USD/MXN

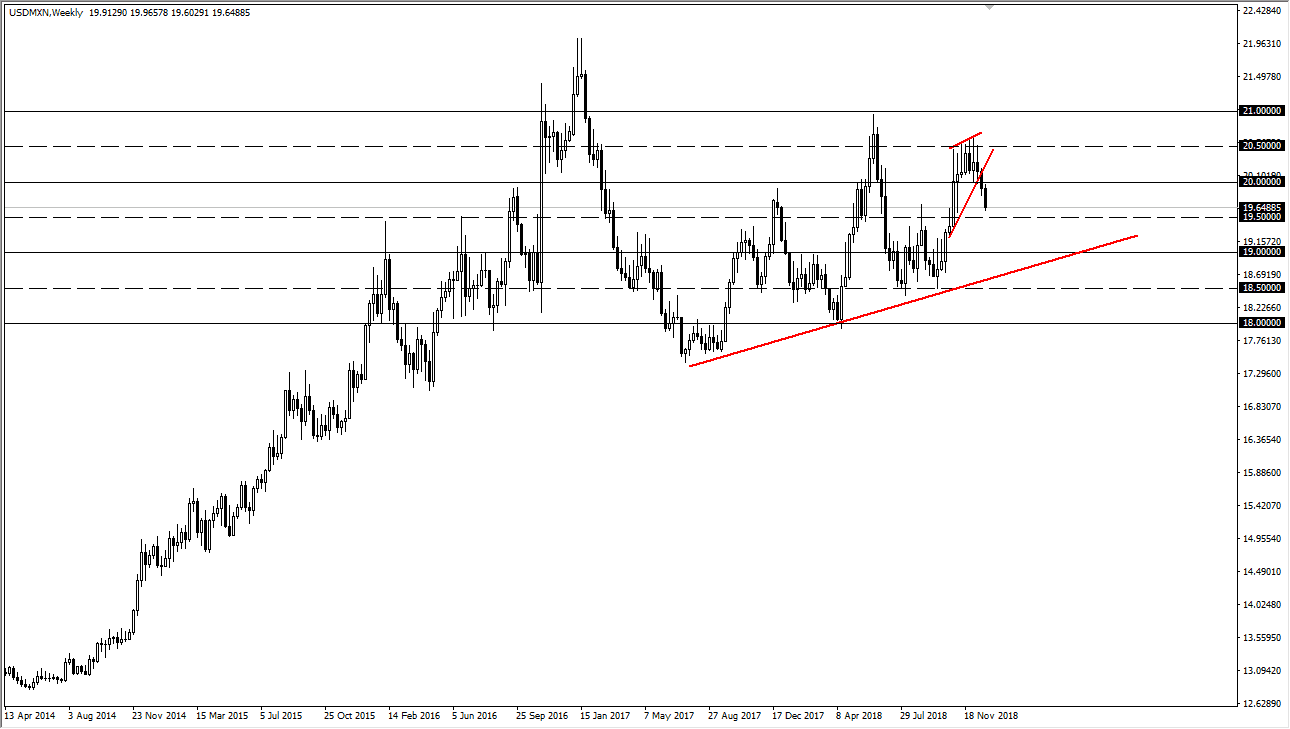

The US dollar has fallen in the late part of December against the Mexican peso, as we have seen US dollar strength dissipate after a less than hawkish Federal Reserve statement. Now that we are below the 20 pesos level, I think that we may go looking towards lower pricing. I believe that the 20 pesos level is an area of major resistance, and that signs of exhaustion in that area should be sold. You can see that I have a rising wedge that is marked on the chart that we have clearly broken through. That’s normally a very bearish sign and as a general rule you try to reach the bottom of that wedge.

It is because of this that I think we will probably fall to the 19.25 pesos level after a short pull back, and then a break down below there could send the market looking towards the 19 pesos level, and then of course the uptrend line which is somewhere closer to the 18.65 pesos level. I think this is a simple pull back in and uptrend though, and I do think that longer-term we will return to the bullish pressure in this market, as the new Mexican government may be a bit quick and loose with spending.

Beyond that, we are starting to see a little bit of stability in the oil markets, and that helps the Mexican peso as it is highly levered to the crude oil coming out of the Gulf of Mexico. I think we are simply looking for a bit of a pullback early in the month, and then a bounce a couple weeks into 2019. Keep in mind that this pair does tend to trade most volume in the North American session, so be cautious about when you enter the market.