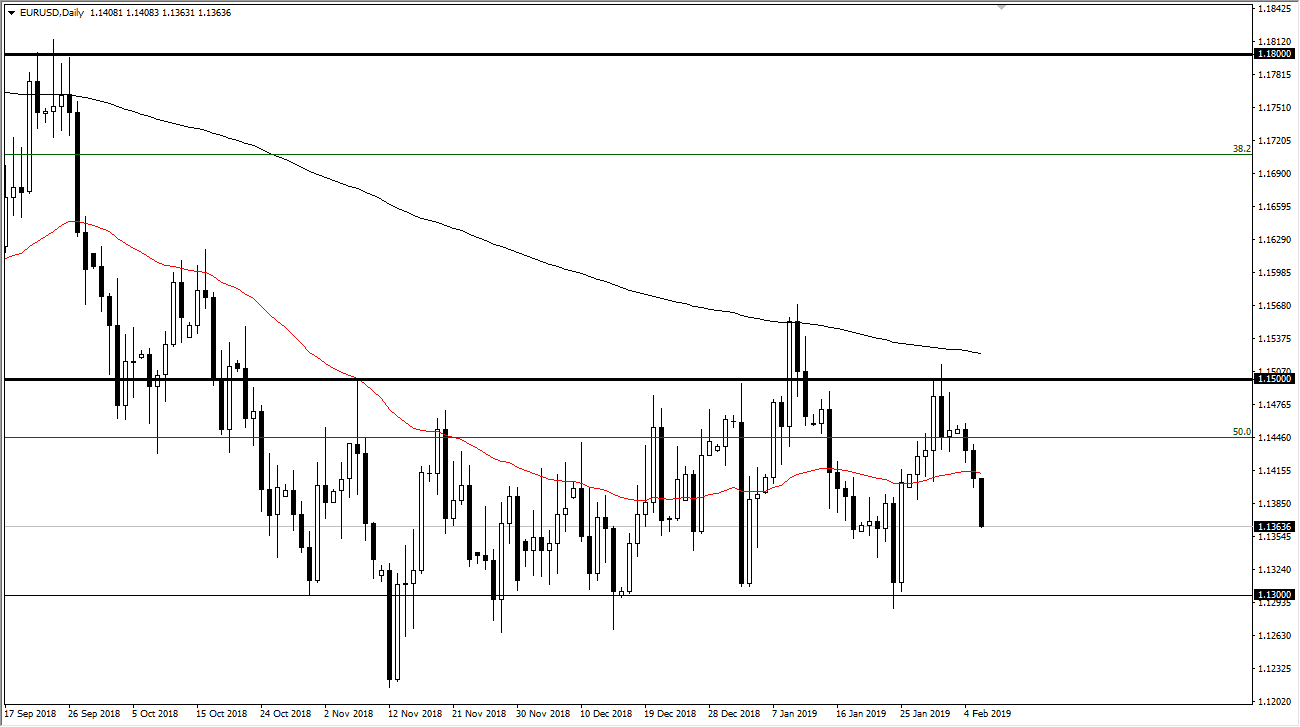

EUR/USD

The Euro broke down rather significantly during the trading session on Wednesday as we continue to see a lot of negativity in this pair. However, there is massive support underneath that should continue to be important. I believe that the 1.13 level should continue to hold, but even if it doesn’t we have the 61.8% Fibonacci retracement level at the 1.12 level as well. In general, I think that there will be some value to be had in this general vicinity, but quite frankly we need to see a supportive candle in order to get involved. The US dollar is strengthening, perhaps by default as the ECB is stuck with a stagnant economy. However, don’t despair - it’s only a matter of time before somebody from the Federal Reserve comes out and does something or says something dovish.

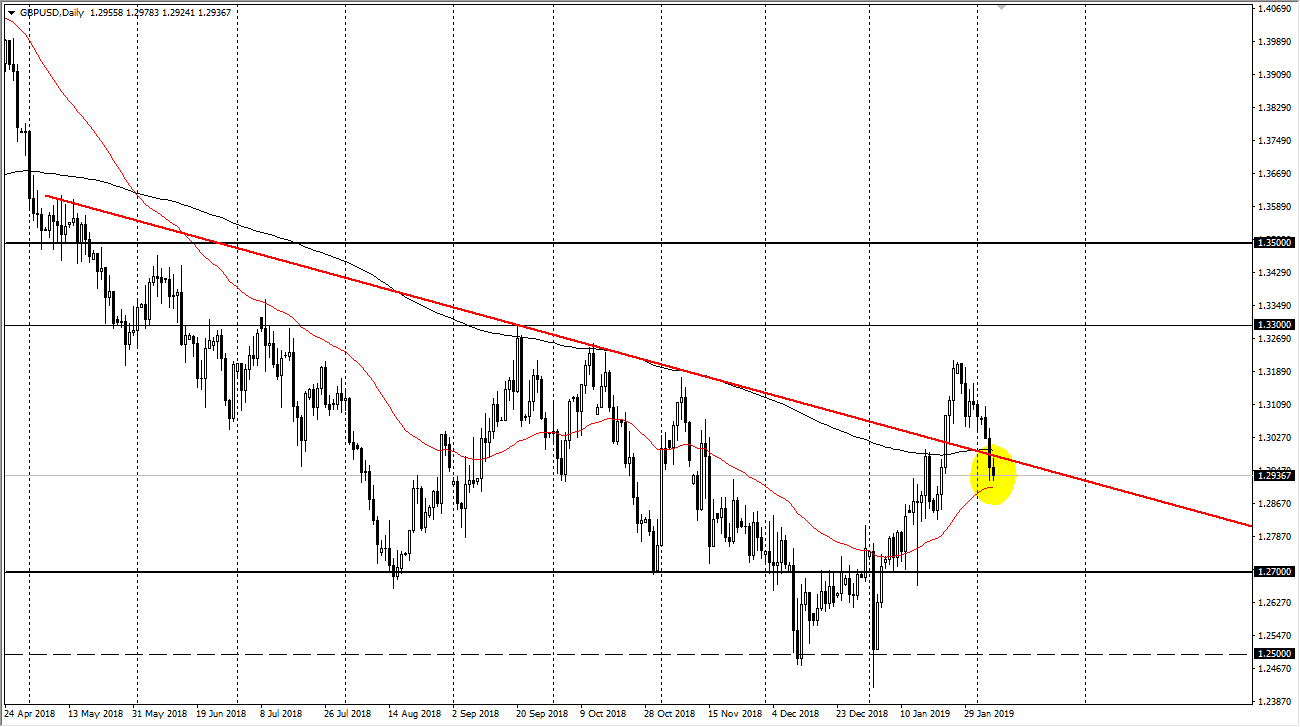

GBP/USD

The British pound has initially tried to rally during the trading session on Wednesday but then fell again to show signs of weakness. The 50 day EMA is just below, and as a result I think it’ll be interesting to see where we go next because if we can break above the top of the candle stick for the day on Wednesday, you get above the 200 day EMA, which would be a very bullish sign. By breaking above the 200 day EMA, you should then start to see buyers jump back into the marketplace. The 50 day EMA of course offer support as well, and I think there is a major cluster just below near the 1.2875 handle as well. Overall, the market participants have soured on the British pound as we continue to worry about the Brexit. However, the Federal Reserve will come out and weaken the greenback sooner rather than later.