Gold prices ended the week up $1.96 at $1287.48 an ounce, recoding a fourth consecutive weekly gain. The dollar was pressured after minutes from the Federal Reserve’s most recent meeting indicated officials thought they would be patient in raising interest rates this year. “Especially with inflation low and under control, we have the ability to be patient and watch patiently and carefully,” Powell said last week. The precious metal’s gains, however, were limited by investors’ appetite for riskier assets. World stocks markets rallied on signs the United States and China made progress during their trade negotiations.

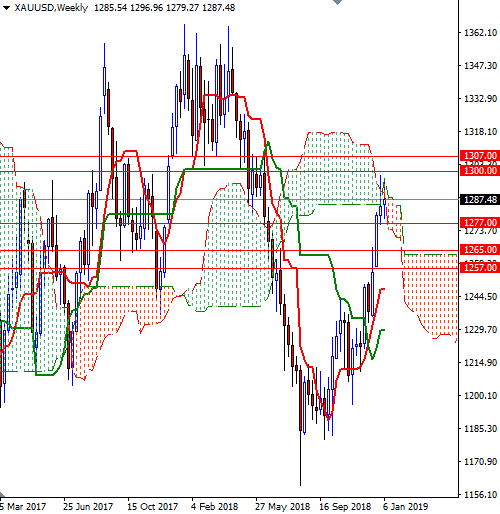

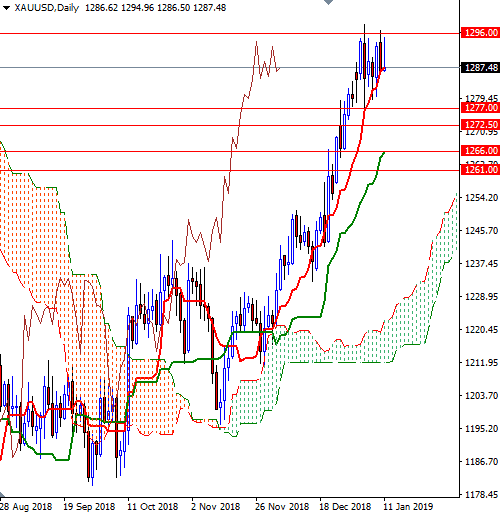

The bulls have the overall technical advantage, with the market trading above the daily and the 4-hourly Ichimoku clouds. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. However, also keep in mind that XAU/USD has been trading sideways for the past eight session, indicating a near-term market top is in place. In fact, last week’s pause is normal given the solid gains scored in December.

If prices see a bullish upside breakout from the recent sideways trading range, look for further upside with 1300 and 1307/4 as targets. Closing above 1307 on a daily basis would open the door for a move to 1316/2. The bulls have to overcome this solid barrier to challenge 1325. The bears, on the other hand, need to pull prices below the 1277/6 area to tackle the next support in 1272.50-1270. A successful break below 1270 paves the way for a test of 1266/5. Once below there, the market will be targeting the 1261/57 area.