USD/JPY

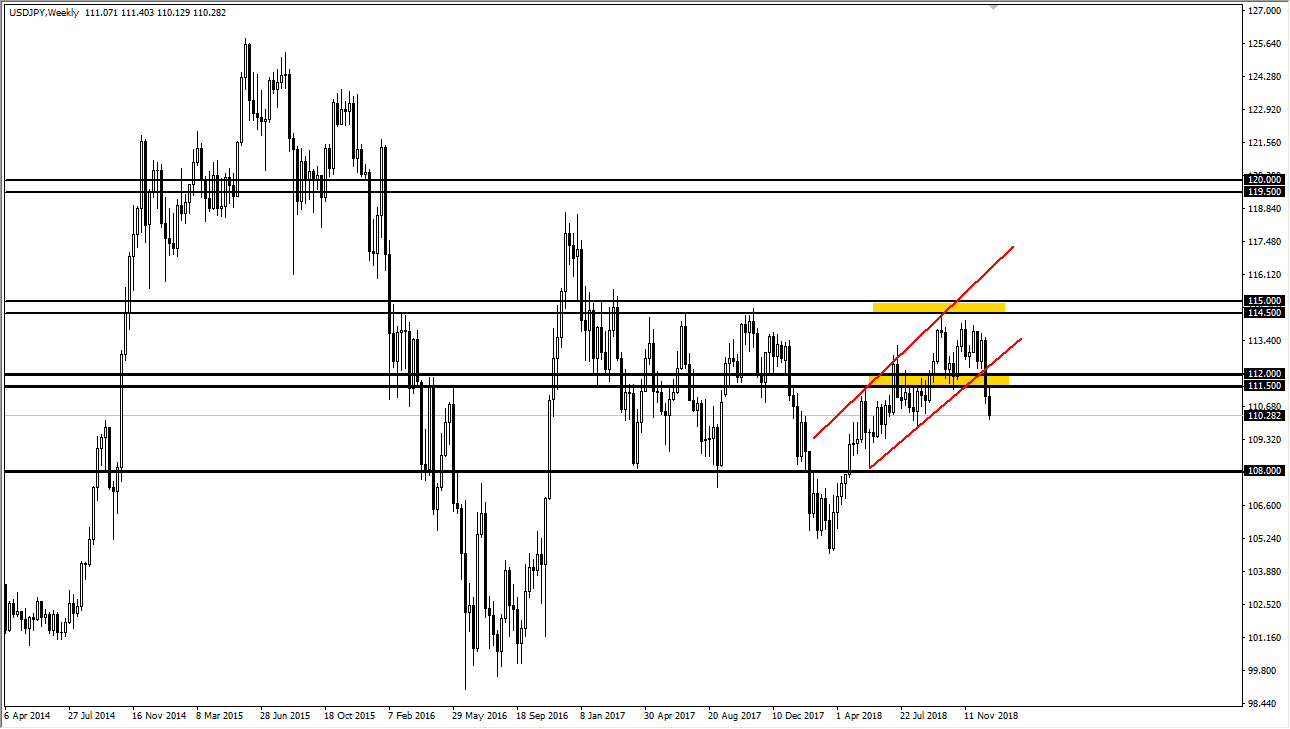

The US dollar fell rather significantly towards the end of 2018, slicing through a major uptrend line, and of course the ¥112 level. This is a bearish signal, as it has confirmed the ¥114.50 level as being too expensive for the market to hold. The level has caused resistance several times, and it looks as if the rejection of price will be the main signal for the month of January, and I believe even beyond that.

There are a lot of concerns when it comes to global growth out there, and of course whether or not the Federal Reserve can raise interest rates. Because of this, it is negative for the US dollar, and it makes sense that if there are concerns out there, traders will flood into the Japanese yen. I think at this point, it makes sense that the market will probably continue to sell rallies, and I believe that the ¥112 level will be the major ceiling of the market in the short term. I anticipate that we could get a little bit of a bounce, but I think that will be short-lived and that rallies will continue to be sold. At the end of the month, we had been pressuring the ¥110 level, so that’s obvious short-term support based upon a large, round, psychologically important figure. If we can break down below there, then I think the market will probably go looking towards the ¥108 level underneath which is more supportive. In fact, I would not be surprised at all to see this market reach down to that area by the end of the month. Either way, I think this is a market that is starting to change its attitude, and therefore will continue to rollover.