short the gold market.