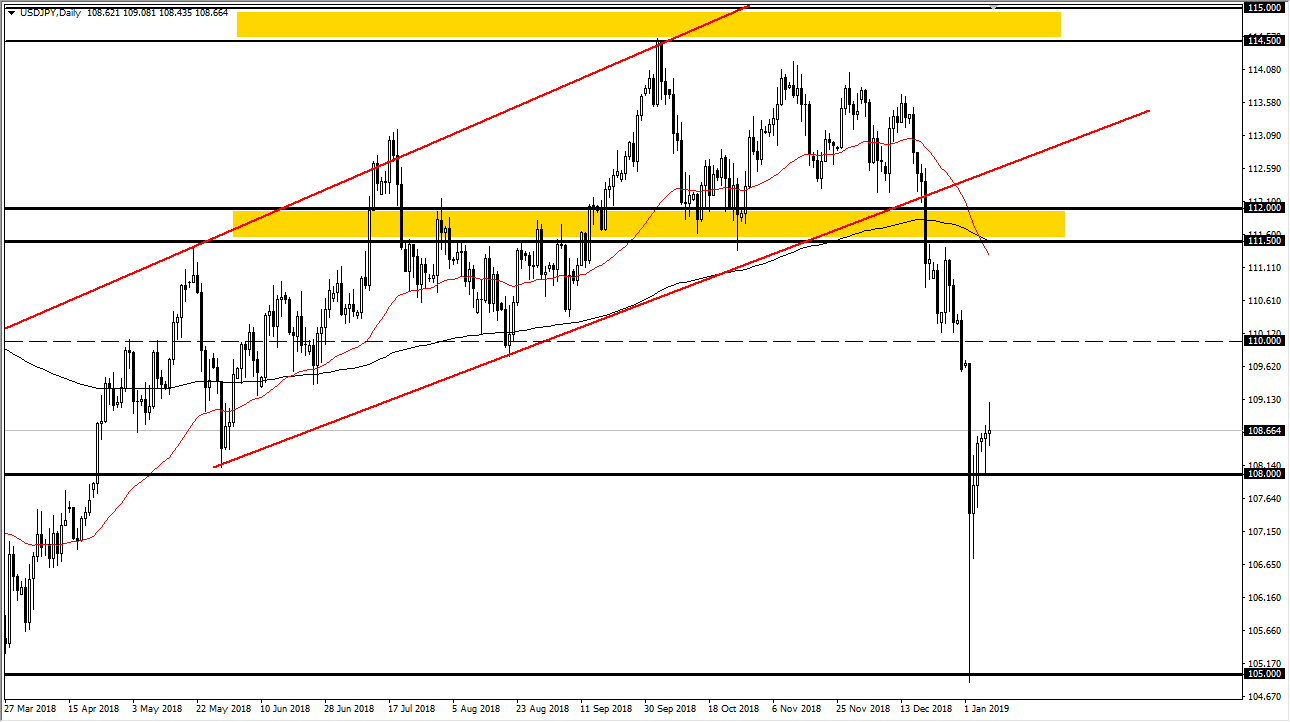

USD/JPY

The US dollar initially tried to rally during the trading session on Tuesday but rolled over at the ¥109 level to form a bit of a shooting star. That shooting star of course shows signs of exhaustion and a bit of confusion, considering that the hammer had been formed on the day before. I think that the ¥108 level underneath is massive support, so if we break down below there I think the market could go much lower, perhaps down to the ¥106 level. If we break above the top of the shooting star, then we could go to the ¥110 level after that. I think that the ¥110 level is massive resistance though, and I think it would be very difficult to get above there, as we had seen so much consolidation in that area. Once we get a “risk off” attitude out there again, the market will fall.

AUD/USD

The Australian dollar initially pulled back during the trading session on Tuesday but turned around to show signs of life again. By forming the hammer that it did, it suggests that we are going to try to go higher and I think that a lot of the positivity in the Australian dollar is probably due to the talks between the Americans and the Chinese showing signs of positivity. If we broke down below the bottom of the hammer for the day, then we probably go down to the 0.70 level. Otherwise, if we rally I think we will run into trouble at the 0.7250 level next as well. The 200 day EMA is just above there as well, so I think it’s only a matter time before this market rolls over.