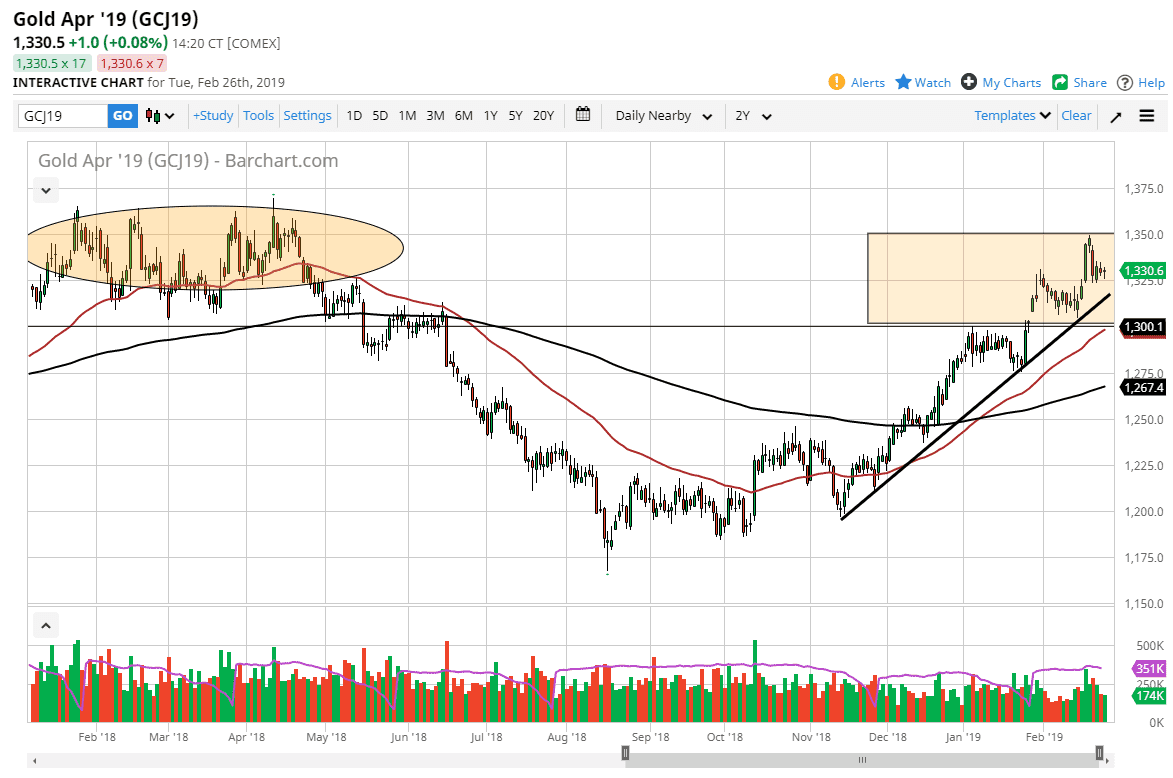

Gold markets initially fell a bit during the trading session on Tuesday but continues to see buyers jumping in at roughly $1325. This is an area that was previous resistance, and as gold markets tend to move in $25 increments, it makes an interesting spot on the chart to say the least. The fact that we bounced from there should not be a huge surprise, but all being said, it was a relatively quiet session.

There is an uptrend line just below that should also keep this market positive, so therefore I think pullbacks should be thought of as potential value. This will of course be a “buy on the dips” scenario going forward. Looking at the chart though, I think the most important thing you can keep in mind is that we have essentially “stair stepped” to the upside for some time now.

Looking at the calendar, we still have the Humphrey Hawkins testimony coming out on Wednesday that could continue to move the US dollar. Remember, Jerome Powell has been a bit dovish as of late and reiterated that stance on Tuesday. Ultimately, this could continue to favor the upside in this market, and therefore I have no interest in shorting. In fact, I don’t think it’s until we break down at the very least below the 50 day EMA, which is essentially at the $1300 level. If we do break down through that level, then it’s possible we may get a little bit more downward pressure, but all things being equal it looks as if the Federal Reserve and other central banks around the world will remain very loose with their monetary policies. If that’s going to be the case, it makes sense that precious metals can continue to go higher with gold leading the way.