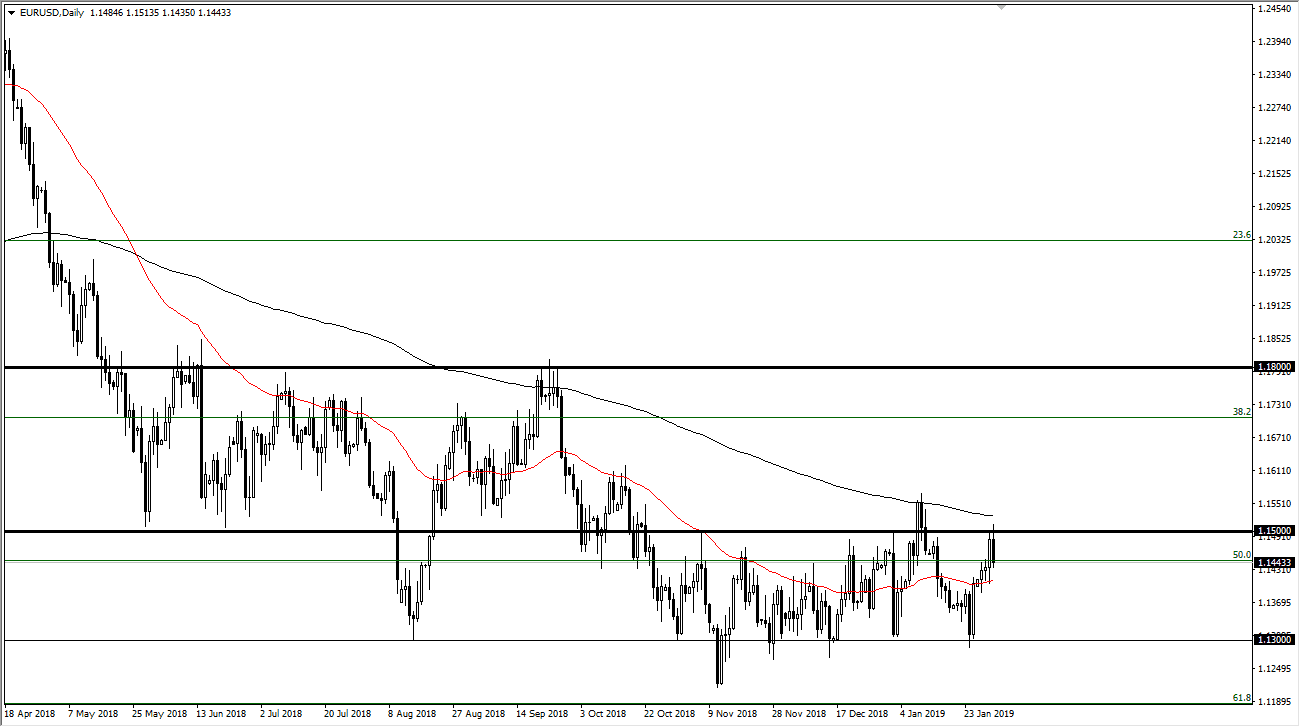

EUR/USD

The Euro initially tried to break above the 1.15 level but gave back enough of the gains to turn around and break down to the 1.1450 level. The 200 day moving average has offered resistance again, and although this market gave back quite a bit I do believe that it’s likely that we continue to try to grind to the upside. If we can break above the 200 day EMA, then the market could go much higher but ultimately the jobs number has people on the sidelines to wait to see what happens next. That being the case, I think that pullbacks will probably be looked at as potential buying opportunities but I would also point out that the pair tends to end up going nowhere after slamming around during the day on these sessions, so I would not be surprised to see this market end up moderately higher, but still below the 1.15 handle.

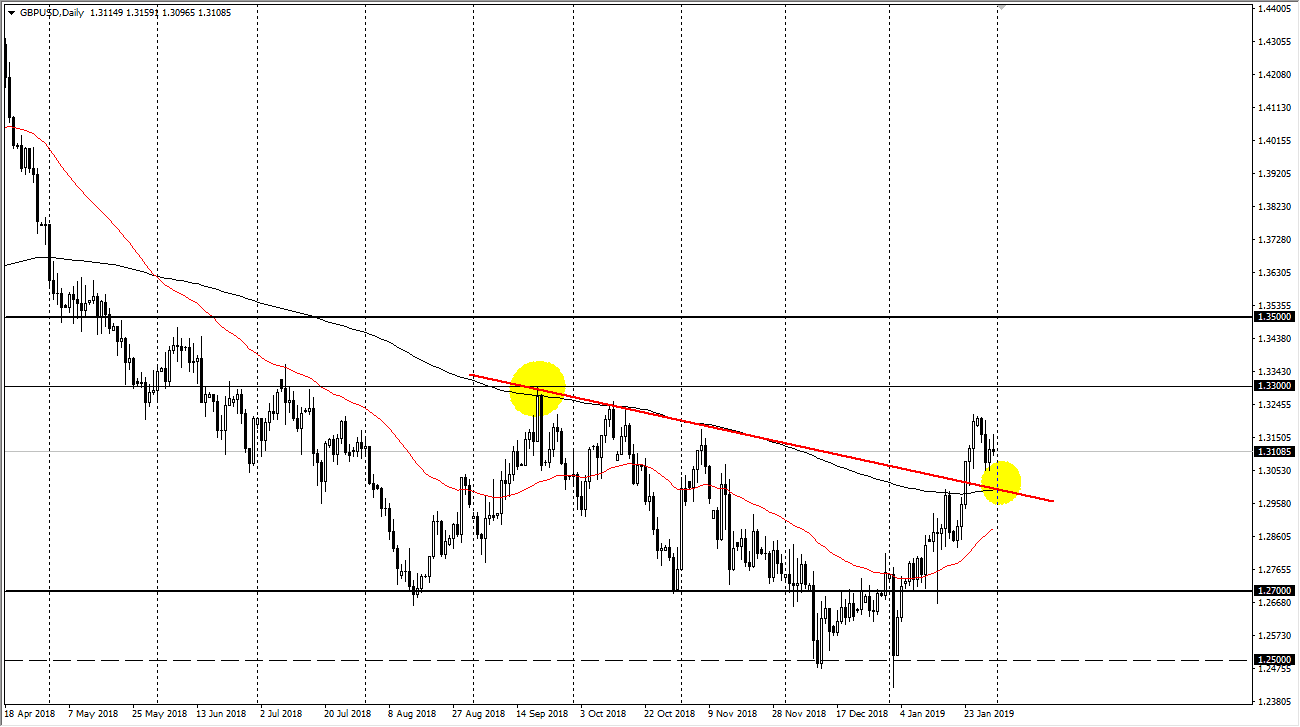

GBP/USD

The British pound has also tried to rally during the day but gave back quite a bit to form a shooting star. As you can see on the chart, I have a downtrend line that had been broken on the chart, and I think that we will go back to test that area again. If we see so poured of action in that area, which happens to coincide at the 1.30 level, then the buyers will probably start pushing to the upside for a longer-term move. Keep in mind that the Brexit of course has a lot of influence on this pair and that we will have plenty of headlines occasionally to move things around. Beyond that, we have the jobs number which influences the US dollar side of this, but I do think that the 200 day EMA slicing through the 1.30 level suggests that there is plenty of opportunity for buyers to see this as value. If your patient enough, you should get an opportunity.