BTC/USD

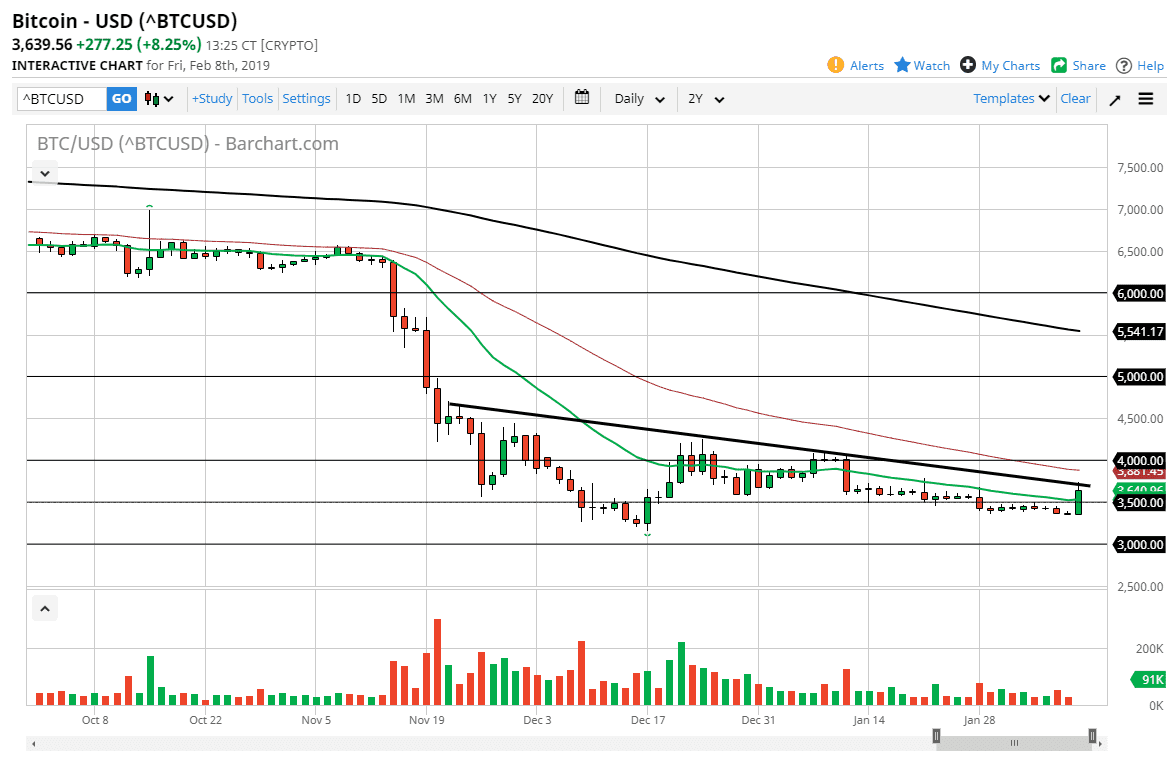

The bitcoin markets exploded to the upside during the trading session on Friday, sparking hope in the crypto currency community. I’m reading headlines about how many great things are going on, but as you can see even with an 8% rise during the day, the downtrend line that I have drawn previously has held. At this point, I think that the market will probably role right back over and go below the $3500 level again. Beyond that, we also have the 50 day EMA and the $4000 level.

In fact, it’s not until we break above the $4000 level that I entertain the idea of buying Bitcoin, because it simply cannot hang onto gains longer term. I suspect this will be another opportunity to start shorting again, as the trend is most decidedly to the downside. Nothing long term has changed quite yet, and this is probably the result of an oversold condition and perhaps a market that has very little in the way of volume.

I believe that the market giving back some of the gains almost immediately at the trend line is a hint that we simply don’t have enough momentum to break out. If we do, I would be concerned about the daily candle stick on Monday, as to how it closes. We could see a false breakout as well, turning around to form something like a shooting star which of course is a very bearish sign. However, if we do break out above the downtrend line with an impressive and tall candlestick, then perhaps it could be a buy signal but right now I choose to follow the trend because selling rallies continues to work through most of 2018, and 2019 has been more of the same.