USD/MXN

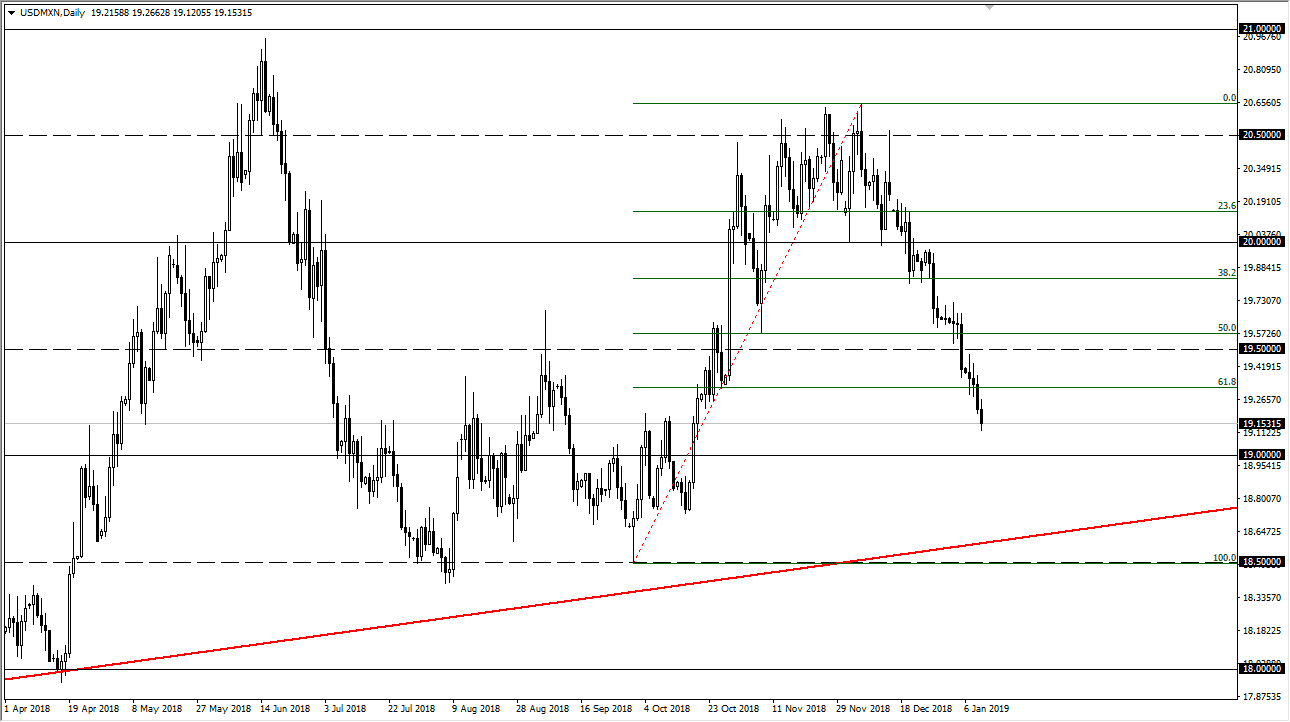

The US dollar initially tried to bounce a bit against the Mexican peso on Thursday but then struggled a bit as we continue to go lower. I think at this point we will probably go down to the 19 pesos level, perhaps even lower than that. I think at this point it’s obvious that there is a lot of resistance above in the form of the 19.50 pesos level, and I think that any attempt at that level will be repelled. The US dollar will continue to struggle in the face of the Federal Reserve looking a little bit more flexible and perhaps confused, so therefore I think it makes sense that we would drift a bit lower. Beyond that, I think that the uptrend line underneath will be the initial target. Because of this, I believe 19 pesos may cause a bounce, but in the end it will probably be an afterthought.

Pay attention to the crude oil markets, because they do have an influence on the Mexican peso as well. With the crude oil markets break out, it makes sense that this pair breaks down. Overall, this is a market that is falling rather rapidly, and therefore is due for a bounce. I look at the bounce as an opportunity to sell at higher levels and by pesos “on the cheap.” If we did turn around and break above the 19.75 level, then it would change everything. Otherwise, it’s very unlikely to see this market to change the overall attitude. We need to see US dollar strength overall to see this pair turned around. I believe that the Mexican peso has a bit further to go and should continue to reach lower levels, perhaps even the 100% Fibonacci retracement level which is just below that previously mentioned uptrend line.