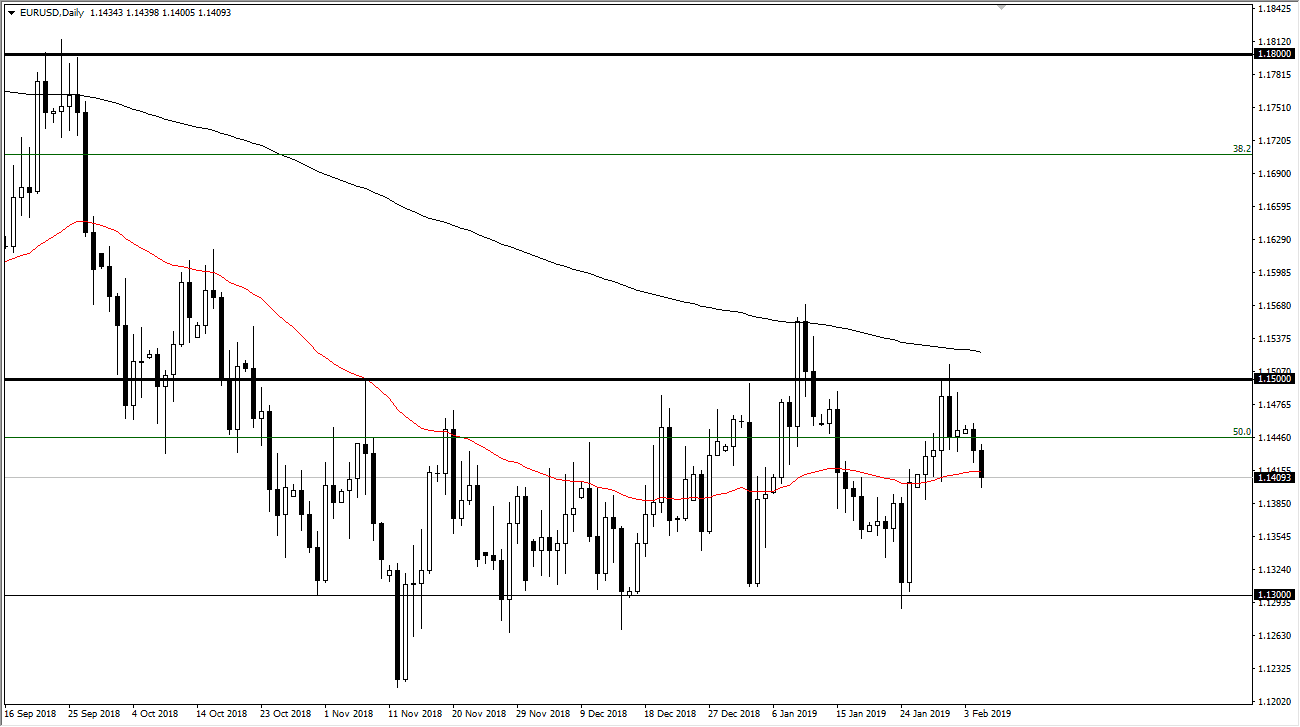

EUR/USD

The Euro fell during trading on Tuesday, breaking below the 50 day EMA but holding the 1.14 level. Because of this, and the fact that we have an impulsive candle that ended just in this area, I think that the market will probably start to find buyers again. Late in the day, we are starting to see the US dollar loses some of its luster, so I would not be surprised at all to see this market turned around to reach towards the 1.1450 level. Ultimately, this is a short-term buying opportunity as the massive resistance barrier in the form of the 1.15 level will continue to be an issue.

This market continues to struggle with the idea of the Federal Reserve softening its stance on interest rate hikes, but at the same time we have the European Union struggling with a lot of poor economic figures. Because of this, I think that this market will probably continue to be very choppy and somewhat tight, but we have clearly started to trying to break out to the upside as the Federal Reserve change in stance should lead to a softer US dollar later this year.

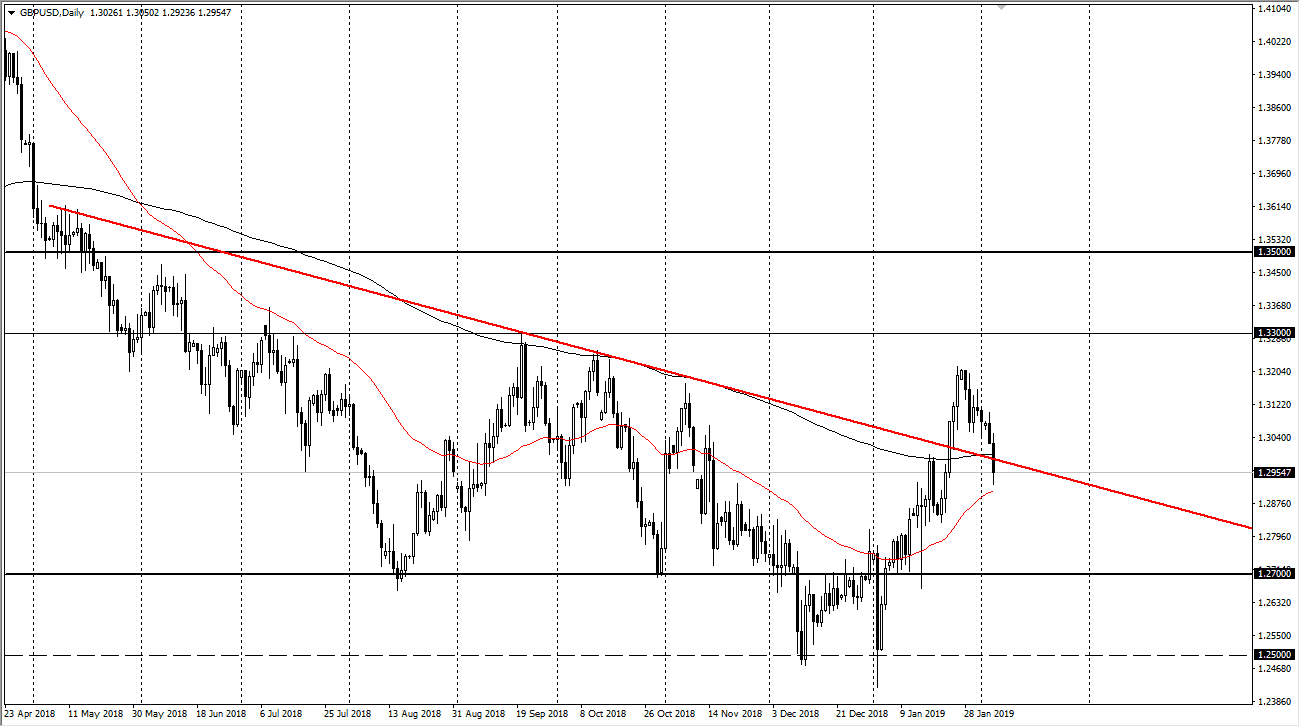

GBP/USD

The British pound broke down during the trading session on Tuesday, slicing through the 200 day EMA. The downtrend line has been broken through, which should be support. However, we are starting to see some stability late in the day and we have rallied a bit so at this point I think if we can break back above the 200 day EMA, it could be a nice buying opportunity. This is a market that continues to be very noisy and difficult due to the various headlines involving the Brexit, but I do think that eventually we rally again.