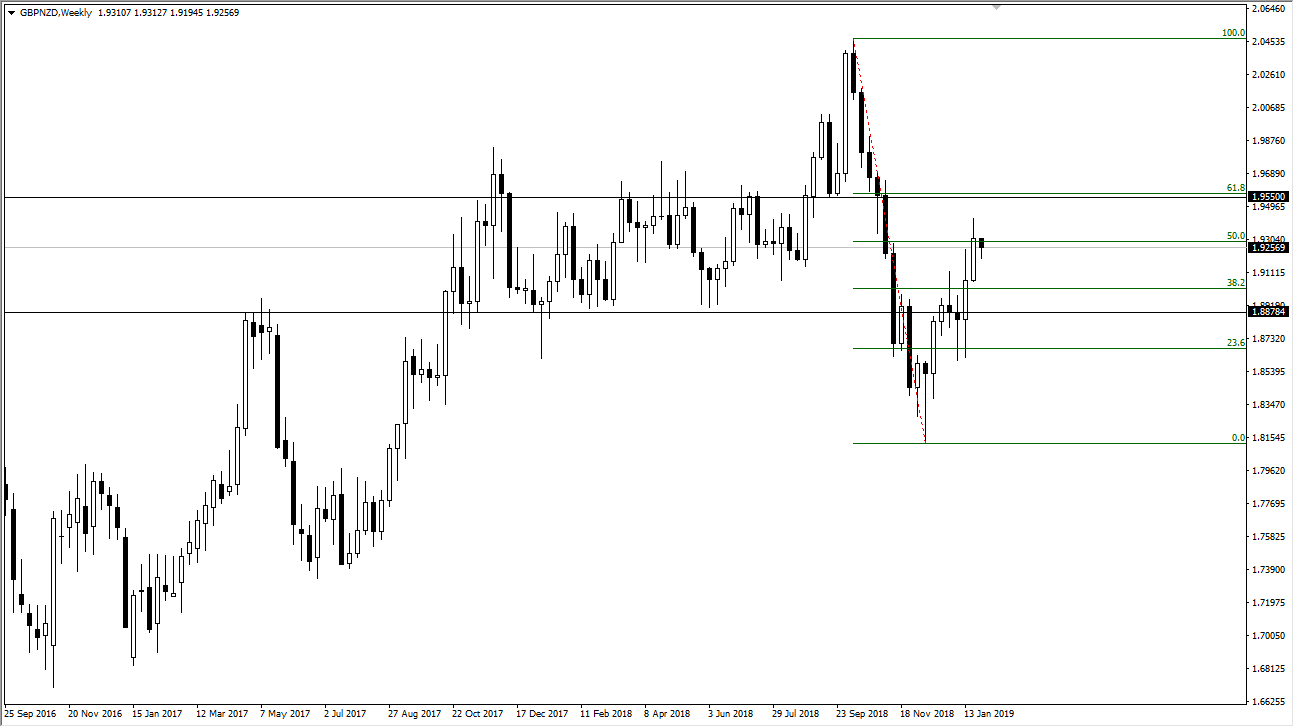

GBP/NZD

The British pound has been the shooting much higher against many other currencies around the world as there seems to be a delay in the Brexit coming. Because of this, the British pound has been one of the favored currencies of Forex traders recently, and I think that the pop has been rather interesting. However, there are still a lot of concerns out there when it comes to the British pound, and as a result I find it interesting that towards the end of the month of January, we are testing the 50% Fibonacci retracement level. That being said, we have had a couple of strong candles on the weekly chart, and I do believe that the British pound is going to continue to grind to the upside. At this point, I think that the next major technical barrier is somewhere near the 1.95 region.

Beyond that, the 61.8% Fibonacci retracement level is just above there, so I think it’s only a matter of time before the sellers come back in. I think we may have short-term bullish pressure, but pay attention to the 1.19 level, if we start to see signs of exhaustion, then I think that the market is probably going to roll over a bit. The massive selloff that we had seen to get down to the 1.8150 level has turned around, but the velocity of that move was rather strong. With that in mind, it’s difficult to imagine that we are done selling at this point. I think all it is going to take is some type of negative headline coming out of the Brexit negotiation or perhaps the UK parliament to get sellers back in. Pay attention to the GBP/USD pair, if we start to pull back that will certainly be a main driver over here as well. Alternately, if we can get a weekly candle stick that closes significantly above the 1.1950 level, I have found that typically one the 61.8% Fibonacci retracement level was taken out, you will go back to the 100% Fibonacci retracement level. That will certainly be the case if we get some type of Brexit deal.