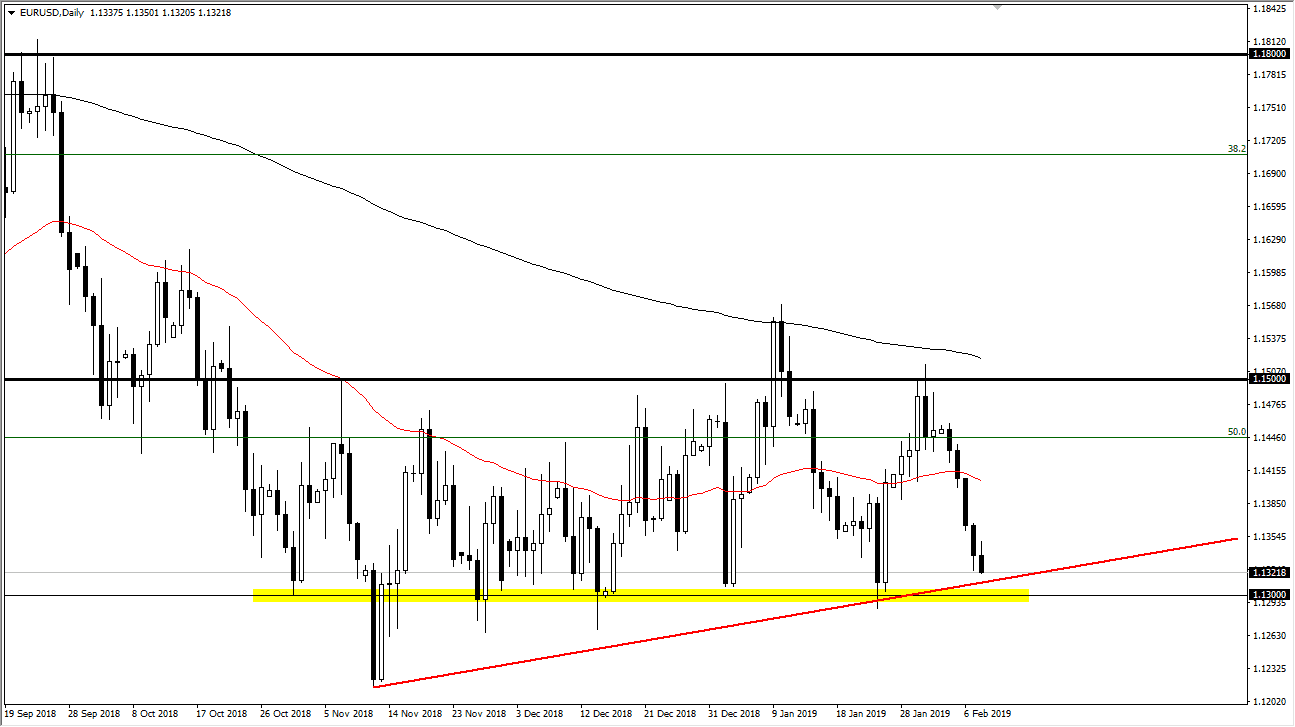

EUR/USD

The Euro initially tried to rally during the trading session on Friday and at one point looked relatively bullish. However, later in the day we started to see the Euro break apart and go looking towards 1.13 level. I think that there is massive support underneath though, so it’s going to be likely that we see a bit of buyers jump in. The 1.13 level has been supportive previously, and of course there is an uptrend line that I have drawn on the chart that could affect this market as well. The German economy seems to be deteriorating, so that’s not good for the Euro obviously. However, the Federal Reserve is very soft at the same time, and of course we have the concerns of the US/China trade situation, as well as a potential government shutdown in America. In other words, this pair is going to continue to be a mess. A bounce from here would make sense, but at this point anything’s possible.

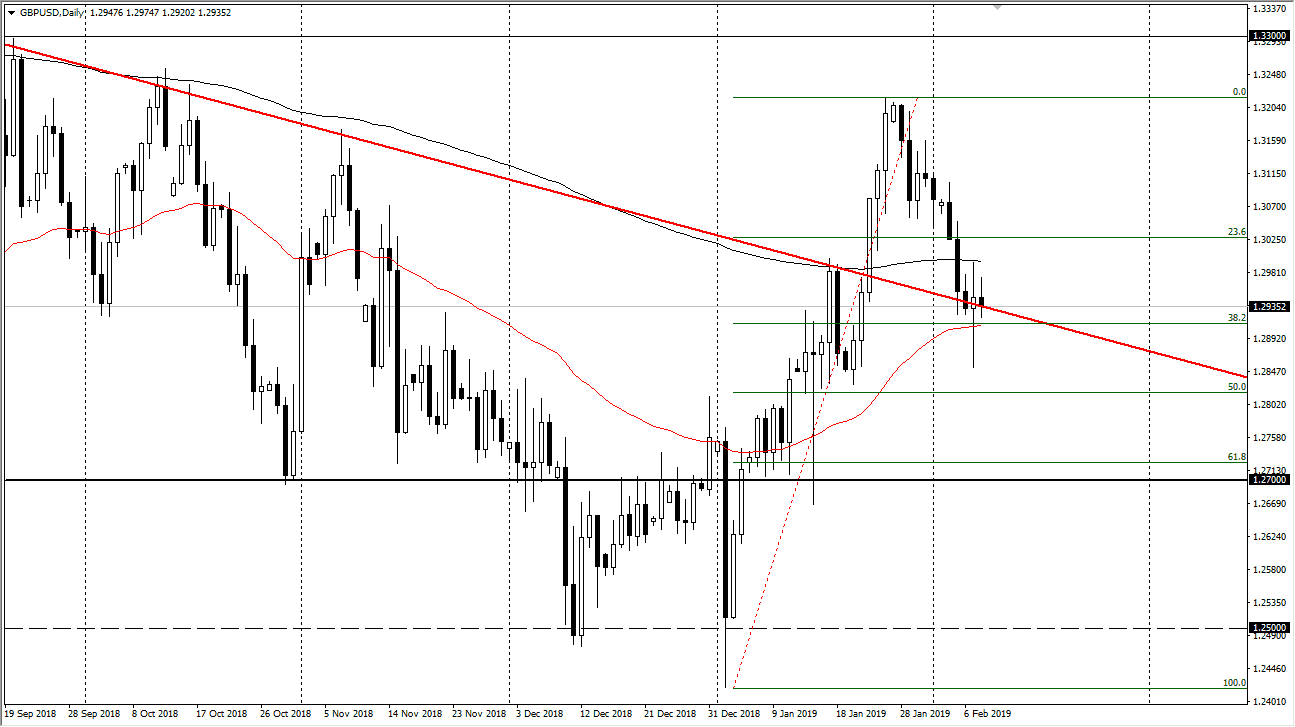

GBP/USD

The British pound went back and forth during the trading session on Friday, testing a previous downtrend line that is trying to offer support. We are currently between the 50 day EMA below, and the 200 day EMA above. At this point, the market continues to go back and forth and I think at this point we are trying to build up enough momentum to go higher. The 38.2% Fibonacci retracement level is just below, from the move that had seen the buyers come in. I believe that the markets are trying to build up enough momentum to continue going higher and the area that we are in right now suggests that we are at a major inflection point. If we can break above the 200 day EMA, I’m a buyer. Otherwise, I expect to see a lot of choppiness in this area as we await some type of resolution to the Brexit situation.