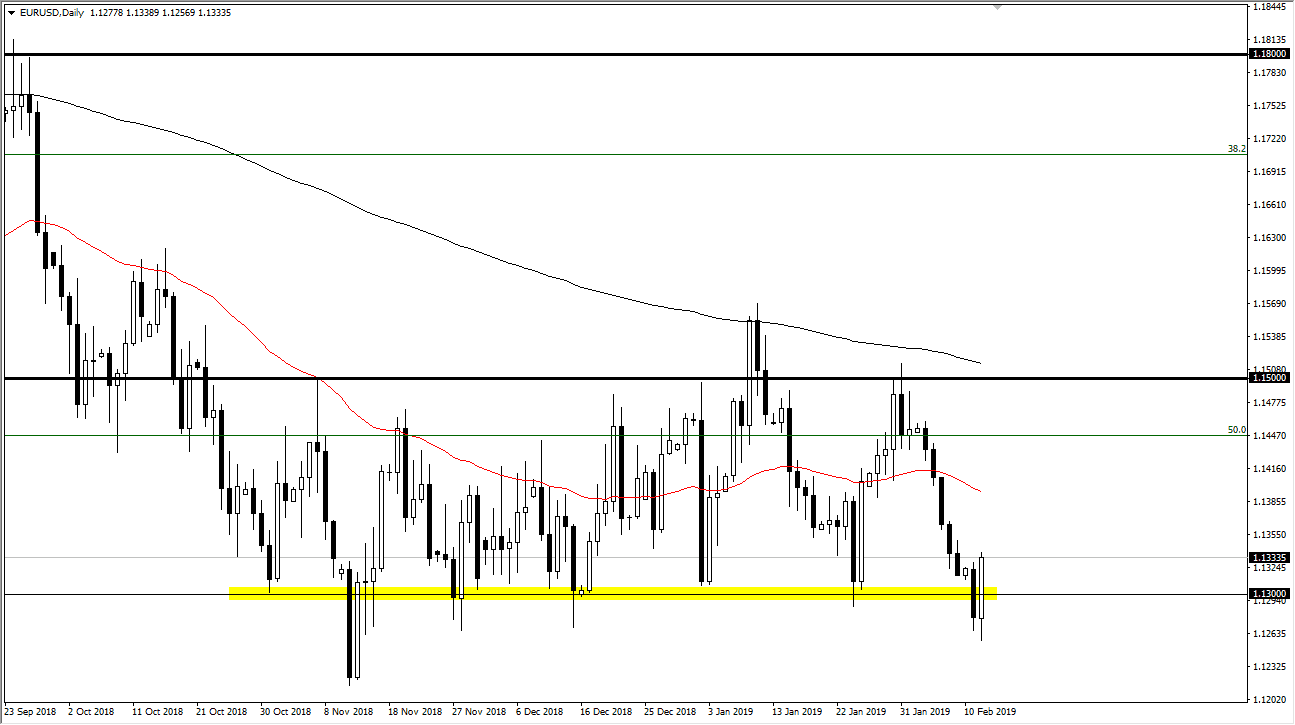

EUR/USD

The Euro initially fell during the trading session on Tuesday but then turned around to rally rather significantly. That being the case, it looks very likely that we have hit a short-term bottom, perhaps testing the outer reaches of the overall consolidation range that we have been in. I think at this point it’s very likely that we will find a lot of support in this area, but we also should have a lot of resistance above. I think that the market is likely to continue going higher, especially if the Federal Reserve continues to look rather dovish. That being the case, I think that a break above the daily candle stick for the trading session on Tuesday is reason enough to expect that the rally continues. I believe that we simply don’t have enough clarity to make a longer-term decision.

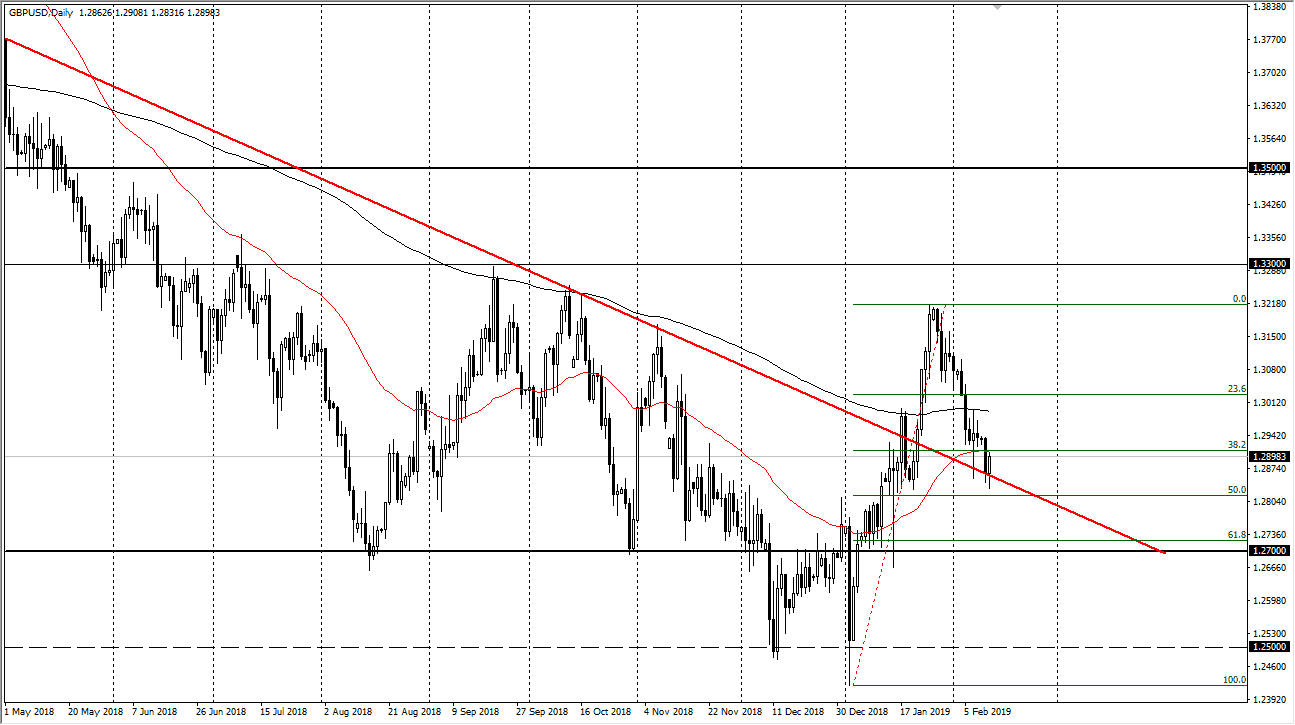

GBP/USD

The British pound initially fell during the trading session on Tuesday but turned around to show signs of strength and break above the top of the downtrend line. Ultimately, I think that short-term pullbacks should offer plenty of buying opportunities, so I think that the market could go looking towards 1.30 level. If we can break above there, the market should then go looking towards 1.32 level after that, and I think that the market is in the process of trying to bottom. With that I am a buyer of the British pound but I also recognize that we should probably enter this position very slowly and recognize that we have short-term volatility that we need to deal with due to headlines noise involving the Brexit. If we can get some type of clarity or at least agreement it’s likely that we could go higher.