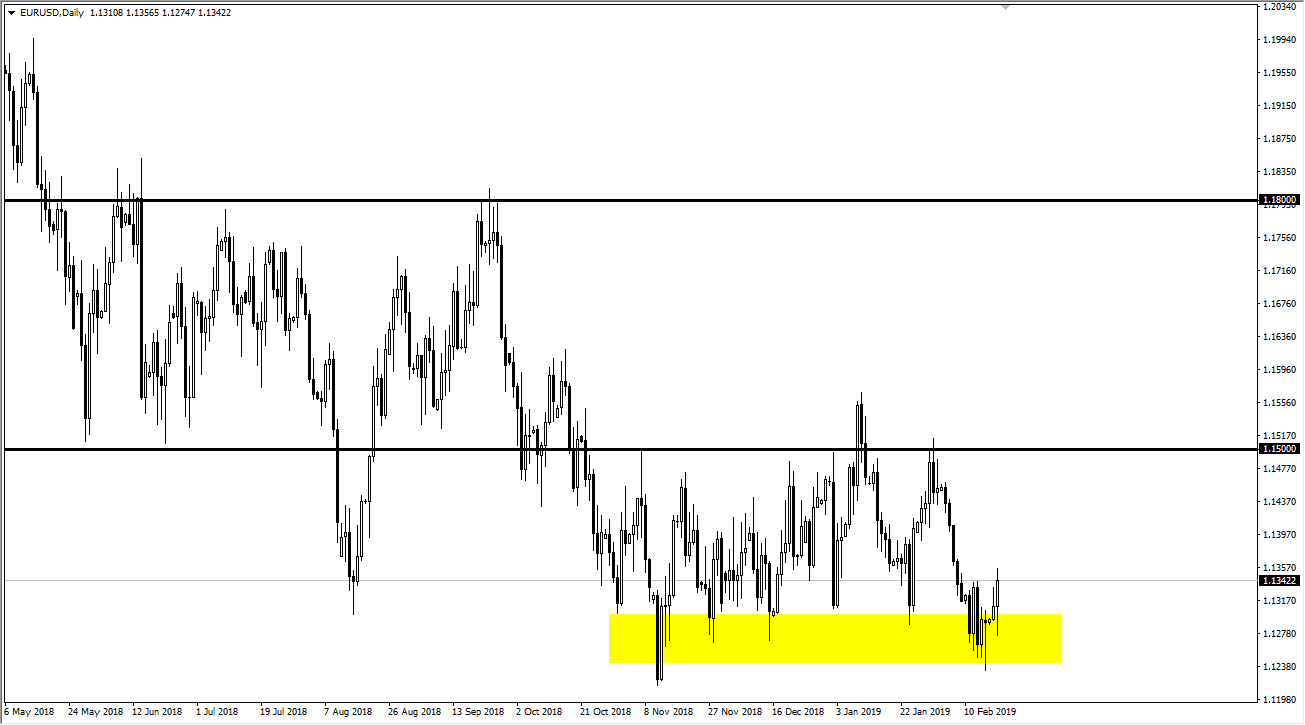

EUR/USD

The Euro initially fell during trading on Tuesday but found enough support underneath the continue to show the area near the 1.13 level to be rather supportive. Ultimately, I think that the Euro has found a pretty significant support level based upon the longer-term consolidation. I think the 1.12 level underneath is even more supportive based upon the 61.8% Fibonacci retracement level, and of course previous action. At this point, I like the idea of buying short-term pullbacks, and I believe in aiming towards the top of the overall consolidation which is near the 1.15 handle above. However, I do recognize that there is a lot in the way of volatility ahead, as we have a couple of central banks that have no hawkish tone at all and should continue to weigh against both currencies overall.

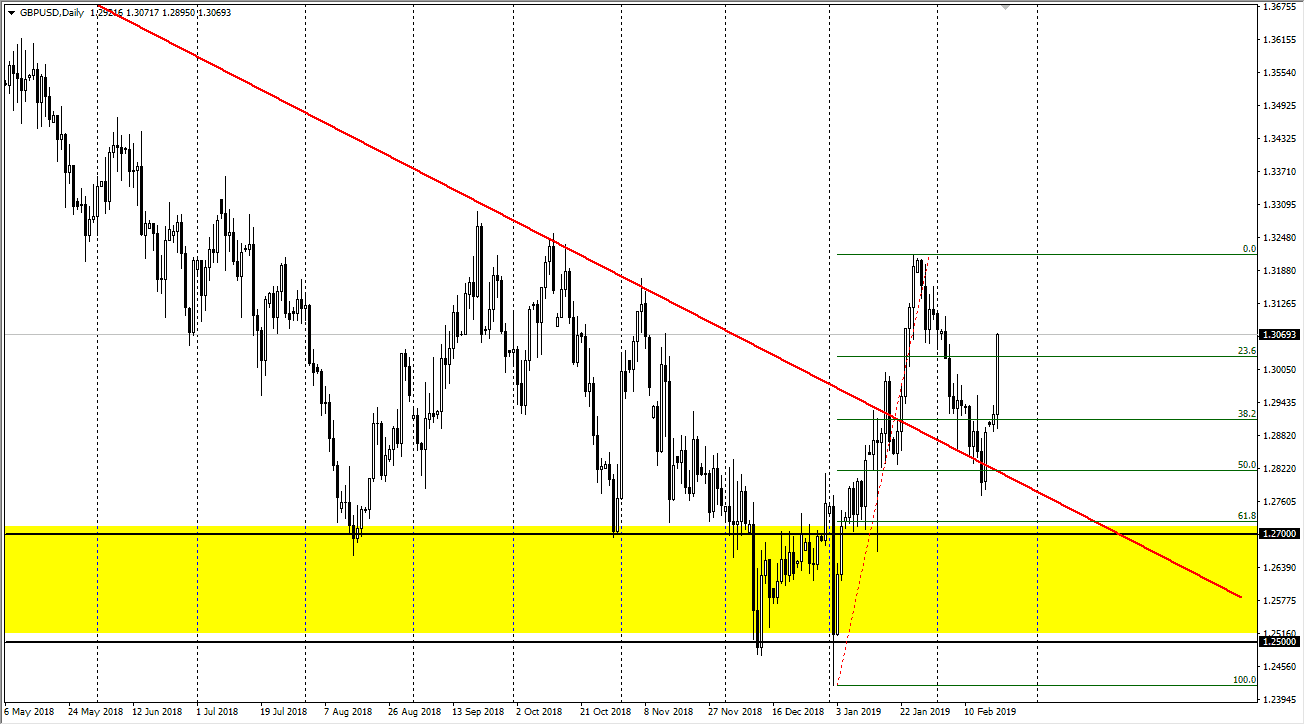

GBP/USD

GBP/USD rallied significantly during the trading session on Tuesday, as there seems to be a bit of optimism surrounding the Brexit. We are above the 1.30 level, which of course is a very bullish sign so it’s likely that we will continue to see people pile into the British pound. Lately, I have been suggesting that the British pound has bottomed longer-term, as we have retested the previous downtrend line near the 50% Fibonacci retracement level, which is a bit of a “double whammy” for this market. Ultimately, this is a market that should show plenty of support near the 1.27 level, and the 61.8% Fibonacci retracement level, which of course is the same area. I do expect a certain amount of volatility based upon the fact that this is the British pound, but we are going higher over the longer-term so I’m looking for short-term pullbacks to buy based upon supportive action and bounces.