USD/MXN

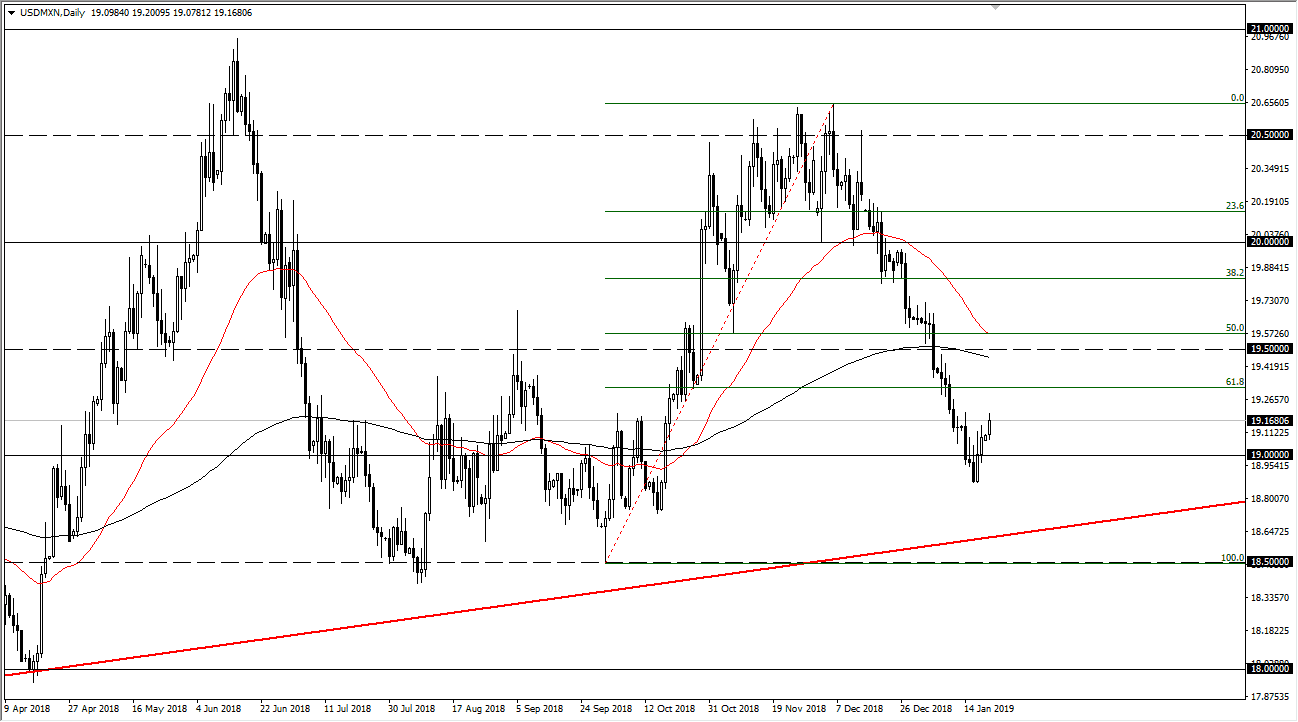

The US dollar rallied a bit against the Mexican peso during relatively quiet trading on Monday, as it was Martin Luther King Jr’s birthday, which of course is a national holiday in America. That being the case, it’s likely that we will continue to see a bit of a bounce from here, which we have gotten a bit overextended. However, I think it’s only a matter of time before we ran into selling pressure, perhaps near the 200 day moving average again, but it’ll be interesting to see how this plays out. Remember, the Mexican peso is highly sensitive to the crude oil market, which does look like it’s trying to break out to the upside. If it does, that will continue to put bearish pressure on this market.

Alternately, there is an uptrend line underneath that should offer support, so keep that in mind. I think at this point we could get a bit of a bounce from there once we get down to that level. That being said though, I believe that waiting patiently for some type of exhaustive candle above is probably the best way to play things out and start shorting. If we break above the 19.75 pesos level, then I think we could probably go to the 20 pesos level. The 18.50 pesos level underneath being broken would be a very negative sign and should send this market even lower. That would be a complete repudiation of the previous uptrend, wiping out the 100% Fibonacci retracement level.

I would expect volatility, but with oil looking as good as it does, and the Federal Reserve looking likely to stay on the sidelines, at least in the near term, I believe that we continue to fall.