The US dollar has fallen slightly against the Mexican peso during the trading session on Thursday, as we continue to hover just above the 19.50 pesos level. This of course is a large come around, psychologically significant number, so it makes sense that perhaps we would pause here. Beyond that, Friday will see the Nonfarm Payroll Numbers coming out of the United States, which of course will have a massive influence on the US dollar. Because of this announcement, there will probably be an extreme amount of volatility in the markets during the day, especially around 8:30 AM Eastern Standard Time, or 8:30 AM in New York City.

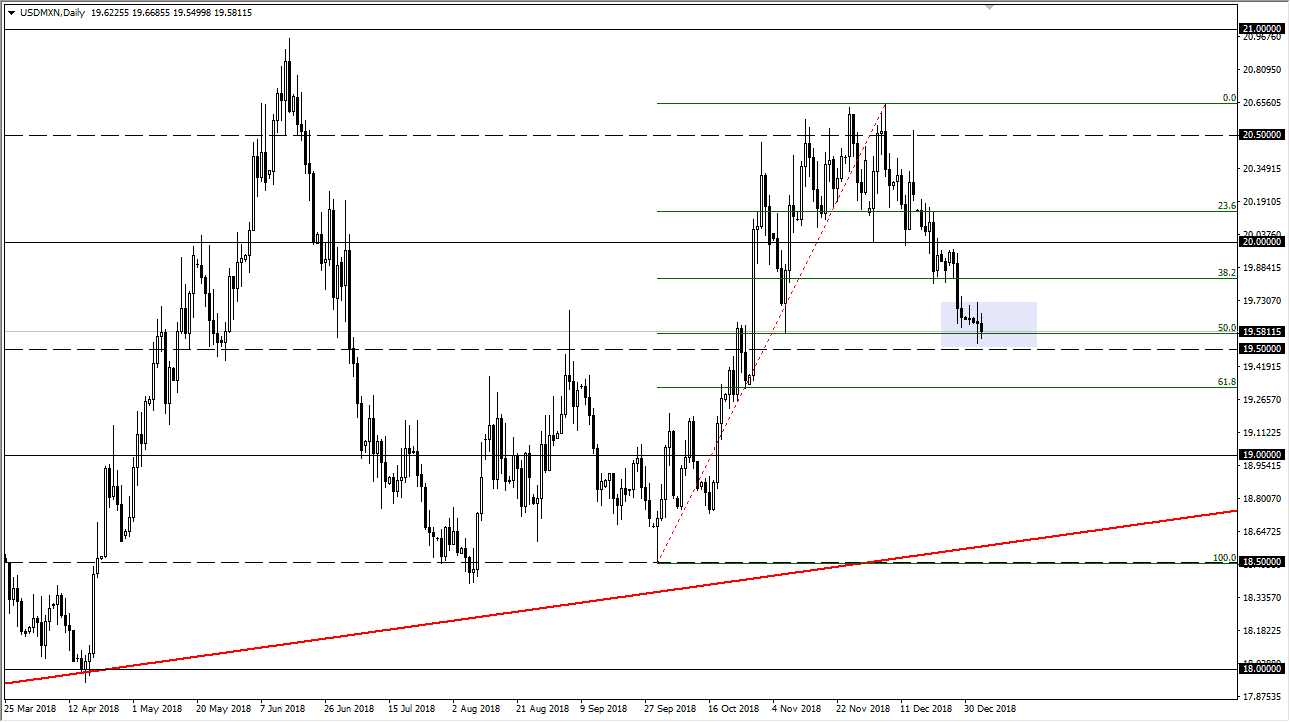

When you look at this chart, you can see that we are essentially at the 50% Fibonacci retracement level, which coincides nicely with the 19.50 pesos level. I have drawn a lavender box on the chart, and I think that once we break out of this box, it gives us a hint as to where we are going next. Because of this, it is very likely that the market will be very quiet until that announcement, especially considering that the Mexican peso is basically traded during North American hours only, at least as far as volatility is concerned.

If we break above the 19.73 pesos level, then I anticipate that the market will probably go towards the 20 pesos level. The alternate scenario is that we break down below the 19.50 pesos level, which opens the door to the 19.30 pesos level at the 61.8% Fibonacci retracement level, followed by the 19 pesos level below there. It will be a very interesting session, and it should give us insight into which direction the market will be going over the next several sessions, as this will be driven by the greenback more than anything else.