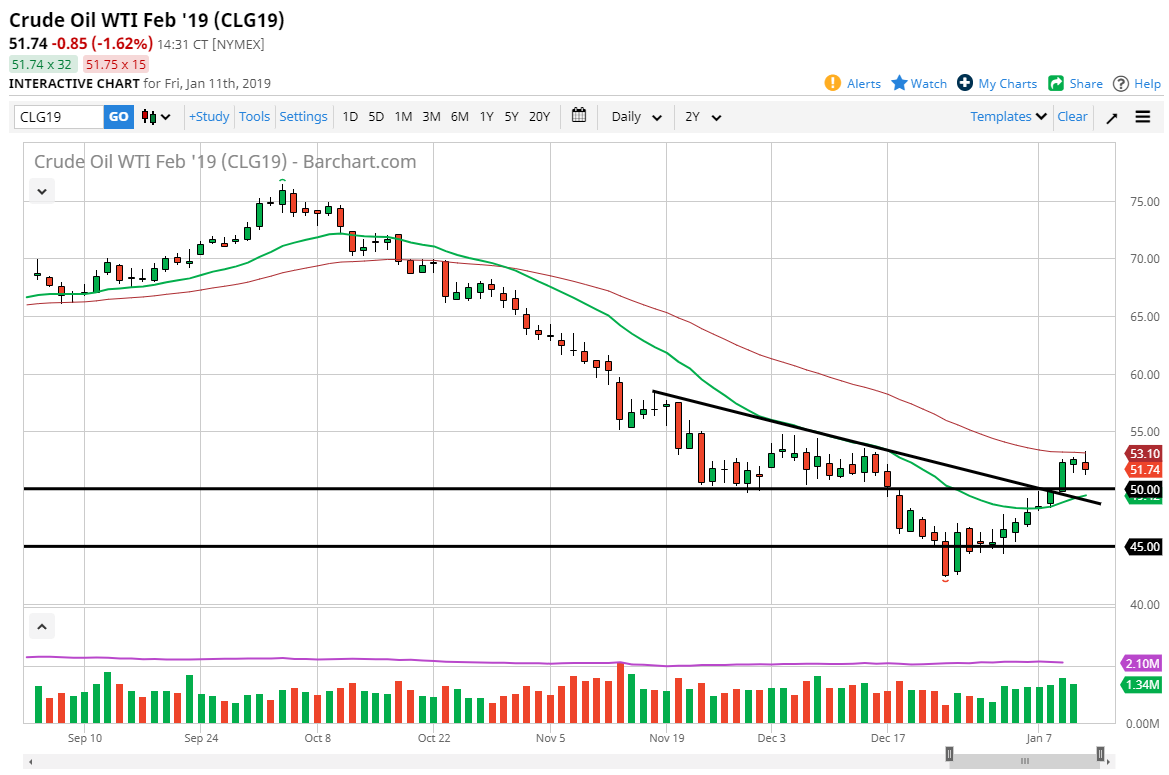

WTI Crude Oil

The WTI Crude Oil market has been very noisy during the Friday trading session, touching the 50 day EMA. However, we ran into enough resistance to turn around and fall. This is a negative looking candle stick but ultimately there does seem to be a significant amount of support just below, especially at the $50 handle. The 20 day EMA is turning to the upside, breaking above the $50 handle. The downtrend line has been broken and ultimately that should send this market higher. I think that crude oil had gotten itself oversold and is due for a significant bounce. Ultimately, I think there is a lot of volatility in this area, but I do think that the buyers will eventually take control of the situation and push towards the $55 level, possibly even the $60 level.

Natural Gas

Natural gas markets shot straight up in the air towards the end of the session on Friday as a major snowstorm is going to hit the United States. However, this is simply a short-term rally, and probably just the market trying to fill the gap. The 20 day EMA above should offers resistance, perhaps even the top of the gap near the $3.30 level. I think there is even more resistance at the $3.50 level, so any sign of exhaustion is probably an opportunity to start shorting a market that is very negative.

We could turn right back around and break down through the bottom, but that seems very unlikely. This is a market that tends to move very erratically and with the weather, which means we will sell off just as quickly as we rallied as soon as the weather passes. Be patient, you should get an opportunity soon.