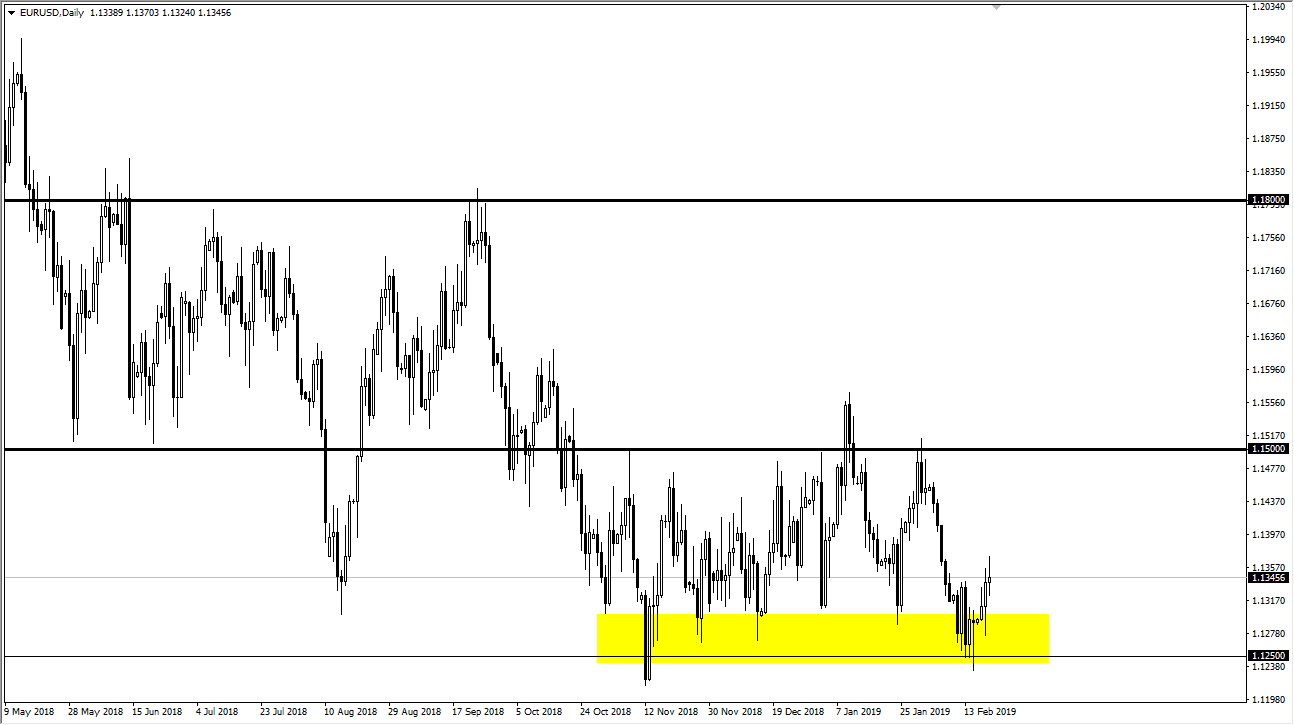

EUR/USD

The Euro has gone back and forth during the trading session as you would expect due to the Federal Reserve releasing the Meeting Minutes, which of course the market was focusing on. However, we have broken through some resistance in the form of the 1.1350 level, so I do think that we probably continue to grind higher. However, that’s the key phrase here: grind higher.

Short-term pullbacks should be buying opportunities, as we are closer to the bottom of consolidation than the time, so therefore I think we will find plenty of value hunters out here looking to take advantage of this area. The 1.1250 level is rather important, so it’s very likely that level should continue to hold going forward, especially with the Federal Reserve being a bit softer than it has in the past. However, don’t expect explosive moves because the European Union isn’t exactly on fire right now when it comes economic figures.

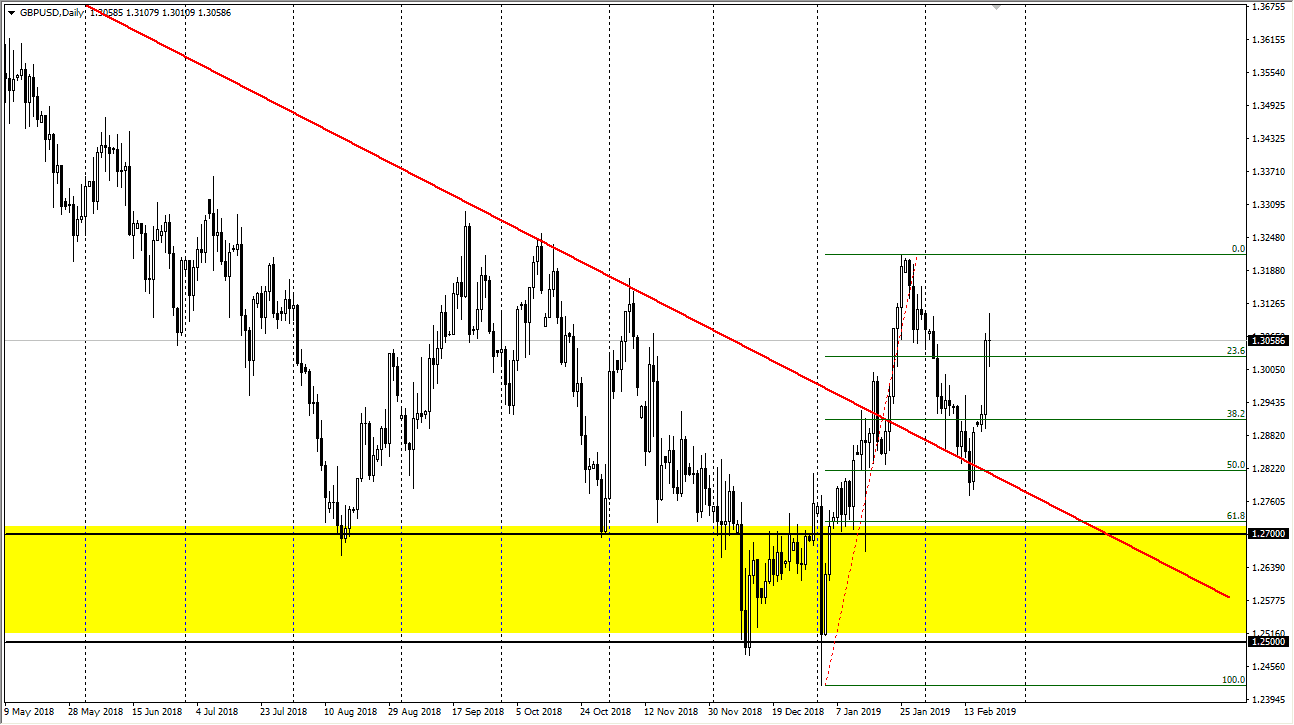

GBP/USD

The British pound ended up forming a very significant candlestick during the trading session, at the 1.3050 level. At this point, we could be running into a little bit of exhaustion, so a pullback would necessarily be the most surprising thing. However, I do think that we continue to reach towards the top of the previous move, fulfilling the bounce back property of the 50% Fibonacci retracement level that cause this market to turn back around. The 1.32 level above is the short-term target.

I believe that value hunters will continue to come back into this market, as the British pound has been oversold, and of course the Brexit headlines could help as there is somewhat of a hopeful attitude when it comes to the Irish backstop.