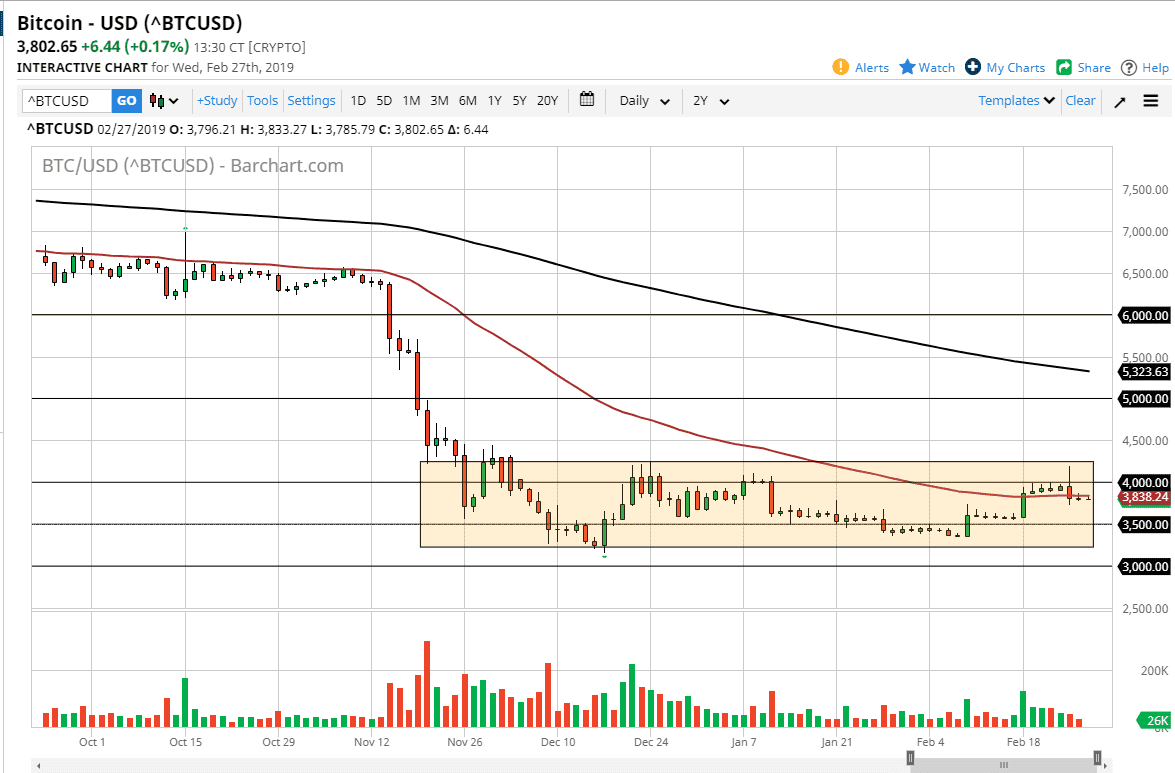

BTC/USD

Bitcoin markets went back to doing nothing during the trading session on Wednesday, as we continue to dance around the 50 day EMA. This is a market that has recently broken above the $4000 level, only to turn around and roll over again. The market clearly isn’t ready to go anywhere of substance and trading this market has become almost impossible because of the widening spreads that we are seeing with most brokerages. I’m obviously referring to CFD brokers, but at this point the lack of liquidity will cause issues in the actual markets as well. Either way, it is going to be very difficult to trade bitcoin for larger moves when we simply don’t have the volatility anymore.

Because of this, it has become a longer-term investment. You simply either believe that Bitcoin will continue to be useful and pick up value over the longer-term, which I think a lot of the diehard investors feel, or you are a bit more skeptical and believe that it will eventually be worthless. I really think at this point the market has come to that point, where you are either buying a put down to zero, or a call up to $20,000 or more. It really isn’t much of a market at this point, and therefore it’s really difficult to take trades that last less than a couple of weeks.

At this point, we have significant resistance at the $4250 level, just as we have significant support near the $3225 level. I believe that we are simply bouncing around in this area and killing time. Once we break out of that range, it gives you an idea as to where we are going next. However, you are going to need to be very patient.