USD/JPY

The US dollar initially tried to rally against the Japanese yen again on Tuesday but has found resistance above as we have seen more than once lately. We have had a couple of shooting stars form near the ¥110 level, and the candle stick on the Tuesday session now looks very much the same, although from a lower level. I think we are going to grind ourselves lower, and quite frankly of Jerome Powell seems a bit dovish during the news conference on Wednesday, it’s very likely that the US dollar will lose value against multiple currencies not just the Japanese yen. In fact, I believe that the ¥110 level is a massive resistance barrier that will be difficult to break, not only because of that round figure, but the price action at that area, the 61.8% Fibonacci retracement level being at that area, and of course the 50 day EMA.

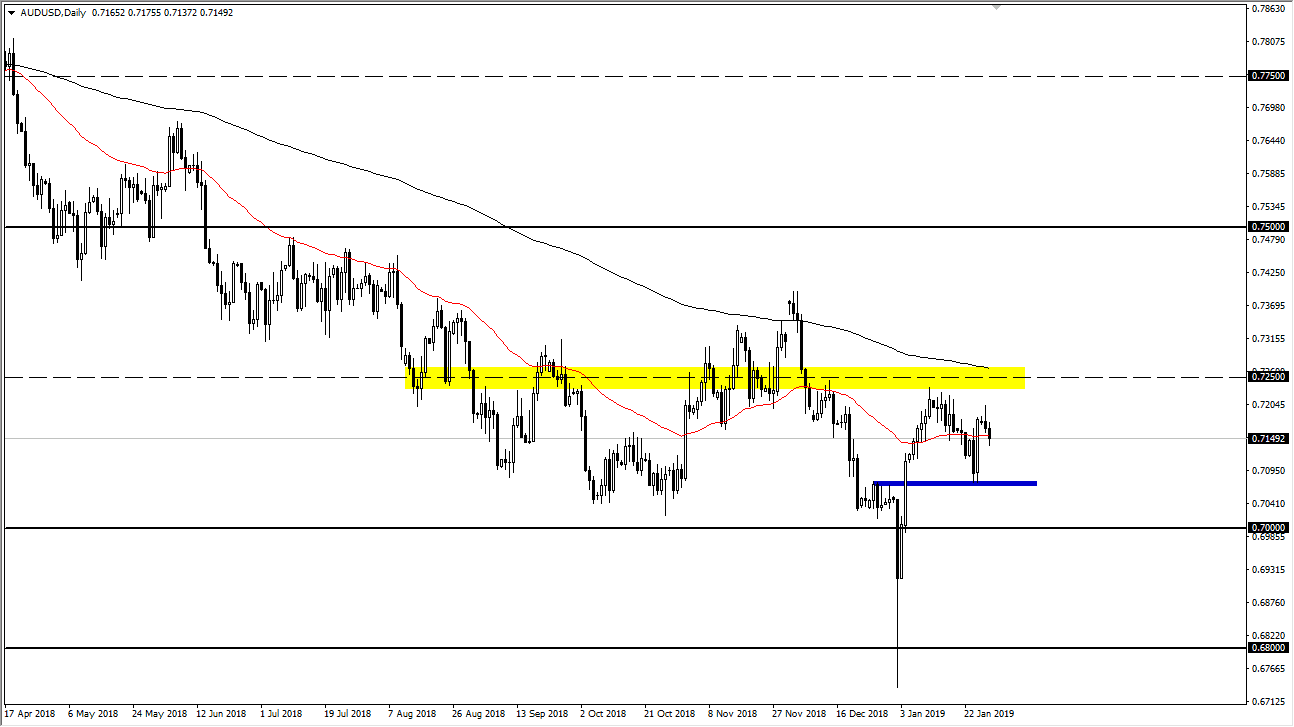

AUD/USD

The Aussie fell a bit during trading on Tuesday, as it looks like we are ready to continue consolidating and churning in the region. The US/China trade talks continue this week, and of course Australian dollar traders will be paying quite a bit of attention to them. However, I think we are probably not going to see much in the way of a breakthrough, so it’s going to be difficult for the Aussie to take off to the upside. Having said that, there is a ton of support underneath that starts at the 0.70 level, extending down to the 0.68 level. This is an area that has been massive support in the past on longer-term charts, so it should be crucial for the market. I think that at the very least we are probably looking at a short-term pullback.