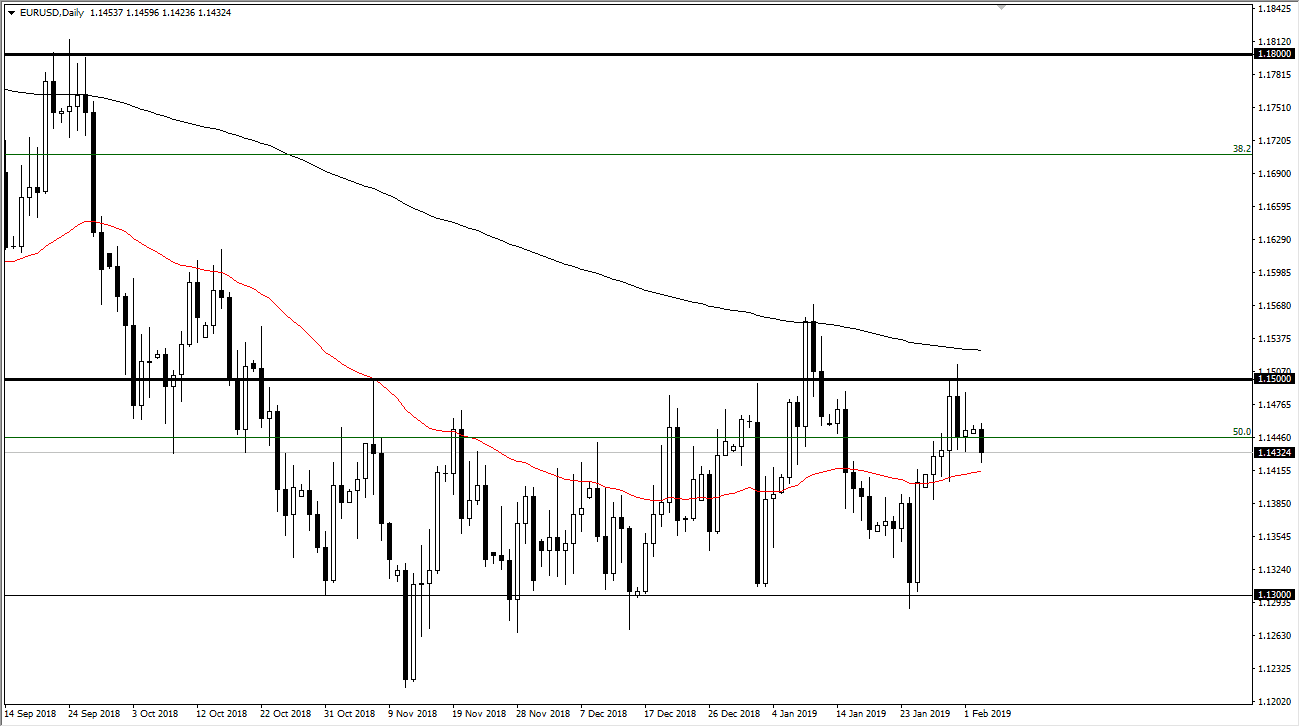

EUR/USD

The Euro fell during the trading session on Monday, reaching towards the 1.14 level. The 50 day EMA has offered support though, as we continue to show signs of a grind higher, but quite frankly the 1.15 level above is massive resistance. The 200 day EMA, pictured in black, offers longer-term resistance and it is starting to fortify the resistance at the 1.15 handle. Ultimately, the red EMA, the 50 day EMA on the chart, is offering support, showing signs of grinding higher to the upside. We are now trading between those two massive technical levels, so it’s very likely that we continue to grind sideways in general, with a severe lack of direction as the Federal Reserve looks to be soft, while the European Union has very lackluster economic figures coming out as of late.

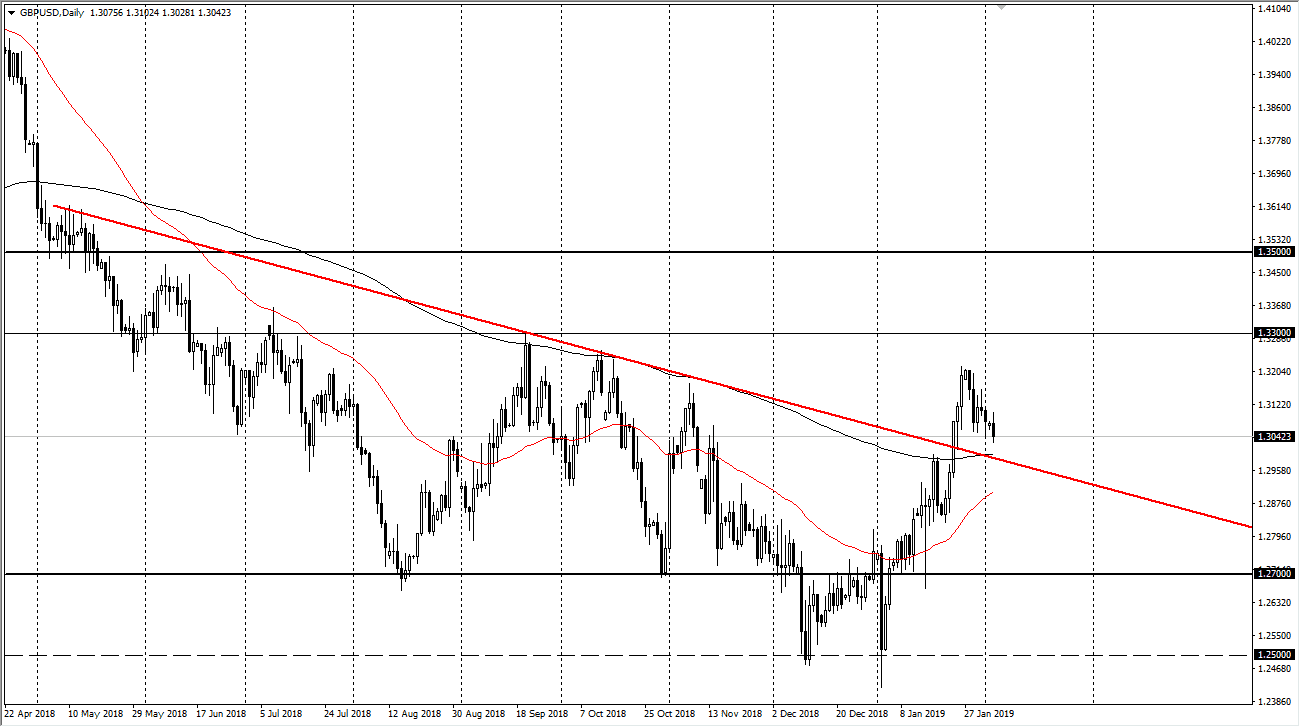

GBP/USD

The British pound initially tried to rally during the day on Monday but then turned around to start falling again. I think there is a significant amount of support below though, especially near the 200 day EMA, pictured in black. This coincides quite nicely with the 1.30 handle, which also coincides nicely with the previous downtrend line. Below there, the 50 day EMA is starting to turn higher, and I think it is only a matter of time before we get the “golden cross” yet again, as the 50 day crosses above the 200 day moving average. Longer-term, I think that the market is probably going to go looking towards 1.33 handle above, which looks to be somewhat resistive. I think that the British pound will of course continue to be thrown around by the occasional headline, but certainly it looks as if we are trying to break out and start grinding higher longer term.