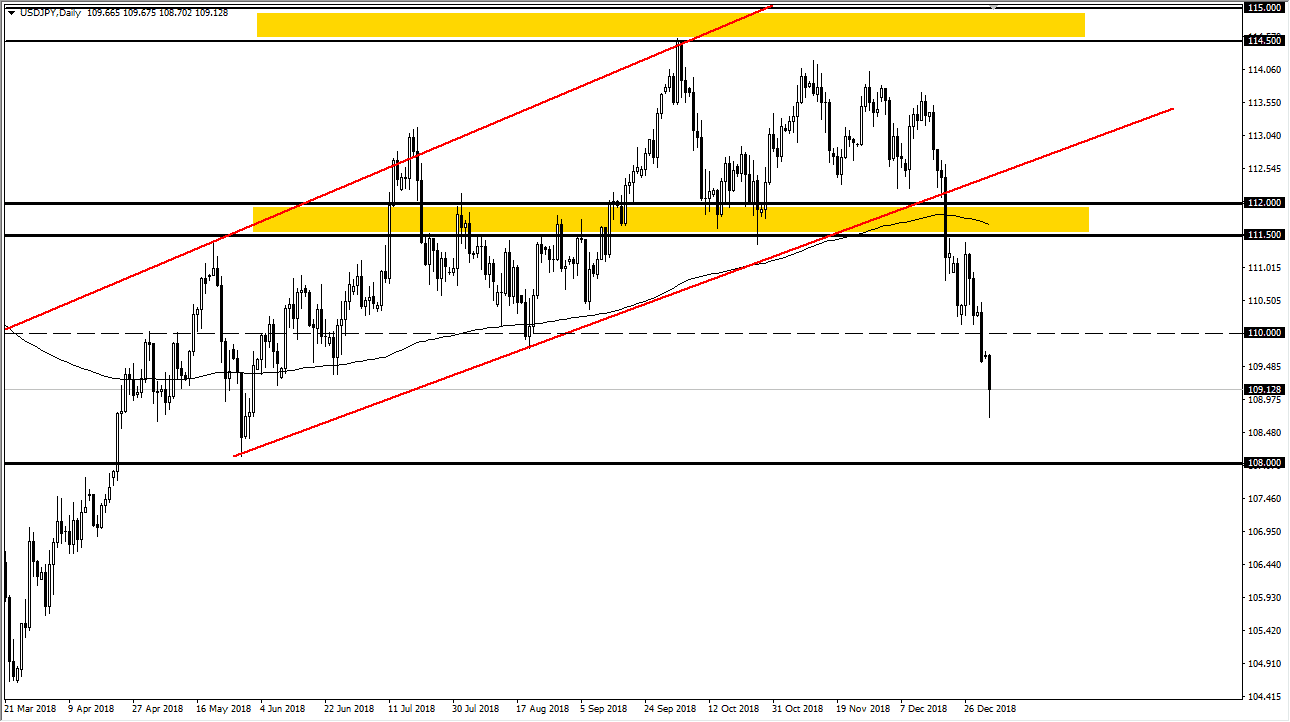

USD/JPY

The US dollar has broken down rather significantly during the trading session on Wednesday as traders came back to open up the 2019 year. The US dollar falling against the Japanese yen of course is a sign of a safety trade, as the Chinese economic figures disappointed. I think that it’s only a matter of time before we reach down to the ¥108 level. That’s an area that should attract a lot of attention, but we have fallen apart rather quickly so a bounce makes sense. I think that bounce will attract a lot of resistance, so somewhere around that area that I would expect to see an opportunity to start selling on signs of exhaustion. The alternate scenario of course is that we break down below the bottom of the candle stick for the trading session on Wednesday, but either way I think we are looking at the ¥108 level.

AUD/USD

The Australian dollar spent most the day falling apart on Wednesday, breaking below the 0.70 level. However, it looks as if we are trying to bounce from here, and I think it will continue to offer a lot of support. Nonetheless, I like the idea of shorting this market on signs of exhaustion, and therefore I think that the rallies are to be sold off. Ultimately, I think we could go down to the 0.68 level, because it has been massive support. Remember that the Australian dollar is highly levered to the Chinese economy, and as the Chinese figures are coming out less than anticipated, that of course weighs upon the Aussie dollar as well. Beyond that, we have the trade tariff issues out there that will continue to put a lot of pressure on this market.