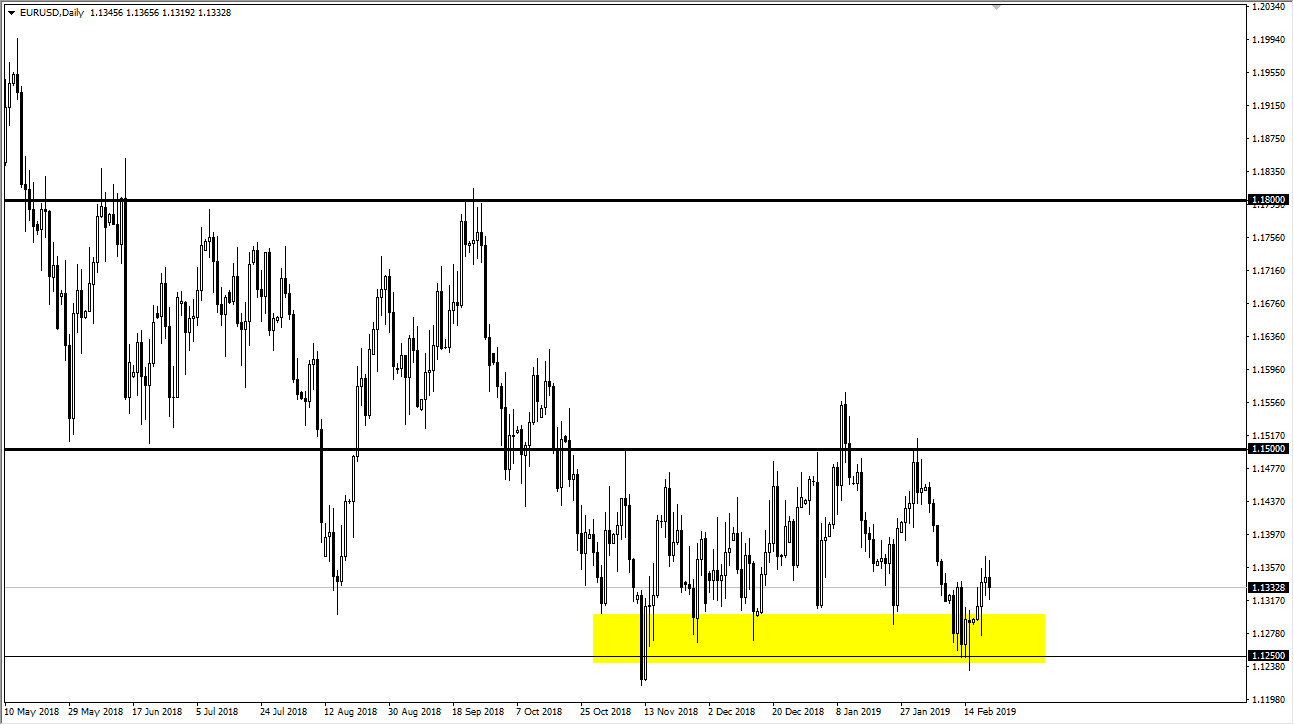

EUR/USD

The Euro went back and forth against the US dollar during trading on Thursday, as we continue to struggle near the 1.1350 level. Overall, this is a market that should continue to see a lot of interest in this area, so I do like the idea of buying eventually. We probably will get a short-term pullback, but that pullback should be an opportunity to go long in a market that obviously has massive support underneath. That support extends down to at least 1.1250, and very likely the 1.12 level itself, as it coincides nicely with the 61.8% Fibonacci retracement level. With that being the case, it’s very likely that the market will continue to be choppy but I think value hunters will return sooner rather than later. After all, the Federal Reserve will continue to soften the greenback if they can.

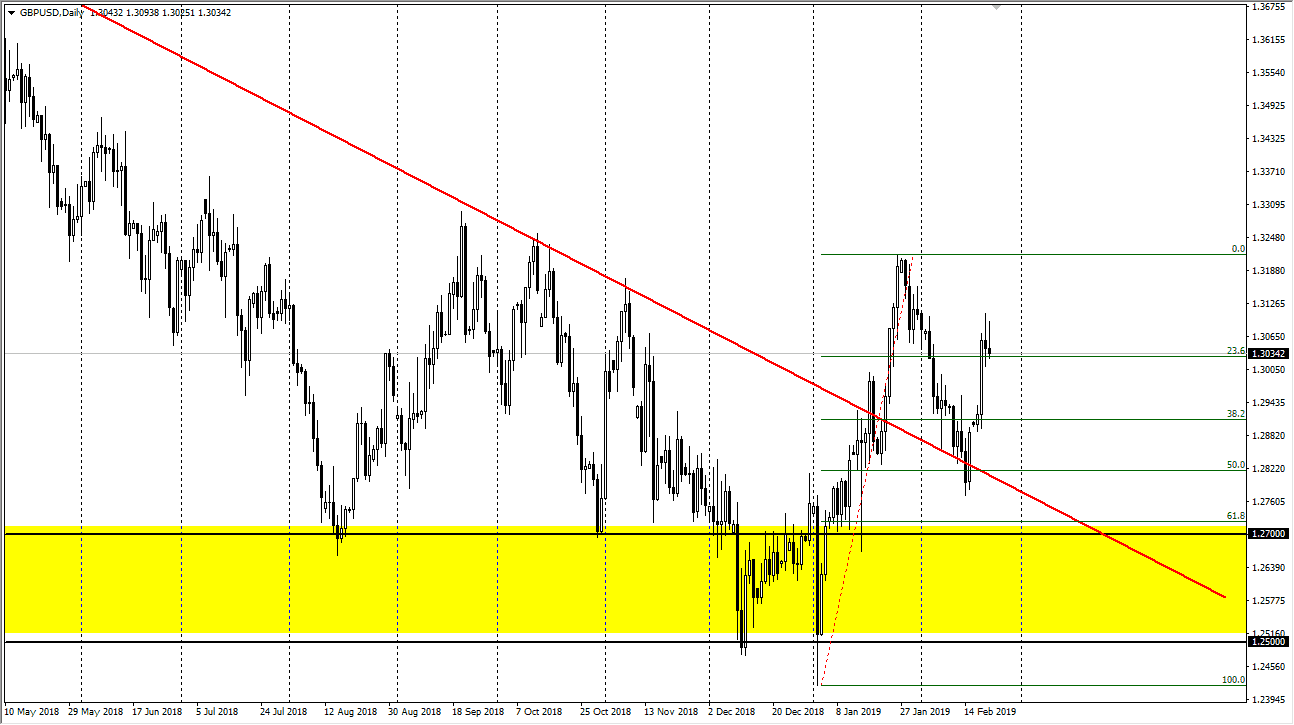

GBP/USD

The British pound has rallied significantly over the last several sessions, but both Wednesday and Thursday have seen a bit of lazy trading, and perhaps we are getting a little bit ahead of itself. At this point, pullbacks should be buying opportunities, as the British pound has certainly broken out to the upside. We have cleared the major downtrend line, and it now looks as if the 50% Fibonacci retracement level and the pullback has offered support. Beyond that, the Brexit noise is starting to become somewhat ignored and people are starting to look to the future. If we get a no deal Brexit, that may be very destructive for the British pound, but as long as we get some type of an agreement, the British pound will have bottomed longer-term from what I see. I have no interest in shorting this market, but look at dips as buying opportunities.