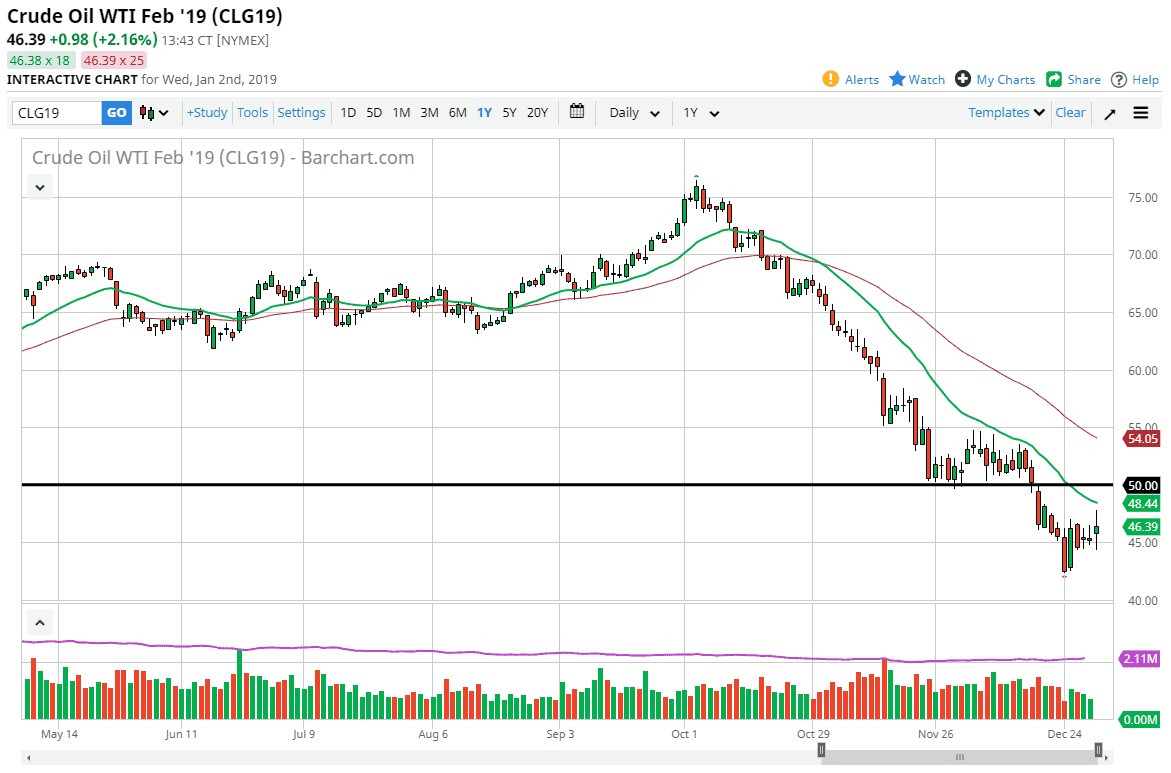

WTI Crude Oil

The WTI Crude Oil market rallied rather significantly but gave back a lot of the gains late in the day. This shows a little bit of instability, and I think at this point what we are going to continue to see sellers above, reaching all the way to the $50 level. The $50 level will of course offer resistance based upon the large come around, psychologically significant figure and of course the previous support level that should now offer resistance. I think that resistance extends all the way to the $55 level, so somewhere between now and then I would expect an exhaustive candle that we can start selling. If it’s close to the $50 level, that’s even better. However, if we were to break above the $55 level, then we could get significant buying pressure to the upside.

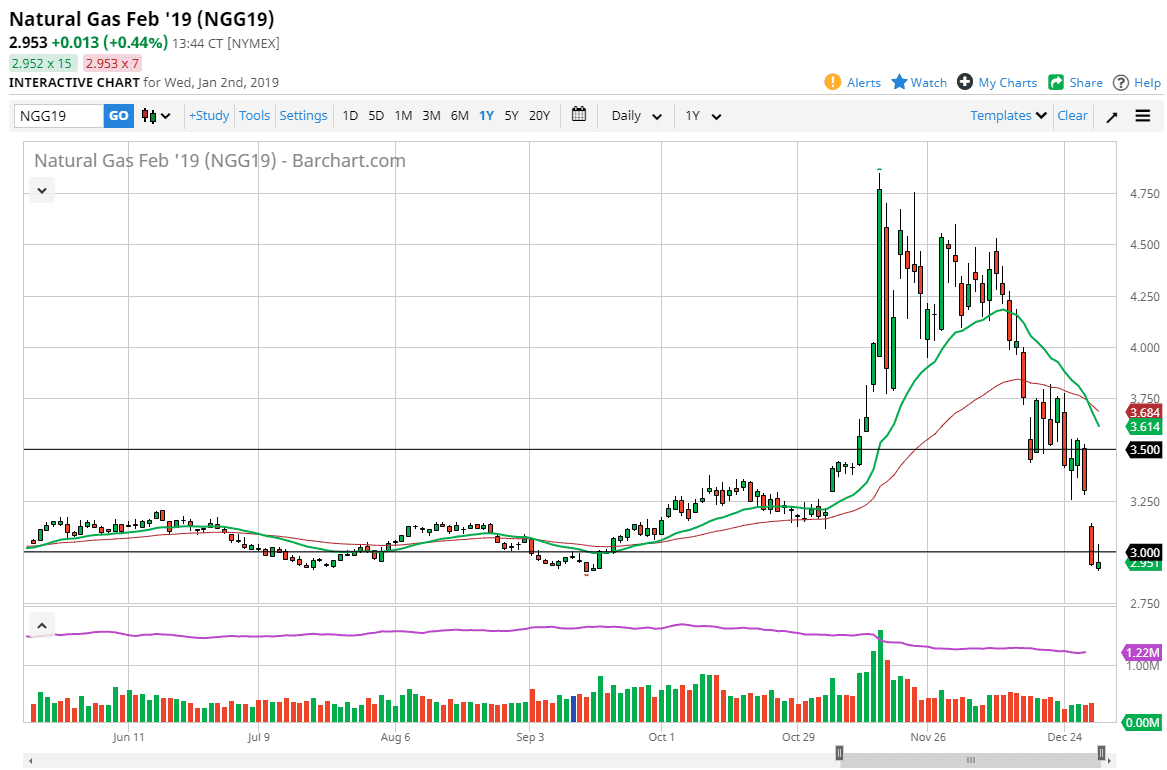

Natural Gas

Natural gas markets tried to rally during the day but gave back quite a bit of the gains. The $3.00 level has attracted a lot of attention, and by forming an inverted hammer, so if we can break above the top of the candle, that could be a very bullish sign. I think that would probably have this market looking to fill the gap, so signs of exhaustion closer to the $3.27 level could send this market back down. I think it’s only a matter time before rallies are sold again, and quite frankly this is a market that has completely wiped out all of the gains, and although it’s clearly a negative looking market, the reality is chasing the trade if we start shorting this market down here. Give yourself a better opportunity to make money by waiting for higher levels to short from.