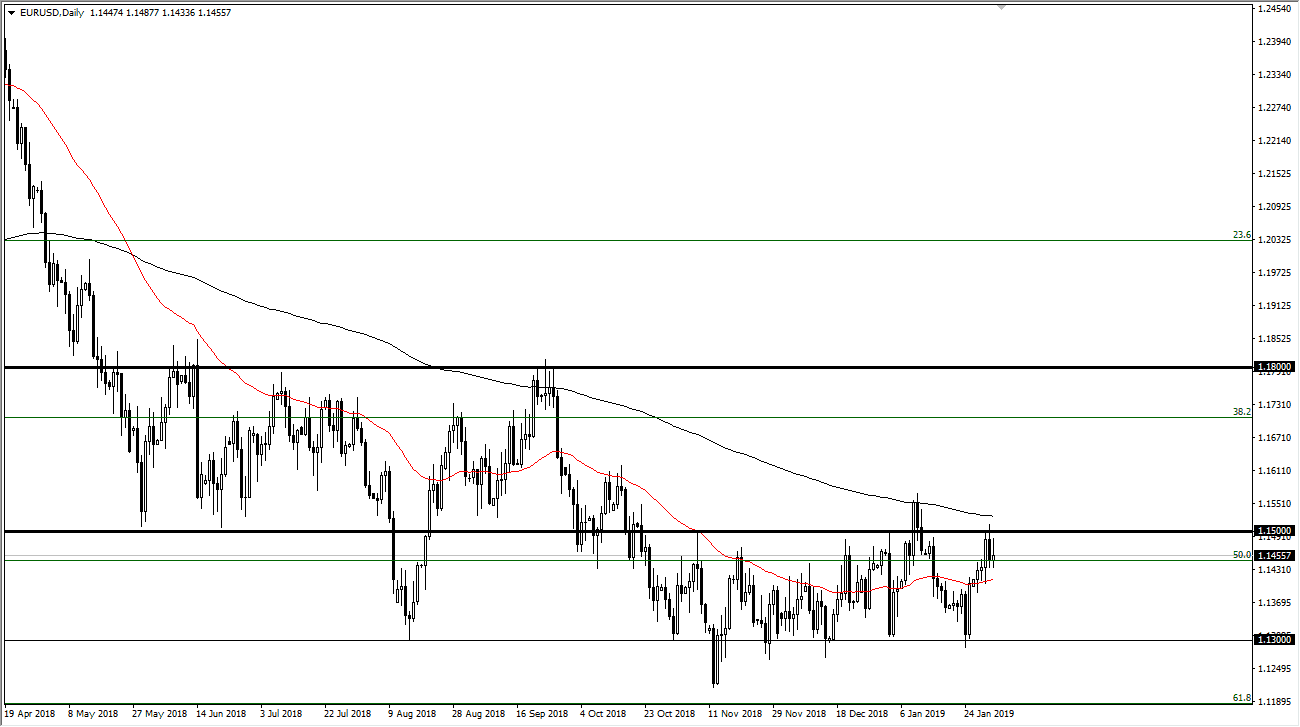

EUR/USD

The Euro initially tried to rally during the day on Friday but gave back quite a bit of the gains to form a shooting star just below the 1.15 level. This means that we will probably pull back slightly, but I also look at the 50 day EMA, pictured in red on the chart, and suggests that there is some support underneath. I think we continue to chop around but longer-term I believe that the market continues to try to break out to the upside due to the Federal Reserve. On the other side of the Atlantic though, there is a lot of trouble in Europe so it’s not can be an easy break out. The 200 day EMA, pictured in black on the chart, will be a major barrier to overcome. If we can on a daily close, then I think we go looking towards the 1.18 level. In the meantime, look at a lot of choppiness.

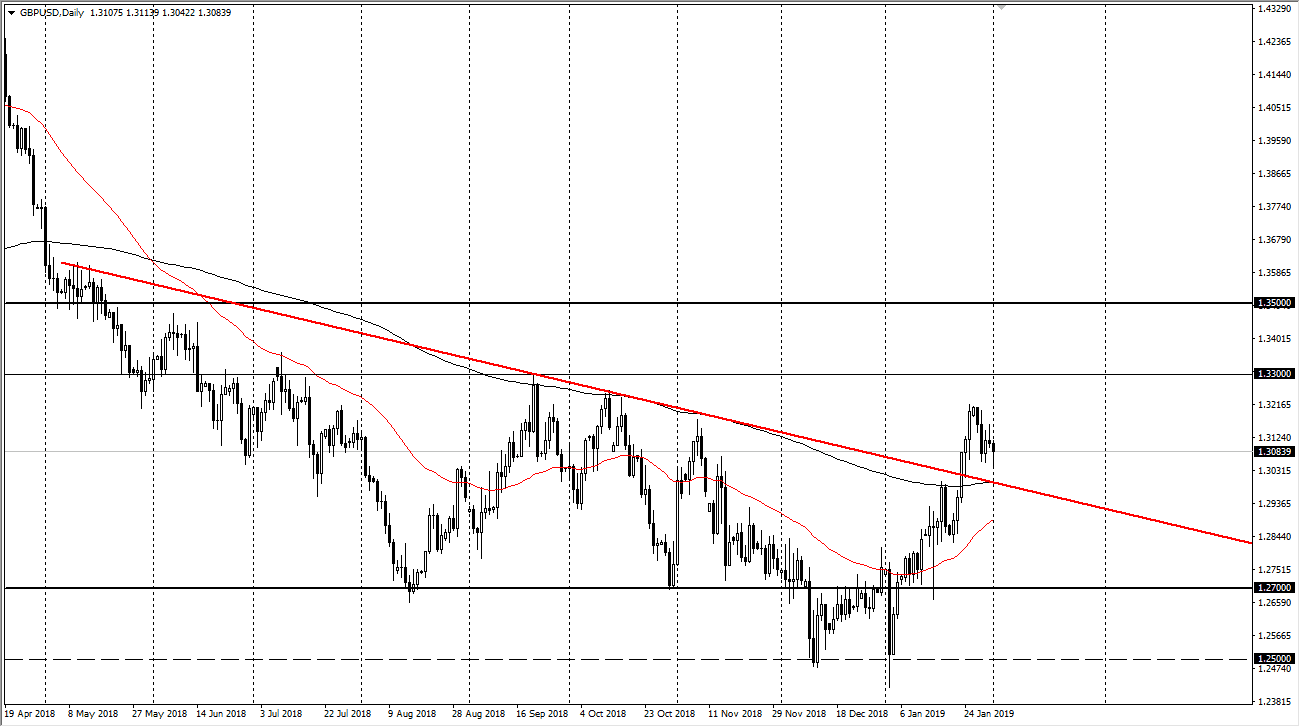

GBP/USD

The British pound initially pulled back during the trading session on Friday but turned around of form a bit of a hammer just above the 200 day EMA. At this point, the downtrend line sits just below as well, so I do think that the British pound continues to rally. That’s not to say that it will be easy but I think the Federal Reserve is starting to be the main focus of the world right now, and there is a believe that the British pound is going to be saved you by either a softer Brexit, or a delayed Brexit. At this point, it’s going to be a lot of noise from the headlines but I do think that we have put a bottom in when it comes to sterling. We will initially target the 1.33 handle, and that eventually the 1.35 level after that.