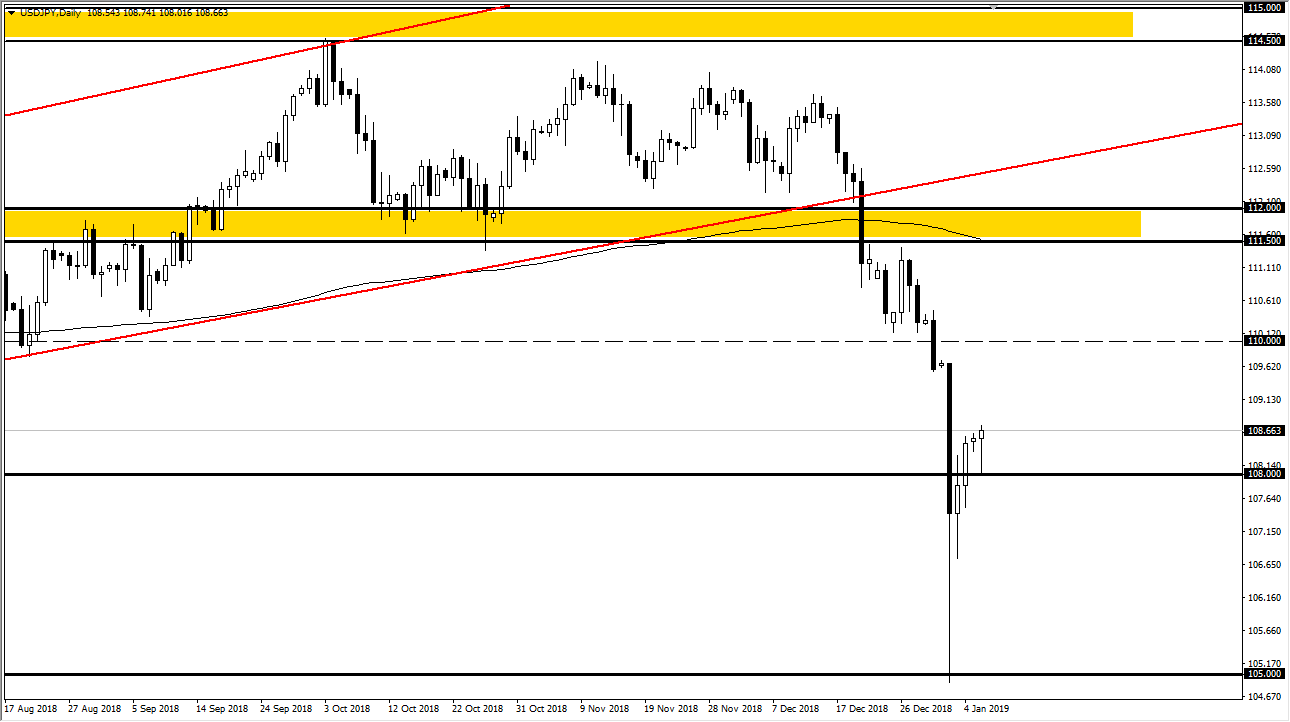

USD/JPY

The US dollar initially fell during the trading session on Monday but turned around of form a bit of a hammer. It looks as if we are going to bounce from the ¥108 level, and it’s likely that we will go looking towards resistance above. The ¥110 level above is a massive barrier from what I can tell, and I think that it is only a matter of time before we get some type of shock to the markets that continues to push this market to the downside. Ultimately though, if we were to break down below the 100 a yen level, the market probably drops down to the 107 young level, possibly even the ¥105 level. Ultimately, the market looks likely to find a lot of volatility, but I do think that rallies will eventually be sold as there are a lot of concerns out there. Right now, it seems as if we are simply trading on hope.

AUD/USD

The Australian dollar rallied a bit during the trading session on Monday but didn’t necessarily make a huge gain. We are currently trading around the 50 day EMA, and I think it’s only a matter of time before the sellers come back. I think a lot of this will come down to what happens between the United States and China with the trade negotiations, so keep in mind that an ugly headline could send this market right back around. That being said, we have seen a strong move to the upside but I also think that the movie is probably getting a bit overdone, so I think that we will find some equilibrium just above. At the first signs of exhaustion, I am more than willing to start selling again.