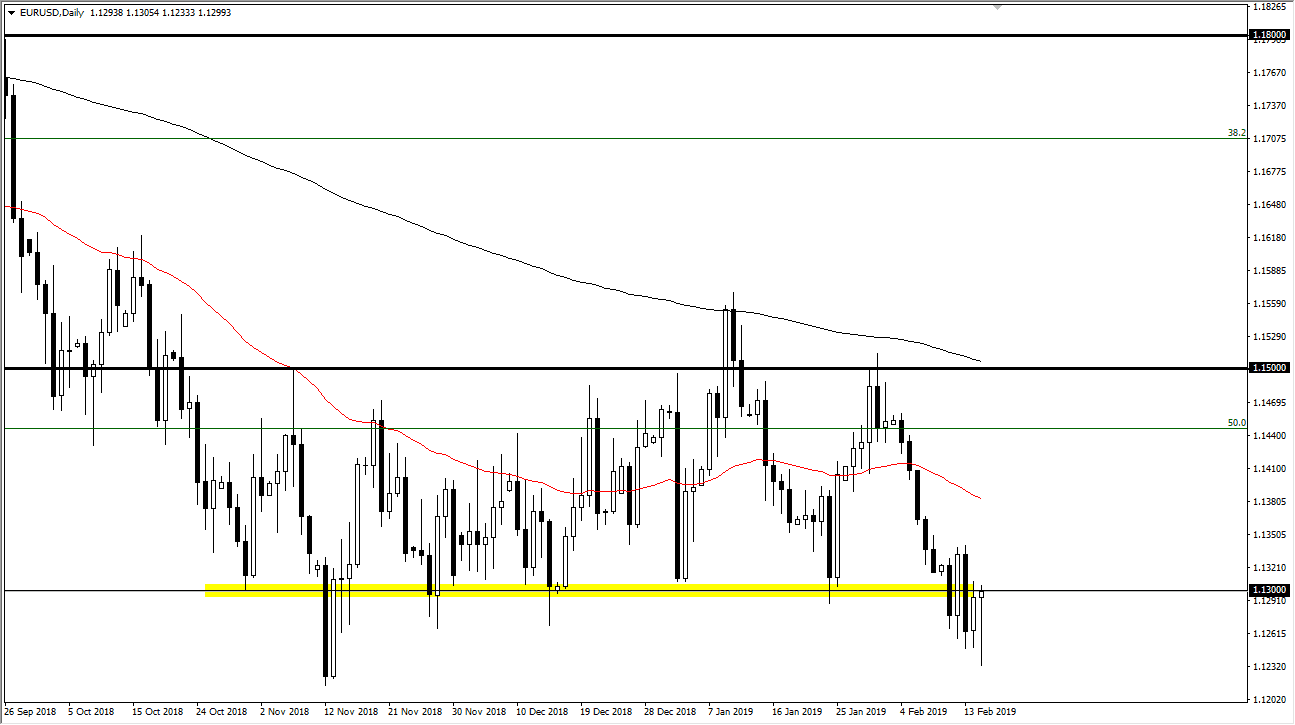

EUR/USD

The Euro initially fell during trading on Friday, after comments coming out of an ECB member suggested that perhaps the slowdown was “much more significant than originally thought.” However, the market turned around as you can see on the chart and reached towards the 1.13 level. This is a pair that continues to be rather interested in this area, as we simply go sideways overall. We are starting to see more explosive moves and could be forming a bit of a “megaphone pattern”, which you typically see at the end of an uptrend, but they can sometimes occur at the bottom of a downtrend. This shows just how much buying pressure there is underneath, so I think that the market will eventually break to the upside and go looking towards the 1.1450 region again.

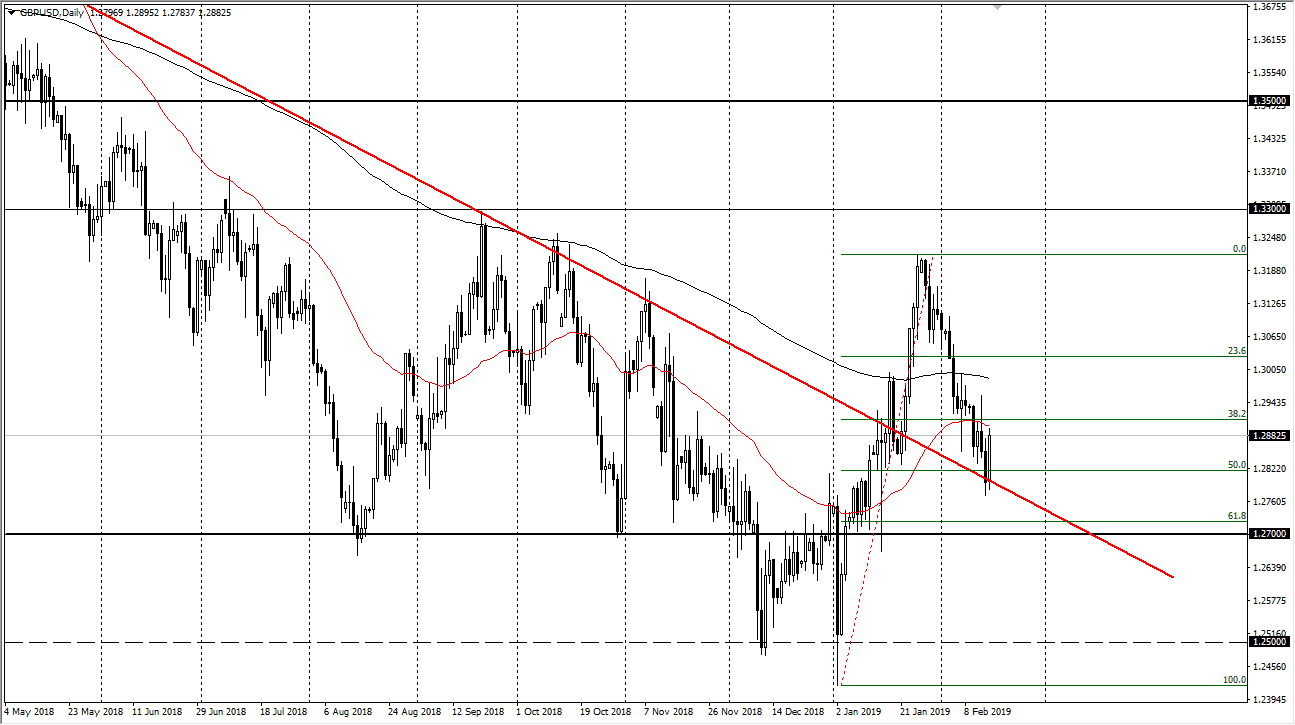

GBP/USD

The British pound exploded to the upside during the trading session on Friday, using the trend line and the 50% Fibonacci retracement level as reason to go higher. It looks as if the market is going to continue to find buyers on dips, but obviously the British pound has a lot of noise attached to it due to the Brexit. Be aware of the headlines, and how they can move this market but I do think that the British pound has bottomed longer-term. Even if we break down from here, I believe that the 61.8% Fibonacci retracement level will offer support near the 1.27 handle, so given enough time I think value hunters will continue to push this market to the upside. Beyond that, the other side of the Atlantic Ocean you have the Federal Reserve looking to be as soft and weak as they possibly can be. If we get any good news involving the Brexit, this pair will go higher.