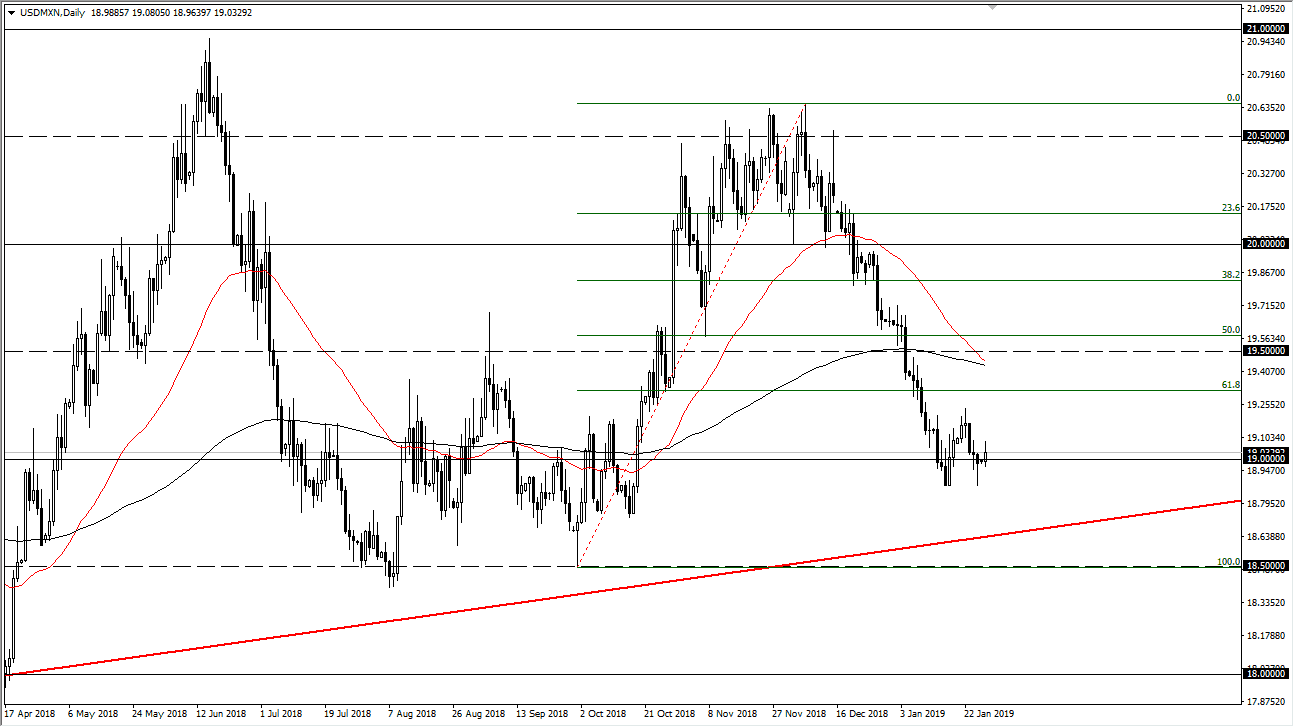

The US dollar has rallied slightly during the trading session on Monday but gave back quite a bit of the gains as we are still very much stuck in a downtrend. Emerging market currencies have had a nice run as of late, as the Federal Reserve looks less likely to aggressively tighten monetary policy and may actually be on hold. Beyond that, it’s possible that we might be looking at a potential reversal of attitude, and if that’s going to be the case it’s likely that we will see EM currencies continue to gain overall. The Mexican peso course won’t be any different.

I think that the uptrend line underneath is a major support, in the neighborhood of 18.80 pesos. A break down below there opens the door to the 18.50 pesos level, and then down to the 18 paces handle next. It’s a little early to say this, but it looks as if we are getting ready to get the so-called “death cross” in this pair, meaning that the 50 day EMA is going to cross below the 200 day EMA, which is a very bearish sign. Beyond that, you can make a little bit of a case for a bearish flag trying to form. If that is in fact going to be true, we could have a big move ahead of us. Expect volatility, but it does look as if traders are starting to hunt for yield again. Keep in mind that the Mexican peso is a bit of a proxy for crude oil, so if the markets rally again and break out above major resistance, that could also continue to push this market lower as so many of the offshore rigs in the Gulf of Mexico are in fact Mexican.